Companies Holding Bitcoin Reserves May Face Increased Risks as BTC Drops Below $80,000

-

Public companies holding Bitcoin reserves are currently facing severe financial repercussions as Bitcoin’s price drops significantly.

-

The recent plunge in Bitcoin’s value, hitting below $80,000, has provoked critical discussions about the viability of corporate investments in cryptocurrencies.

-

Economists like Peter Schiff have publicly criticized these companies, raising alarms over potential bankruptcies due to their Bitcoin holdings.

Amid Bitcoin’s sharp decline below $80,000, public companies holding Bitcoin reserves are facing mounting losses, raising concerns about crypto investments.

Crypto Holdings Under Pressure: The Impact on Corporate Strategies

The cryptocurrency market faced a devastating downturn recently, with Bitcoin experiencing a staggering 9.6% drop in value. This sharp decline has raised alarms for companies holding significant Bitcoin reserves, leading many to question the sustainability of their crypto investment strategies. The price fell to $75,089, marking one of the lowest points in recent months, prompting a reevaluation of Bitcoin as a long-term investment.

According to data from Coinglass, the liquidation of positions during this dramatic drop reached a staggering $474 million. Notably, $405.7 million of this came from long liquidations, reflecting the vulnerability of traders and companies alike in a rapidly changing market.

Companies with substantial Bitcoin reserves, which were once seen as innovative financial strategies, are now reporting significant unrealized losses. The NGU (Number Goes Up) ratio, which measures the disparity between Bitcoin’s current price and a company’s investment cost, is now negative for many of these firms.

