Altcoin Investors Spot a Major Technical Signal Igniting Excitement

In Brief Technical signals indicate a promising accumulation phase for altcoin investors. Historical patterns suggest potential for recovery following similar market conditions. DCA strategies are recommended to navigate uncertain market environments effectively.

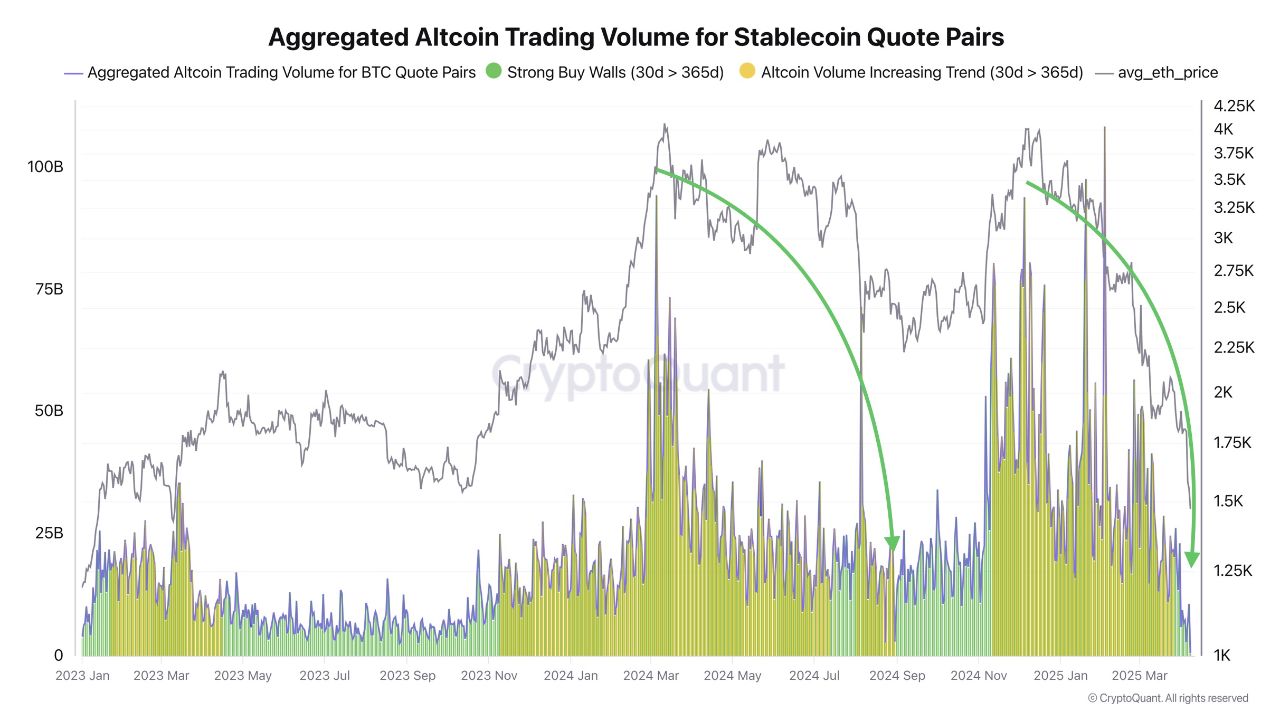

A significant technical signal has emerged in the cryptocurrency market, capturing the attention of altcoin investors. According to a report by the on-chain data platform CryptoQuant dated April 11, altcoin trading volume statistics have returned to the accumulation zone. This resurgence into the accumulation zone presents noteworthy opportunities, particularly for medium-term investors, as experts recall that similar historical periods yielded profitable outcomes.

Technical Indicators Signal Rising Trends for Investors

The indicator used in this analysis hinges on the 30-day average volume of altcoins traded against stablecoins, which has dipped below the 365-day yearly averages. This technical crossover has historically marked the onset of recovery phases following downturns. A similar signal was observed most recently in September 2023, after which a robust upward wave began.

According to CryptoQuant analyst Darkfost_Coc, the altcoin market has re-entered the accumulation zone. Particularly, the drop of the 30-day trading volume average below the annual average supports this view. A significant discrepancy between trading volume and price is evident on the chart.

Altcoin Stablecoin Pairs – CryptoQuant

Altcoin Stablecoin Pairs – CryptoQuant

The most striking aspect of this signal is its resemblance to past examples. After a similar formation was observed in September 2023, the altcoin market experienced a notable recovery. The recovery process following that downturn lasted approximately six months, prompting some experts to view the current signal as a strategic accumulation opportunity.

Market Conditions Favor DCA Strategy

The Dollar Cost Averaging (DCA) strategy, often recommended for long-term investors, gains increased importance during such periods. High market uncertainty can negatively impact investor psychology with sudden drops and spikes. Technical signals like these help ground investment decisions in rationality.

The graph published by CryptoQuant supports this interpretation. The drop in volume for altcoins traded against stablecoins clearly indicates an entry into the accumulation zone. Besides technical indicators, market sentiment also emphasizes the need for careful monitoring and positioning during this period.

While such data does not constitute a direct buying recommendation, investors may benefit from heeding past examples to seize potential opportunities. Planned investments made at regular intervals can serve as a protective strategy against market volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amir Bandeali Stays True to Code as Co-CEO of 0x

Bitcoin Hash Rate Reaches Record High

Bitcoin's hash rate just hit a new all-time high, signaling strong network security and growing miner confidence.What the Record Hash Rate Really MeansA Surge Driven by Miner OptimismPre-Halving Momentum Builds

Bitcoin Nears $85K Amid Trade Optimism and Fed Hints at Rate Cuts

Trade wars push blockchain into supply chain solutions