Exaion expands Tezos support as an Etherlink validator

Exaion, a subsidiary of French electric utility giant EDF Group, is now a validator of Etherlink, the Tezos-powered layer 2 blockchain.

Exaion, which offers high-performance computing and cloud solutions for blockchains, has joined Etherlink, an Ethereum ( ETH ) Virtual Machine compatible L2 powered by Tezos ( XTZ ) smart rollups, as validator.

The move follows a key milestone that saw Exaion join Tezos as a corporate baker in October 2020.

As an EVM -compatible layer 2 platform, Etherlink enables non-custodial and seamless integration with Ethereum tools, leveraging Tezos’ rollup technology for scalability and accountability. Integration across the Ethereum ecosystem includes wallets and indexers.

The layer 2 chain, which launched in late 2024, also connects to other EVM-compatible chains.

“By joining Etherlink as a Smart Rollup node operator, we can play a role in maintaining network security while providing a high-quality digital service to anyone using the chain,” said Fatih Balyeli, chief executive officer and co-founder of Exaion. “We’re proud to continue supporting Tezos, an example of French technological ingenuity that aligns with our own mission.”

Exaion’s move to become an Etherlink validator comes as the Tezos L2 blockchain solution gains traction just months after going live. Etherlink has attracted projects such as money market funds platform Spiko and Coinbase-backed real-world assets platform Midas.

Other platforms are also testing various use cases on the L2, including tokenized assets and contract deployments. Exaion’s launch of validator operations for the network adds to overall stability and decentralization as growth continues.

“Rollup security relies on the presence of at least one honest validator,” said Arthur Breitman, co-founder of Tezos. “So the more reputable parties validating the Etherlink rollup, the more robust it is.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

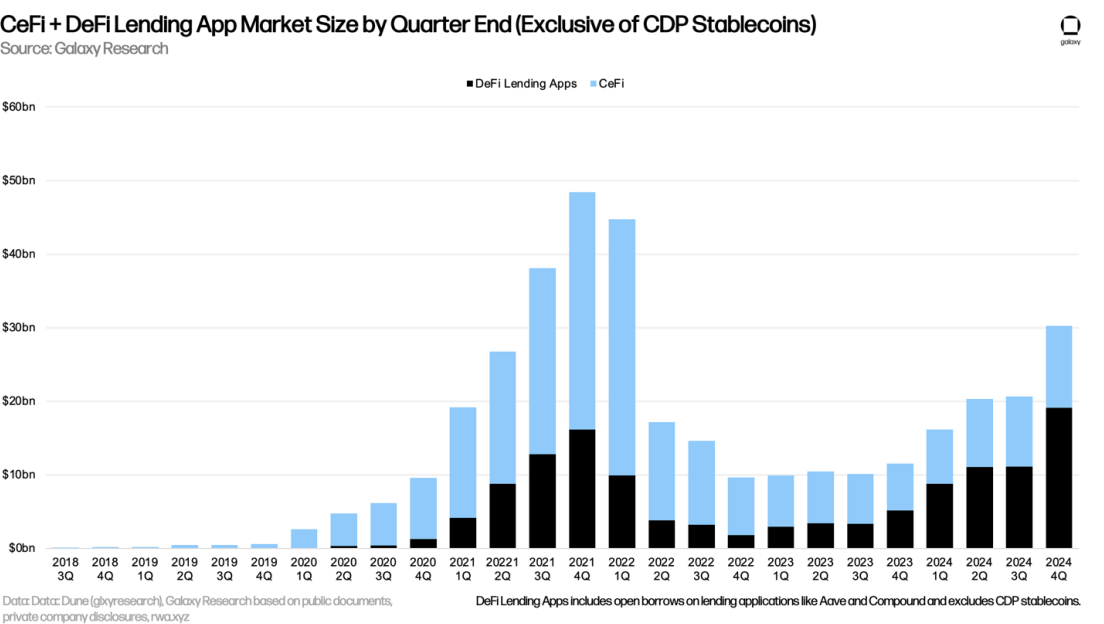

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection