Berachain price recovery cut short as bears overpower bulls

- Berachain surged 12% to $4.71 but fell to $3.85 as bears dominated.

- The Relative Strength Index (RSI), the ADX, and the MACD signal bearish momentum.

- Berachain Network revenue is up 180% over the past month despite the price dropping by 33% over the same period.

Berachain price jumped by over 12% earlier today, hitting an intraday high of $4.71, but it has since pulled back to around $3.85 at press time on April 10, 2025.

This brief rally offered a glimmer of hope for investors after a brutal 52.9% decline over the past two weeks.

The token has now fallen back into a bearish channel on the 4-hour chart, unable to sustain momentum despite a broader crypto market recovery spurred by Trump’s tariff pause .

Notably, bears remain firmly in control, with technical indicators warning of further downside, overshadowing the network’s impressive 450% revenue surge.

Technical indicators flash warning signs

Berachain’s Relative Strength Index (RSI) on the 4-hour chart recently dropped to an alarming 16.97, signaling extreme oversold conditions.

While it has bounced back above the oversold region, the bullish momentum has been cut short, and it now sits at around 42, meaning bears are still in control.

Berachain price chart by TradingView

Berachain price chart by TradingView

The Directional Movement Index (DMI) shows an ADX of 46.7, reflecting an extraordinarily strong bearish trend.

Sellers maintain a chokehold with DMI readings of 50 (+DI) and 16.9 (-DI), leaving little room for bullish intervention.

The MACD, despite seeing a crossover, remains below 0, underscoring persistent negative momentum.

In addition, widening Bollinger Bands, now at 86% width, hint at escalating volatility that could trigger a technical bounce or a sharper drop.

Berachain Network growth clashes with price woes

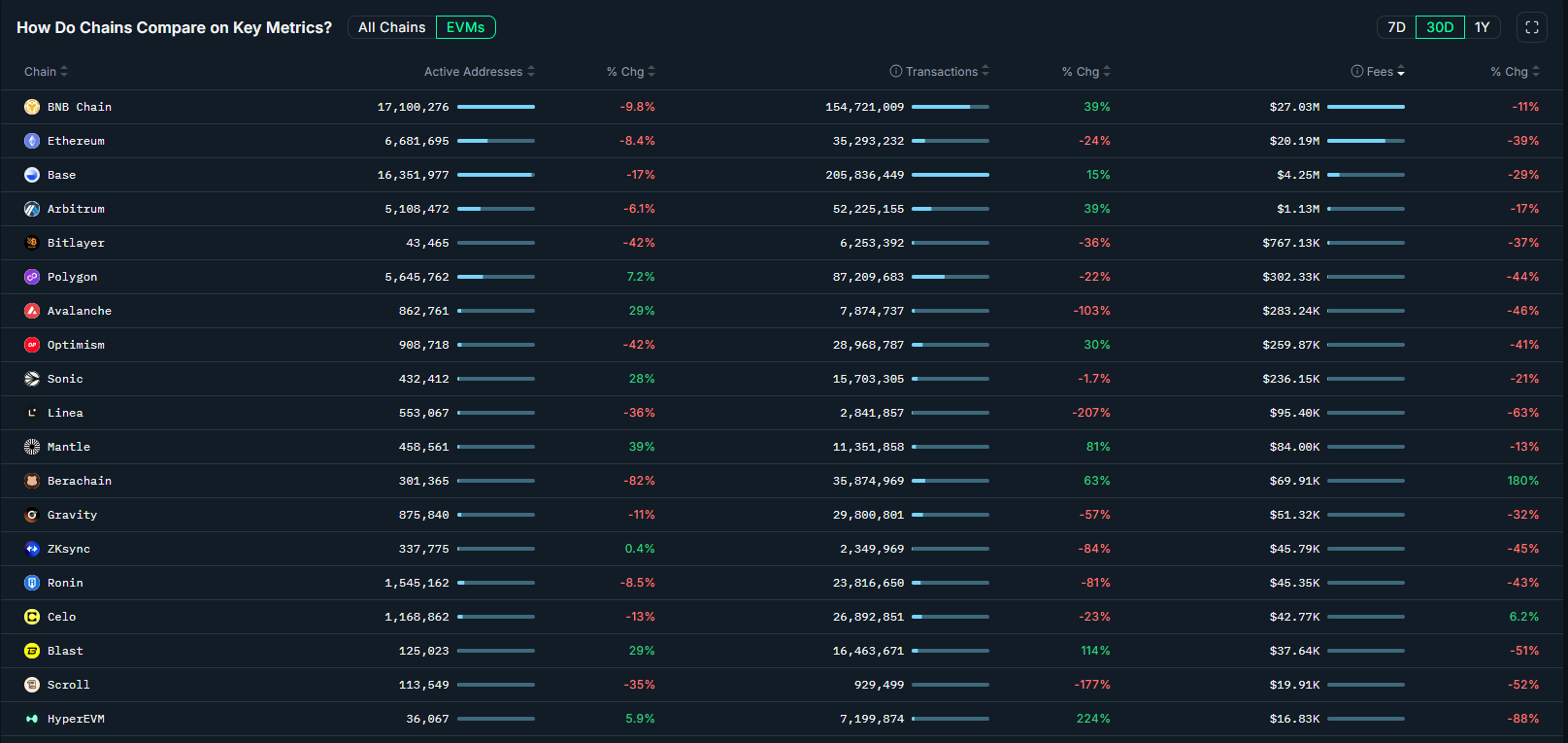

According to data from Nansen , the Berachain ecosystem has experienced sharp growth in recent weeks.

Network fee revenue surged 180% month-on-month to $69,910, while transaction volume climbed 63% during the same period.

Notably, this growth came despite an 82% decline in active addresses, indicating rising engagement or larger average activity per user within the network.

Berachain’s ecosystem has seen explosive growth, with network fee revenue skyrocketing 180% to $69.91k in a month, with transactions rising by 63% despite active addresses dropping by 82% over the same period.

Berachain ecosystem growth by Nansen.

Berachain ecosystem growth by Nansen.

Notably, MEV-related operations account for 34.97% of fees, while the core protocol and native DEX BEX contribute 18.64% and 17.38%, respectively.

Interestingly, this surge in activity contrasts starkly with the token’s 37.9% weekly loss and 62.44% drop from its $14.99 all-time high in February.

Key BERA price levels to watch amid the bearish pressure

Traders eye immediate support at $3.06, with $2.71 as the last line of defense if selling intensifies.

The pivot point at $3.74 remains a crucial threshold for any reversal confirmation.

Also, the resistance at $4.44 and $4.78 looms as a formidable barrier to recovery.

Currently, low liquidity at 58.43% amplifies the risk of sharp price swings, and traders could probably wait for an RSI divergence and volume spikes before attempting counter-trend trades.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An NFT trader may face jail time for hiding $13 million in CryptoPunk profits on his tax return

The tariff shock wave hits the pain point of the US government leadership