Bitget to Burn $120M Worth Of BGB Tokens To Increase Demand, Will This Decentralized Crypto Provided Mirror This Move?

In a bid to increase demand and further solidify its position in the market, Bitget has announced its decision to burn $120 million worth of BGB tokens. This move, which is part of a new utility-based burn mechanism, is expected to reduce supply and potentially drive up demand for BGB tokens. But with Coldware (COLD) ’s rising popularity and its potential to revolutionize the decentralized space, could this latest move by Bitget signal the beginning of a trend in the crypto world?

Could Coldware (COLD) Follow Bitget’s Lead?

Coldware (COLD) has been making waves in the decentralized finance and mining sectors, and its growing ecosystem could set the stage for similar moves. With its innovative approach to decentralized mining and mobile-first solutions, Coldware (COLD) has captured the interest of many in the crypto space, especially those looking for more sustainable mining options.

Could Coldware (COLD) introduce a similar burn mechanism to increase demand for its token? Given the platform’s focus on scalability, decentralization, and community-driven engagement, it’s entirely possible that Coldware (COLD)could implement a token burn strategy in the future. By tying its burns to real-world usage of its platform—such as staking, liquidity farming, and mobile mining activities— Coldware (COLD) could increase both the value and utility of its token.

Bitget’s Bold Strategy: Burning $120 Million in BGB Tokens

On April 9, 2025, Bitget revealed that it would burn over 30 million BGB tokens in its first quarterly burn for the year. The burn was linked to a new utility-based mechanism that ties the burn volume to on-chain activity, particularly the amount of BGB used for gas fees through the platform’s GetGas accounts. With BGB priced at $4.09 at the time of the announcement, this burn is valued at approximately $120 million.

Bitget’s decision to tie token burns to real-world utility is a significant shift away from traditional methods of manually setting burn schedules. By adjusting the burn volume based on user activity, Bitget aims to create a more dynamic and responsive approach to token supply management, one that aligns with the growth and engagement of its platform.

Utility-Driven Tokenomics: A Trend for the Future

The move by Bitget to burn BGB tokens based on actual usage reflects a broader trend in the cryptocurrency space towards utility-driven tokenomics. Coldware (COLD) , with its focus on real-world applications and decentralized finance, is well-positioned to adopt similar strategies that emphasize usage and engagement.

Conclusion: A New Era of Token Burns?

As Coldware (COLD) and other decentralized projects continue to innovate, it’s clear that utility-driven tokenomics could become the next big trend in the crypto world. Just as Bitget is burning tokens to create more demand for its platform, Coldware (COLD) may one day implement similar strategies to ensure long-term sustainability and growth. With Coldware’s expanding ecosystem, the future looks bright for both Coldware (COLD) and Pi Network (PI) holders. As the crypto world evolves, these innovative strategies could help shape the next phase of the decentralized economy.

For more information on the Coldware (COLD) Presale:

Visit Coldware (COLD)

Join and become a community member:

https://t.me/coldwarenetwork

https://x.com/ColdwareNetwork

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

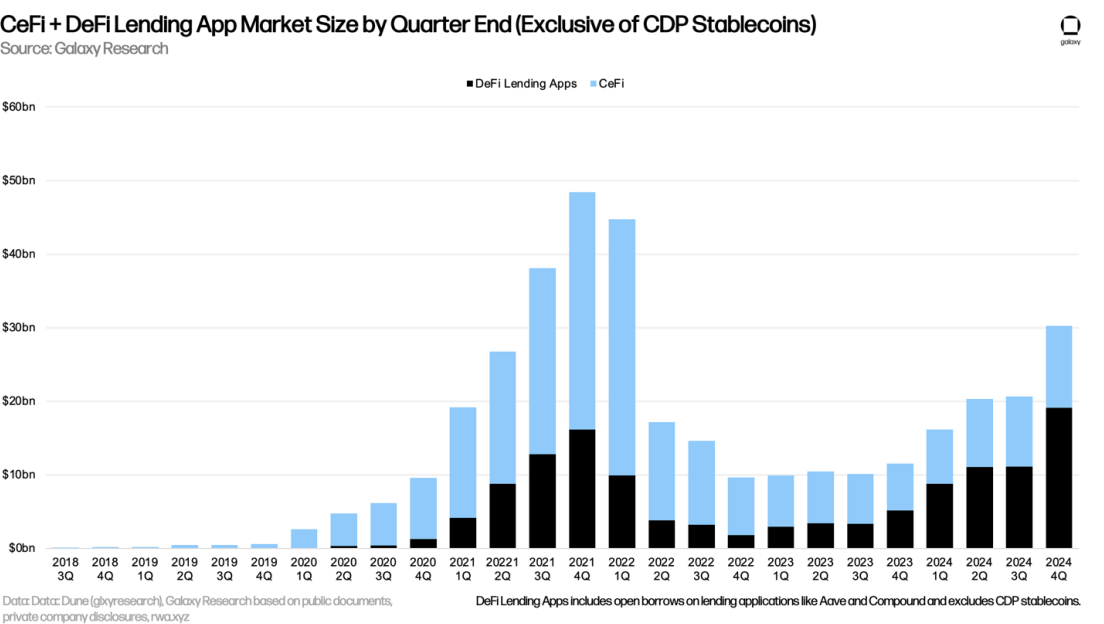

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection