Crypto ETPs See Outflows of $240M After US Trade Tariff News: CoinShares

New US tariffs stir investor caution, triggering a swift capital retreat from crypto products. Varying regional strategies point to deeper shifts as market players reassess risk amid trade policy pressures.

Key Takeaways:

- Trade policy shifts prompt a rapid pullback from digital asset funds.

- Bitcoin-focused products drive most withdrawals; other tokens show uneven momentum.

- Some markets seize lower prices as a chance to build positions.

- Overall, investors are rethinking strategies amid economic pressures.

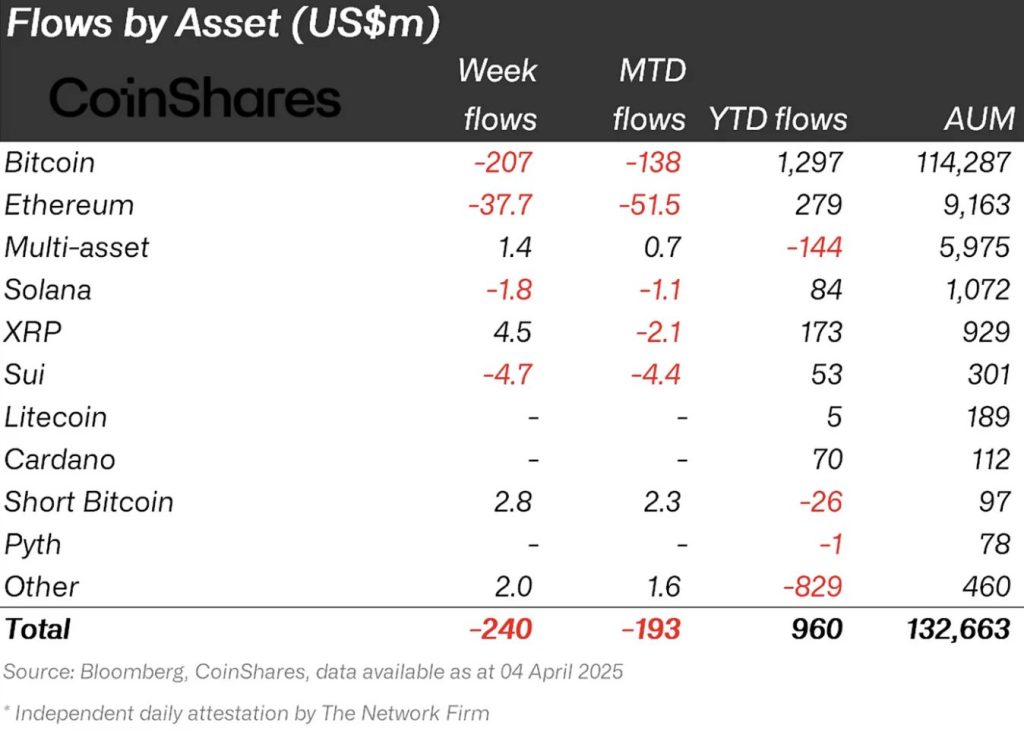

Crypto exchange traded products (ETPs) experienced outflows totaling $240 million last week, a trend influenced by recent U.S. trade tariff developments that pose potential threats to economic growth, according to a research report on April 7 by CoinShares.

Despite these outflows, the total assets under management (AUM) in the digital asset sector is showing resilience, increasing by 0.8% over the week to reach $132.6 billion.

This contrasts with the MSCI World equities index, which declined 8.5% during the same period.

Investor Sentiment Shifts, Notes CoinShares

The outflows were predominantly concentrated in Bitcoin investment products, which saw $207 million exiting, bringing the year-to-date inflows to $1.3 billion.

Ethereum also experienced remarkable outflows of $37.7 million, while other altcoins like Solana and Sui recorded outflows of $1.8 million and $4.7 million, respectively.

In contrast, more niche tokens such as Ton Coin attracted inflows of $1.1 million, indicating selective investor interest in specific digital assets, reports CoinShares.

Geographically, the negative sentiment was widespread, with the United States and Germany leading the outflows at $210 million and $17.7 million, respectively.

Canadian Investors Use Market Downturn as a Buying Opp

Conversely, Canadian investors appeared to view the market downturn as a buying opportunity, contributing inflows of $4.8 million.

This divergence highlights varying regional perspectives on the implications of recent economic developments and their impact on digital asset investments.

Interestingly, blockchain equities bucked the trend, recording inflows for the second consecutive week, totaling $8 million.

This suggests that some investors perceive the recent price weaknesses in blockchain-related stocks as favorable entry points, reflecting a nuanced approach to investment within the digital asset ecosystem .

The recent U.S. trade tariff news has influenced investor behavior, prompting a reevaluation of risk exposure in digital asset investment products.

While the immediate reaction has been one of caution, leading to substantial outflows, the overall stability in AUM indicates a sustained confidence in the long-term viability of digital assets .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Qubetics Presale Hits $16.5M – Top Crypto to Buy Now as Arbitrum and Immutable X Make Waves

Explore Qubetics, Arbitrum, and Immutable X, the top crypto to buy in 2025. Dive into their unique features, presale updates, and blockchain impact.Qubetics: Leading the Charge in Blockchain InteroperabilityArbitrum Enhances Blockchain Privacy with New Web AppImmutable X Partners with Ubisoft to Launch New Blockchain GameInteroperability in Blockchain: The Future is ConnectedConclusionFor More Information:

Open Project proposes tokenized securities on Solana blockchain with support from Superstate and Orca

UK Government Releases Comprehensive Draft Legislation to Support Industry and Curb Fraud

The UK government has unveiled a 27-page draft legislation aimed at bringing cryptocurrency activities under formal financial regulation for the first time. This move seeks to foster innovation while protecting consumers by extending existing financial rules to digital assets like stablecoins, crypto exchanges, and custodial services.

Bitcoin, Ethereum ETFs Witness Significant US Inflows