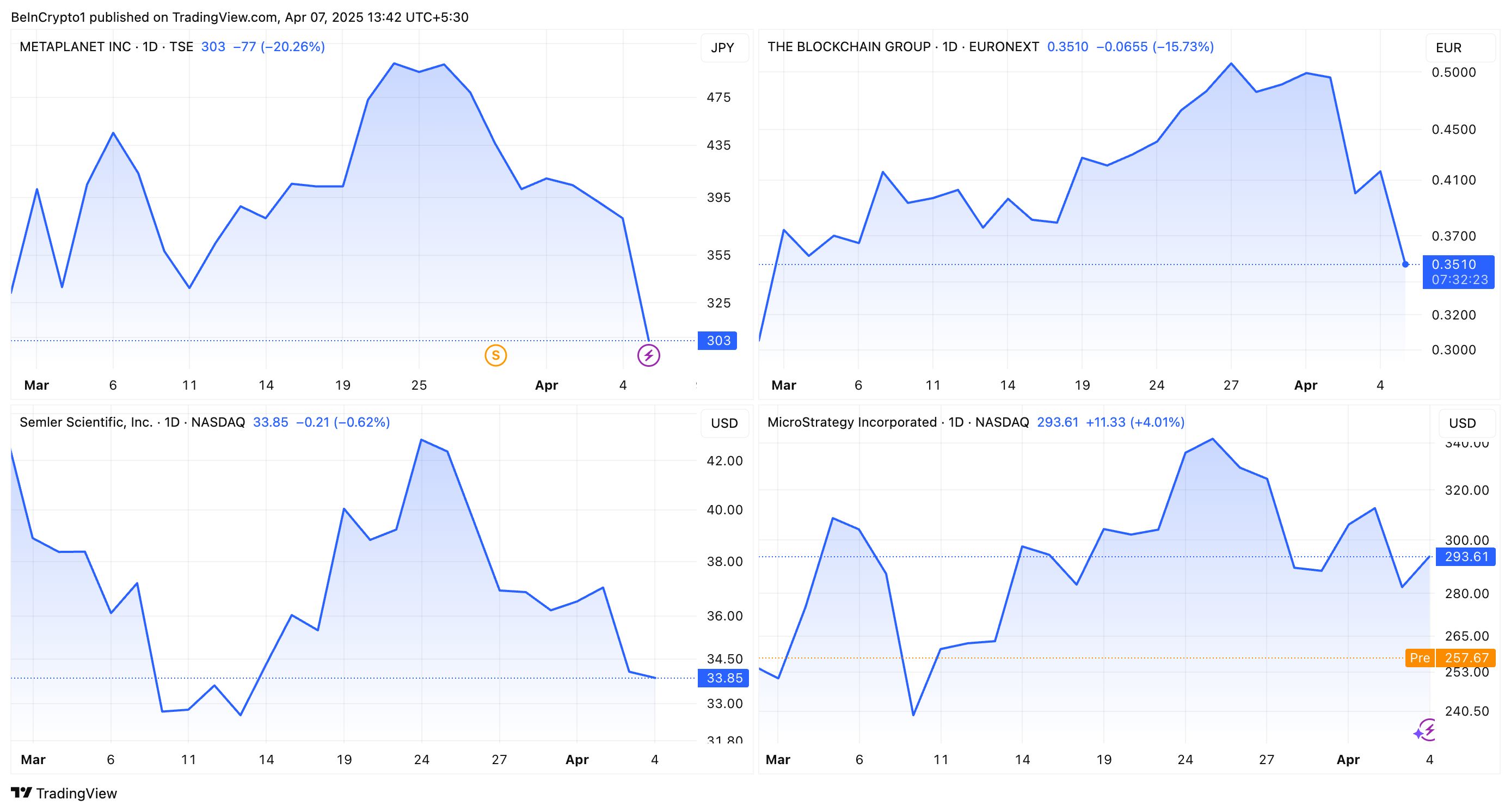

One notable example is Metaplanet, which has reported a 12.4% unrealized loss on its Bitcoin investment, currently valuing its holdings at $314.7 million while its acquisition cost per Bitcoin was around $85,483. Similarly, The Blockchain Group is facing a 14.4% loss, demonstrating just how drastically conditions have changed.

Market Reactions: Stock Prices and Economic Predictions

The fallout from Bitcoin’s decline has extended beyond cryptocurrency price swings and into equity markets. Companies like Metaplanet (3350.T) and The Blockchain Group (ALTBG.PA) are witnessing declines in stock prices, reflecting investor concerns over their crypto exposure. Metaplanet’s stock dropped 20.2%, while The Blockchain Group’s shares decreased by 15.8% as shareholders reconsidered the risk associated with high Bitcoin allocations.

SMLR has also felt the pinch, with its stock experiencing a modest 0.6% decline, but still aligning with the prevailing market trend of reduced confidence in crypto investments. The situation for MSTR (Strategy) is particularly notable, given its extensive Bitcoin holdings acquired since August 2020. Despite their average holding cost being around $67,485 per Bitcoin, the firm’s newer acquisitions have so far resulted in losses, painting a precarious picture for their investment strategy.

Critics of corporate Bitcoin investments are gaining a louder voice in this climate. Peter Schiff’s commentary on the vulnerability of Strategy’s investments underscores the bearish sentiment surrounding Bitcoin as a viable store of value. His stark warning suggests that without drastic measures, companies like MSTR may face dire financial straits.

Looking Forward: Assessing the Risks of Corporate Bitcoin Investments

The current climate presents a compelling question: Are Bitcoin reserve strategies truly sustainable for corporations? The series of losses reported by significant investors signals a potential shift in corporate crypto investment strategies. As more companies report negative NGU ratios and significant unrealized losses, the appetite for Bitcoin among public companies may diminish, as executives reconsider the balance between risk and reward in their investment portfolios.

Additionally, the broader financial implications of Bitcoin’s volatility are forcing corporate leaders to weigh their exposure to the crypto market against traditional investment avenues. Pride in being early adopters of digital currencies might soon give way to caution as the financial realities emerge. The knock-on effects could redraw investment strategies in a world increasingly concerned with stability.

Conclusion

As Bitcoin continues to struggle against declining prices, public companies holding substantial reserves may need to rethink their investment strategies. The current market realities have produced significant challenges, leading to heavy losses and potential concerns for corporate viability in the crypto sphere. With critics vocalizing concerns over the sustainability of these investment approaches, companies must adapt swiftly to navigate the choppy waters ahead and ensure financial resilience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$106 Million In Ethereum Liquidated: Crypto Whale Erased By The Ongoing Storm

Conor McGregor's REAL Token: A Resounding Failure

The CAC 40 Below 6900 Points: Geopolitical Tensions Weigh Heavily On The Market

Bitcoin: Traders Face Record-Breaking Losses