Cardano Price Dips Below $0.64 Amid Bearish Sentiment—Could a Recovery Be Imminent?

Cardano Price Holds Above Key Long-term Resistance Level / Source: Cryptonews

Cardano Price Holds Above Key Long-term Resistance Level / Source: Cryptonews

Cardano (ADA) isn’t having a great week. As of April 6, 2025, the token has slipped to $0.634, marking a over 3.50% decline over the past 24 hours and nearly 7.7% down for the week. It’s now ranked #10 by market cap, sitting at $22.45 billion, with daily trading volume hovering just above $414 million.

The troubling part? Volume is fading fast—down nearly 59%, a sign that interest may be waning. And with a potential death cross forming on the charts, traders are growing cautious.

The 50-day moving average is approaching a cross below the 200-day average (currently at $0.740 and $0.734, respectively), a technical red flag often associated with prolonged downside.

ADA/USD price chart (source: TradingView)

ADA/USD price chart (source: TradingView)

Cardano Charts Paint a Bearish Picture—But It’s Not Game Over Yet

Short-term technicals aren’t offering much comfort either. On the 4-hour chart, ADA remains stuck inside a downward-sloping channel. Every bounce has been short-lived, with the 50-period EMA at $0.664 acting as a resistance for price attempts to break higher.

Support has shifted to $0.612, with a possible drop to $0.581 if that floor gives way. On the flip side, resistance stands at $0.645, with stronger selling pressure just above the upper boundary of the descending channel.

Meanwhile, the Relative Strength Index (RSI) is at 39—not yet oversold, but certainly tilted in favor of the bears.

Quick Technical Recap:

- Current Price: $0.634

- Resistance: $0.645 (then upper channel trendline)

- Support: $0.612 → $0.581

- EMA Resistance: $0.664

- RSI (14): 39 – bearish but not fully exhausted

- Trend: Still downward unless a breakout occurs

Unless ADA can break out of the current downtrend, any upside may be limited in the near term.

Can Strong Fundamentals Turn the Tide for Cardano?

While the price is under pressure, Cardano’s underlying ecosystem is far from stagnant. One notable catalyst: Ripple’s RLUSD stablecoin is expected to launch on Cardano, a move that underscores rising institutional interest in the network.

Even more intriguing, Charles Hoskinson has hinted at bringing Cardano into Bitcoin’s DeFi universe, which could unlock new use cases and demand.

That said, none of this has translated into price support—at least not yet. Analysts warn that if ADA fails to hold the $0.600–$0.650 support zone, the door opens for a deeper correction toward $0.400 or even $0.300, especially if macro headwinds persist.

What to Watch Next:

- If $0.612 fails, watch for a retest of $0.581

- To flip the script, ADA needs to break above $0.645 and invalidate the descending channel

- On-chain activity and market sentiment will be key in shaping ADA’s next move

Final Thoughts: On Thin Ice, But Not Broken

Cardano’s short-term outlook is clouded by technical weakness, fading volume, and macro pressure. However, with meaningful developments happening under the hood—like stablecoin integration and potential Bitcoin-DeFi bridges—the long-term narrative remains intact.

Still, for now, the $0.600 support zone is a critical battleground. Until bulls regain control and push ADA out of its downtrend, caution remains warranted.

BTC Bull Presale: Earn Real Bitcoin with Every Price Milestone

BTC Bull ($BTCBULL) is gaining traction as one of the most exciting presales in crypto, combining meme culture with real utility. Designed for long-term holders, the token automatically rewards investors with real Bitcoin as BTC reaches major price thresholds—aligning community incentives with Bitcoin’s growth.

Staking for Passive Bitcoin Income

BTC Bull offers a lucrative staking program boasting a 119% APY, allowing users to earn passive income while supporting the network. With over 882.5 million BTCBULL tokens already staked, community engagement continues to grow.

Latest Presale Updates:

- Current Token Price: $0.002445 per BTCBULL

- Raised So Far: $4.41M of $5.16M target

With limited time remaining and demand accelerating, this is a key window to secure BTCBULL at presale rates before the next price jump.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

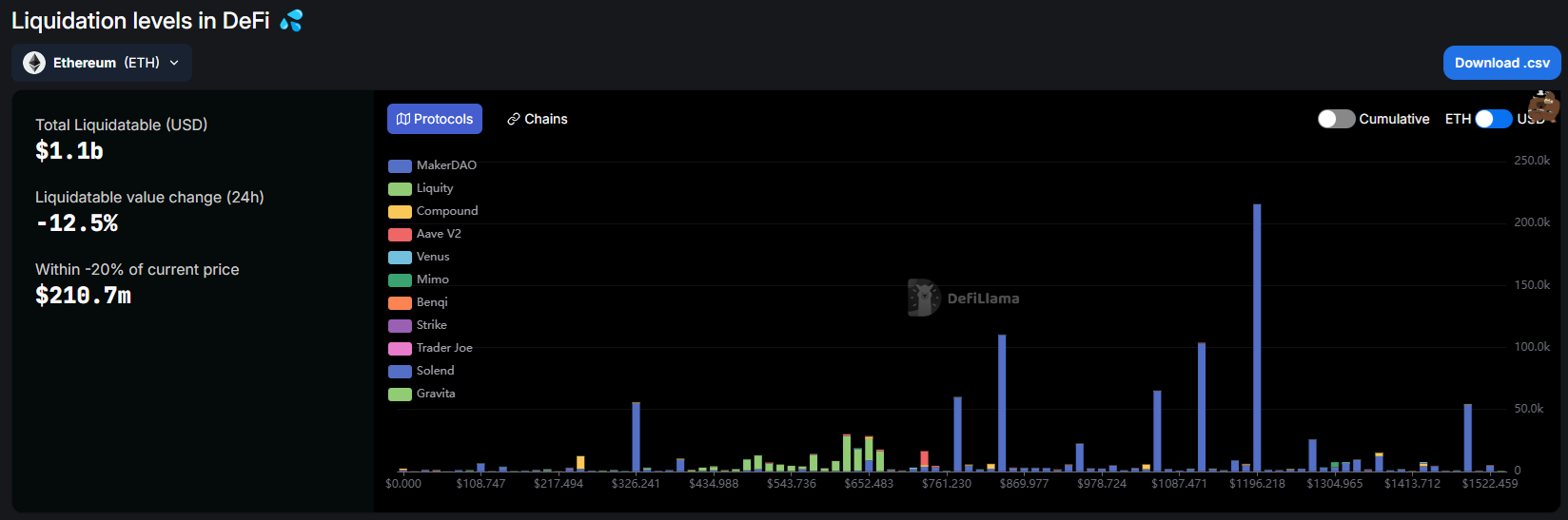

Ethereum (ETH) crashed on selling and liquidation pressure, but whales are still buying the dip

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

The 50X Hyperliquid whale is back with new leveraged long on Ethereum (ETH)

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Dogecoin’s support under threat amid rising liquidation pressure

Solana price falls below $100 as $200M unlock nears