Coinshares: Digital Asset Funds See $240 Million Outflows Amid Global Economic Jitters

Crypto Fund Outflows Hit $240M, but Blockchain Equities Draw Fresh Inflows

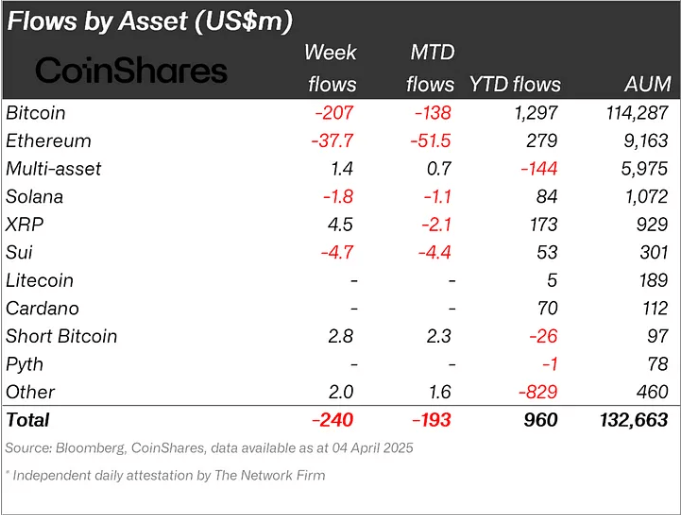

Digital asset funds faced $240 million in outflows last week, with the majority, $207 million, coming from bitcoin products. According to Coinshares’ digital assets weekly report, the downturn appears tied to concerns over new U.S. trade tariffs and their potential impact on global growth.

Despite the outflows, total assets under management (AUM) in the sector rose slightly to $132.6 billion, showcasing relative resilience compared to traditional equities, which saw steeper losses.

Ethereum also experienced notable outflows of $37.7 million, while solana and sui lost $1.8 million and $4.7 million, respectively. In contrast, Toncoin recorded a modest inflow of $1.1 million, highlighting investor interest in alternative assets.

Source: Coinshares

Regionally, the U.S. and Germany led the outflows with $210 million and $17.7 million, respectively. Canadian investors bucked the trend, adding $4.8 million to digital asset holdings amid the market volatility.

One bright spot was blockchain equities, which saw inflows of $8 million for a second consecutive week. The buying suggests some investors are viewing the broader market dip as a long-term opportunity.

While economic uncertainty continues to rattle markets, digital assets appear to be holding firm, maintaining investor interest despite short-term outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到[email protected],本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New York City plans to use AI to predict bad behavior in subway systems

Share link:In this post: The Metropolitan Transportation Authority (MTA) said it plans to use AI to detect potential problems on subway platforms. The Agency confirmed it won’t use facial recognition in surveillance. MTA added that the effort resulted from riders’ safety concerns following unprovoked subway system attacks.

US Treasury announces new Series I bond rate of 3.98% for May-October

Share link:In this post: The Treasury set the new Series I bond rate at 3.98% from May 1 to October 31, 2025. The rate includes a 2.86% variable portion and a 1.10% fixed rate, both updated by the Treasury. Bondholders’ interest rates shift based on when they bought the bonds, not when new rates are announced.

US economy shrank in first three months of the year as fears of tariff impact grow

Investors are still waiting for more concrete signs that the US is working on trade deals with other countries

Prosecutors push for 20-year sentence for ex-Celsius CEO