Investors Turn to Gold-Backed Altcoins for Stability

In Brief Gold-backed altcoins are gaining popularity among investors seeking stability. XAUT is performing well, ranking in the top ten cryptocurrencies. Economic uncertainties are driving increased demand for gold and related altcoins.

Gold continues to stand out as a safe haven asset during times of growing economic and geopolitical uncertainties. Recently, there has been a significant increase in the demand for tokenized gold altcoins among investors, especially in Asia. Assets such as Tether’s XAUT and Paxos’ PAXG have drawn attention for their strong positions in the market. The price fluctuations among different asset groups in the cryptocurrency market further reinforce this interest.

XAUT Joins the Top 10 Cryptocurrencies

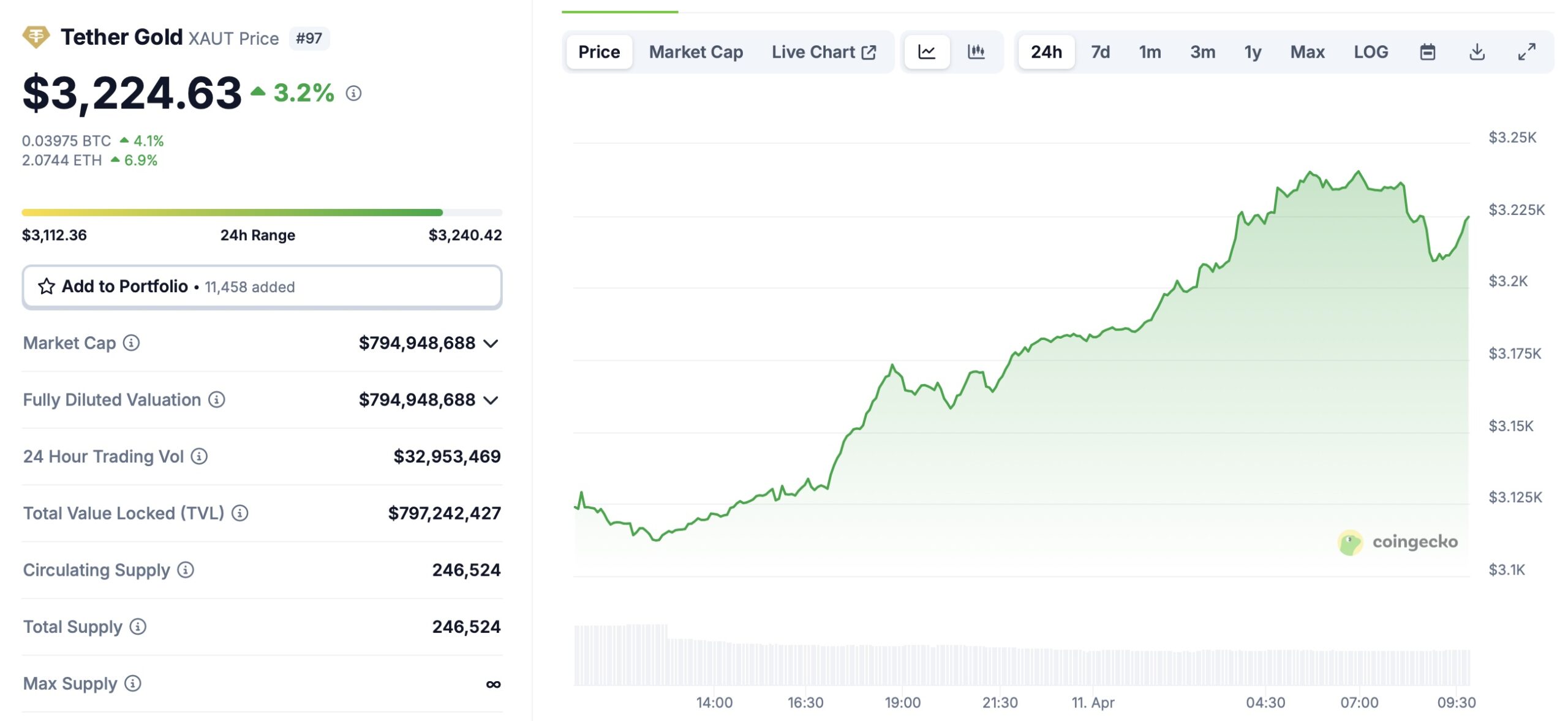

On-chain data reveals that Tether’s gold-backed altcoin , XAUT, has ranked among the top ten performers in the cryptocurrency market in the last 24 hours. It has experienced a rise of 3.4% during this period, making it the largest tokenized gold altcoin by market capitalization. According to CoinGecko, the overall cryptocurrency market has seen a 4.3% increase in the same time frame.

Altcoin Altcoin’s XAUT

Altcoin Altcoin’s XAUT

The current landscape shows that the market possesses diverse dynamics, leading to differentiation in investor preferences. Gold-backed altcoins stand out due to their relatively lower volatility.

Economic Uncertainties Boost Demand for Gold

The price of physical gold traded in Asia has shown resilience, continuing around 3,218 dollars in Hong Kong, despite a slight drop during the last session on the U.S. market. This fluctuation is believed to stem from global market dynamics and economic signals from the U.S. Notably, low interest rates enhance the appeal of non-yielding assets like gold.

Additionally, recent reports from Chinese state media indicate that the government is working on a new stimulus package worth approximately 136 billion dollars, featuring public spending and interest rate cuts. Such measures could impact not only China but also the broader landscape of cryptocurrency investors in Asia, as macroeconomic interventions have the potential to directly influence investment choices.

Data on the U.S. budget deficit and unpredictable policies have accelerated investors’ search for safe havens. As a result, there is a noticeable trend towards both physical gold and tokenized gold altcoins. Especially, altcoins like Tether’s XAUT are gaining attention for combining the conveniences of blockchain technology with backing from physical gold.

Furthermore, the U.S. government’s moves to relax regulations in the decentralized finance (DeFi) sector have led to significant price movements in projects like Curve DAO. For example, CRV coin has surged by 18% in the last 24 hours. These developments indicate that investors are looking to diversify their portfolios and are not limiting themselves to a single asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ronin Bridge CCIP Migration Begins with Chainlink-Powered Security

Celo and Bando Makes Crypto Easy for Buying Gift Cards and Data

VeChain Partners with 4ocean to Advance Ocean and Land Sustainability with Blockchain

Inflation Isn’t Slowing Down and BlackRock CEO Knows Why