North Carolina proposes to allow the use of cryptocurrency for tax payments

Legislators in North Carolina have proposed the "Digital Asset Freedom Act" (H.B. 920), which aims to allow the use of cryptocurrencies in tax payments and other economic transactions. The bill stipulates that eligible digital assets must have a market value of at least $750 billion, daily trading volume not less than $10 billion, and more than 10 years of public market operation history with censorship resistance capabilities. It also requires decentralization, no pre-mining, no internal distribution, and no centralized control. The bill does not specifically mention specific assets such as BTC. Previously, the state has proposed several coin-related bills, including allowing state treasurers to invest in Bitcoin and investing part of pension funds in cryptocurrencies. (The Block)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PancakeSwap Tokenomics 3.0 Proposal Successfully Passed

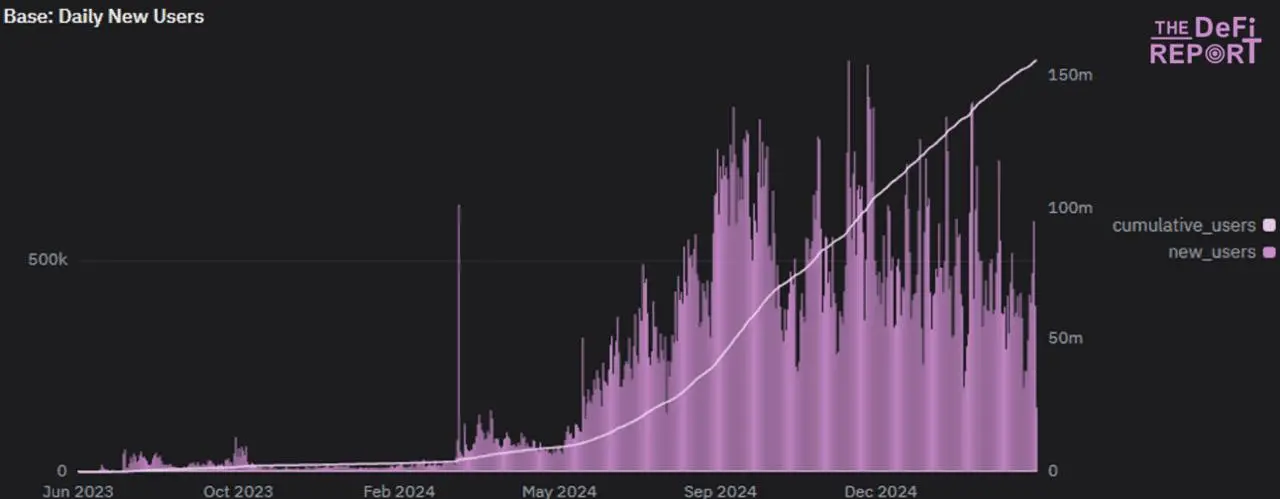

Data: Over 410,000 New Users Daily on Base Chain in the Past 30 Days

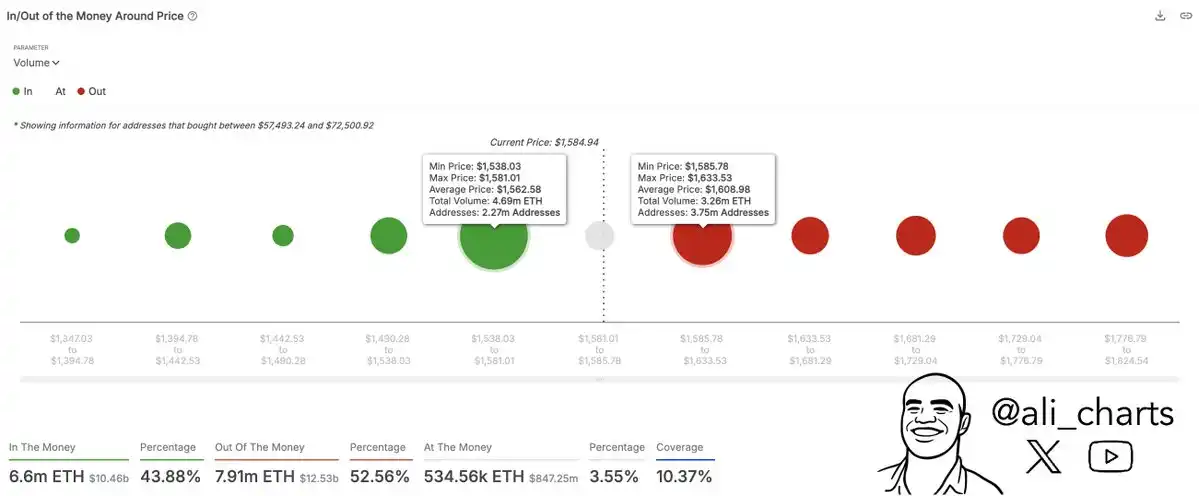

Opinion: Ethereum Chips Concentrated in the $1540-1630 Range, Breakthrough Will Form Trend