Bitcoin News: Addresses In Profit Reach Lowest Level In 3 Months, What’s Next?

Bitcoin price has battled intense bearish volatility that has reduced its profitability. Market sentiment around futures remains speculative and might shift. Optimism that Bitcoin price could reclaim the $100,000 soon remains high.

The number of Bitcoin (BTC) addresses in profit continues to decline, reaching lows last seen in February 2025. As Bitcoin news cycle sees no new respite, BTC price action flashed short-term greens.

The price of Bitcoin is down over 28% from its all-time high of $109,079, set in January this year.

As Bitcoin’s profitability reduces, the market is concerned about the leading cryptocurrency’s prospects.

Bitcoin News: Profitability Outlook Not Looking Good

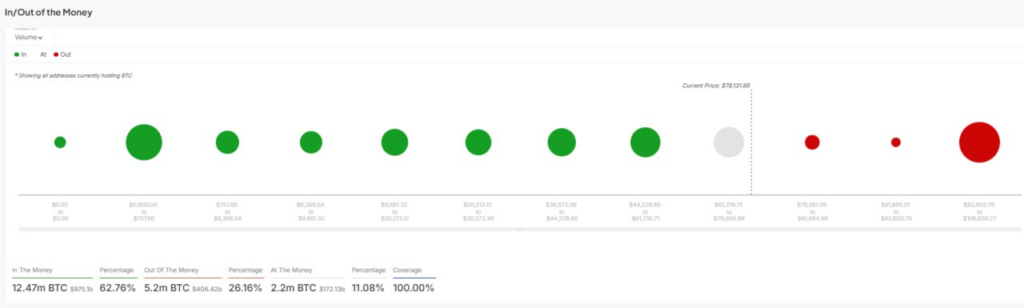

According to IntoTheBlock data, about 26.16% of BTC addresses are running at a loss, a shocking shift from earlier this year.

Based on the current data insight, this percentage equals approximately 5.2 million addresses.

Additionally, addresses at the break-even point total 2.2 million, or 11.08%. With the majority in the money, the metric suggests that prospects of a breakout remain relatively low.

Source: IntoTheBlock

Source: IntoTheBlock

Negative pressure might also force BTC holders to sell their assets soon as Bitcoin news mostly sees bearish turns. With many investors at a loss, any additional bearish trend might spark a sell-off wall.

Bitcoin’s price is currently pegged at $78,954, down 2.69% over the past 24 hours. Per the trend over the past week, the coin has lost more than 4.5% of its price within this time.

The slump in valuation, leading to massive address losses, is not surprising given the 28% drop from its all-time high three months ago.

Currently, most retail investors focus on the technology that has pushed the coin to unimaginable heights. They also anticipate the involvement of whales sparking renewed interest in Bitcoin.

Moreover, investors are still willing to purchase the coin, as trading volume is up by over 480% to $102 billion at the time of writing.

Has Bitcoin Price Bottomed Out?

Some analysts argue that Bitcoin has entered a bear market following the 28% price correction from its cycle peak. Others claimed the price has bottomed and is likely heading for a new rally.

According to data from the onchain analytics platform Glassnode, Bitcoin has printed a major support at $74,000.

This correlates with the first large supply cluster below $80,000 to over 50,000 BTC, around $74,200.

Investors who have remained active for five months usually hold this level. These investors steadily raised their cost basis until 10 March, after which they remained dormant.

Glassnode suggested that the downtrend may slow between $74,000 and $70,000. This is based on the fact that about 75,000 BTC is in cost-based clusters.

Source: Glassnode on X

Source: Glassnode on X

The data further pointed out that the next Bitcoin price support sits at $69,900, where approximately 68,000 BTC are held.

Bitcoin Price Predictions, When $100,000?

Several indicators show that traders are waiting for favorable entry points.

At the same time, the broader downtrend remains, signaled by declining open interest in Bitcoin futures. Glassnode reports that BTC’s futures open interest has fallen to $34.5 billion.

This decline reflects waning conviction, as traders appear to be closing more positions than opening new ones. With skepticism still reigning in the market it’ll be interesting to see where the momentum pivots.

From March 25, cash-margined futures dropped from $30.3 billion to $27.4 billion, and crypto-margined futures declined from $7.5 billion to $6.9 billion.

Still, a decisive breakout could challenge this bearish trend, and many traders maintain hope that Bitcoin will reach $100,000 in the coming months. While few expect the market to make a grand recovery right now, long-term prospects remain bullish.

Renewed capital inflows continue to support this outlook . However, more than just strong retail and institutional buying would be needed to wade through the bearish waters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK court orders BTCMining, a crypto mining platform suspected of international fraud, to shut down

Spot gold fell below $3,220/oz, down 2.09% on the day

Ethereum to Improve User Experience with New Interoperable Address Standard

BTC breaks through $96,000