Crypto Products See $240,000,000 in Outflows Likely in Response to US Tariff Threats: CoinShares

Crypto asset manager and research firm CoinShares says US tariffs were the likely cause of an outflow of hundreds of millions of dollars last week from digital asset investment products.

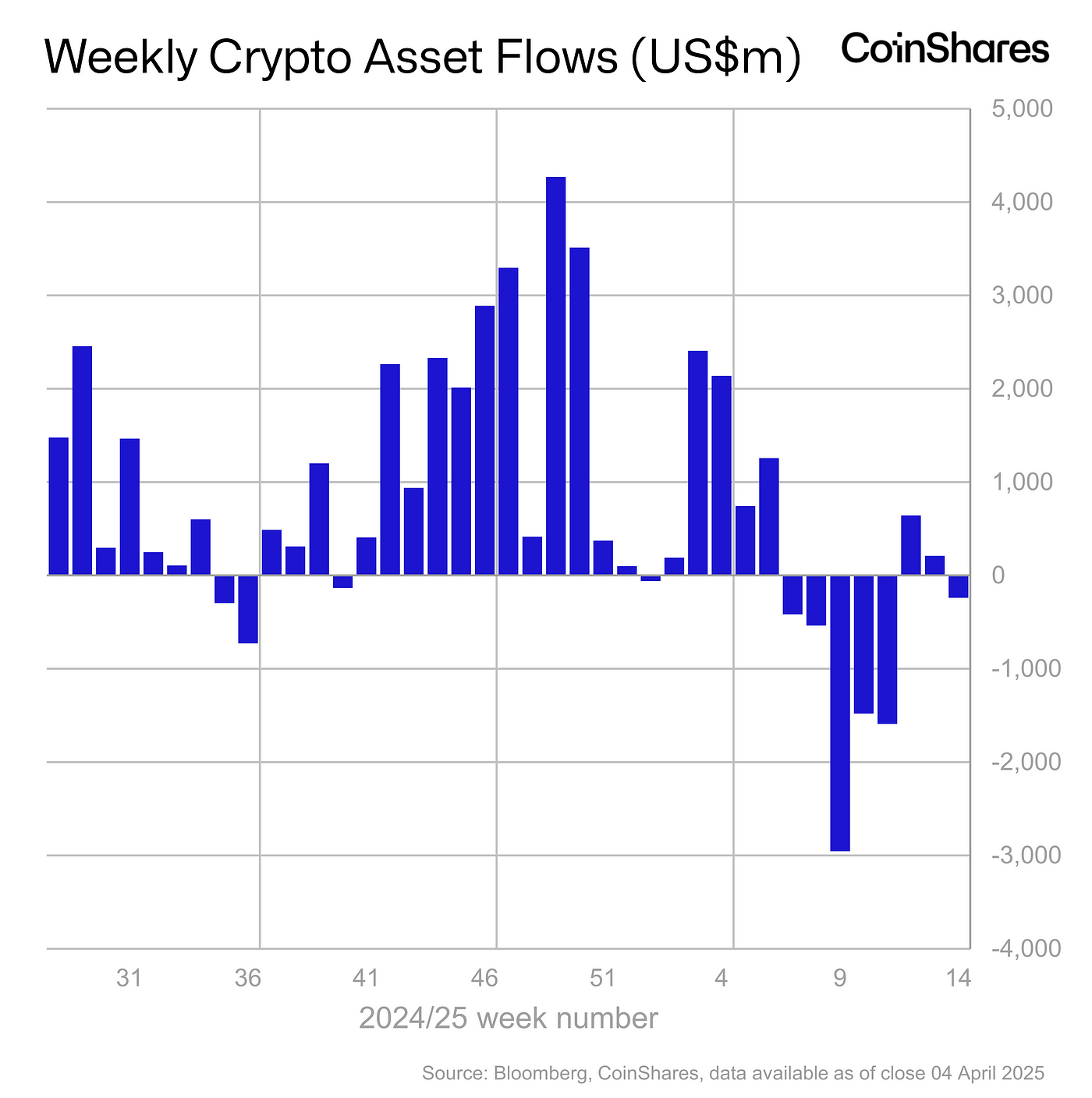

In its latest Digital Asset Fund Flows Weekly Report, CoinShares notes crypto products witnessed a $240 million outflow as US President Donald Trump announced steep tariffs against countries around the world.

Source: CoinShares

Source: CoinShares

However, CoinShares says the outflows were “minor,” especially when compared to other asset classes.

“Despite this [outflow], total assets under management remained remarkably stable at $132.6 billion, marking a 0.8% increase over the week. This resilience is especially notable compared to other asset classes, such as MSCI World equities, which saw an 8.5% decline over the same period, underscoring the robustness of digital assets amid economic uncertainty.”

The largest outflows were in Bitcoin ( BTC ), followed by Ethereum ( ETH ), Solana ( SOL ) and Sui ( SUI ).

“The flows were primarily from Bitcoin, seeing $207 million in outflows, leaving total inflows year-to-date at $1.3 billion. Flows in altcoins were very mixed, with Ethereum seeing $37.7 million outflows, as did Solana and Sui, with outflows of $1.8 million and $4.7 million respectively. More esoteric tokens such as Toncoin saw inflows of $1.1 million.”

Lastly, CoinShares says that blockchain-related stocks performed well last week.

“Blockchain equities saw inflows for the second consecutive week totaling $8 million as investors see recent price weakness as a buying opportunity.”

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP ETF Approval Odds Rise to 85%, Analysts Predict Potential All-Time Highs by 2025

U.S. Crypto Groups Urge SEC to Clarify Collateral Rules

JPMorgan: The decline in the dollar and US stocks is driven by speculators, not hedging purposes

Crypto Project World Launches in the U.S., Plans to Launch Visa Card and Tinder Pilot Program