Major DeFi Protocol Revenues Drop Sharply in March, Data Shows

Solana-based DeFi platforms such as Pump.fun, Jito, and Raydium collectively brought in around $42 million in March, down 55%.

Revenue across major decentralized finance (DeFi) protocols saw a sharp decline in March, reflecting a broader slowdown in on-chain activity and trading volumes across multiple blockchains.

According to industry data , Solana-based DeFi platforms such as Pump.fun, Jito, and Raydium collectively brought in around $42 million in March, down 55% from February and a steep 75% from their record highs in January.

On BNB Chain, leading protocol PancakeSwap generated just $21 million in revenue, marking a 54% drop compared to the previous month.

Ethereum DeFi Revenues Plunge 65% Since January Amid Market Slowdown

Ethereum-based protocols including Ethena, Lido, Aave, Curve, Compound, and Sushi also recorded losses, generating $24.5 million in total March revenue—down over 52% from February and 65% since January.

MakerDAO, now rebranded as Sky, was the only major protocol to buck the trend.

It reported $10 million in revenue for March, representing an 11% increase from the previous month and making it the sole gainer among the group of 11 major DeFi platforms analyzed.

The decline in protocol revenues has mirrored the year-to-date performance of DeFi tokens.

GMCI’s DeFi Index (GMDEFI), which tracks a basket of DeFi-related tokens across multiple chains, is down 40% so far in 2025.

The index includes assets from projects such as Uniswap, Aave, Jupiter, Ethena, Maker, and PancakeSwap.

Analysts suggest that the slump in DeFi revenues is largely due to reduced user engagement, fewer transactions, and broader market headwinds affecting crypto activity.

DeFi TVL Drops Over 30% Since December Peak

As reported, the total value locked (TVL) in DeFi has plummeted more than 30% since reaching a local high in December, underscoring growing market uncertainty and waning investor confidence.

DeFi’s TVL currently sits at $94.49 billion, a sharp decline from its $137 billion peak on December 17. The value briefly dropped as low as $88 billion in March.

The downturn mirrors the broader pullback in the cryptocurrency market, which had initially rallied following the November 5 election of pro-crypto U.S. President Donald Trump.

At the time, investor optimism pushed DeFi TVL beyond the $100 billion mark.

However, the enthusiasm has since faded amid growing macroeconomic concerns and regulatory challenges.

The bullish momentum that followed Trump’s victory was overshadowed by a series of economic headwinds, including sweeping new reciprocal tariffs and persistent inflation concerns.

The Federal Reserve’s extended pause on interest rate cuts has further dampened market optimism.

Bitcoin has since fallen from an all-time high above $108,000 in January to around $83,000, while Ether slid from $4,000 in December to roughly $1,800.

At the same time, regulatory uncertainty in the U.S. continues to cast a shadow over DeFi’s future.

Dan Greer, co-founder of DeFi App, recently told Cryptonews.com that DeFi represents more than just a financial alternative—it is a potential evolution of the global financial system.

However, he warned that unresolved regulatory issues may drive talent and innovation offshore.

“Mass adoption of DeFi hinges on solving its biggest barriers: complexity, cost, and accessibility,” Greer said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

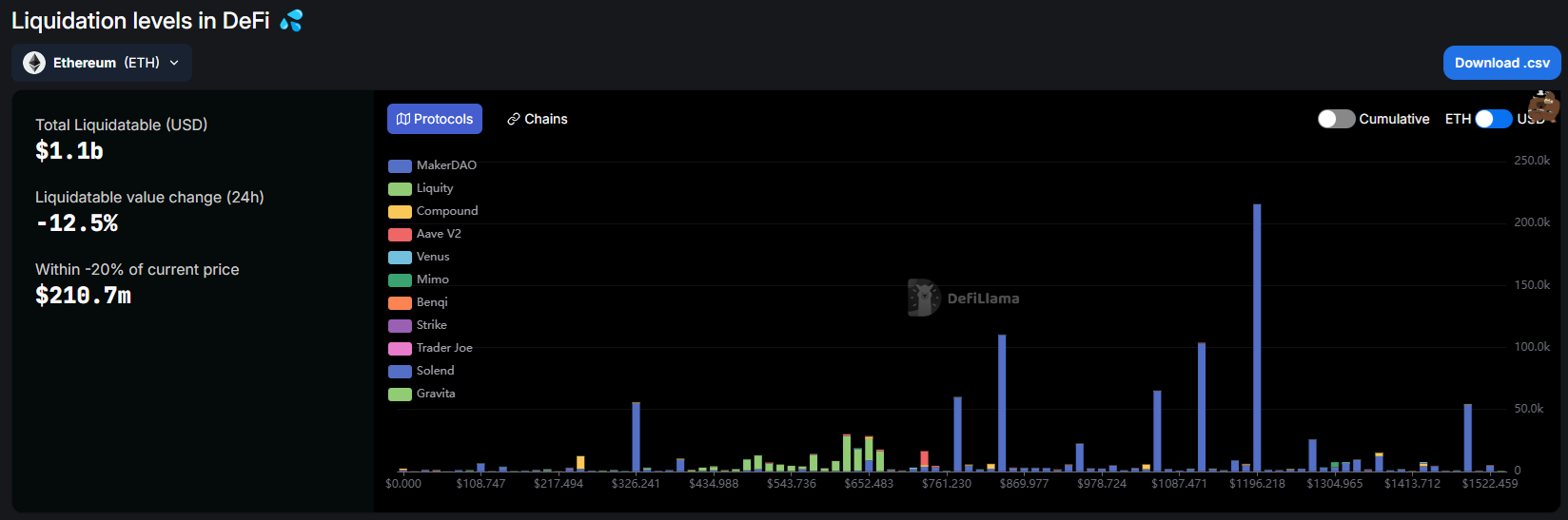

Ethereum (ETH) crashed on selling and liquidation pressure, but whales are still buying the dip

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

The 50X Hyperliquid whale is back with new leveraged long on Ethereum (ETH)

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Dogecoin’s support under threat amid rising liquidation pressure

Solana price falls below $100 as $200M unlock nears