Fed Chair Powell Indicates Possible Relaxation of Crypto Banking Regulations Amid Economic Caution

-

Federal Reserve Chair Jerome Powell recently indicated a cautious stance regarding interest rates while hinting at relaxed crypto banking regulations, showcasing a mixed outlook for financial markets.

-

Powell emphasized the importance of careful monitoring of the economic landscape before making significant policy adjustments, especially in the face of global trade uncertainties.

-

He stated, “A legal framework for stablecoins is a good idea,” reflecting the Fed’s acknowledgment of cryptocurrency’s growing relevance in the financial ecosystem.

Fed Chair Powell signals cautious optimism for crypto regulations despite a hawkish stance on interest rates, creating a mixed sentiment in financial markets.

Fed’s Powell Maintains a Hawkish Outlook on Interest Rates

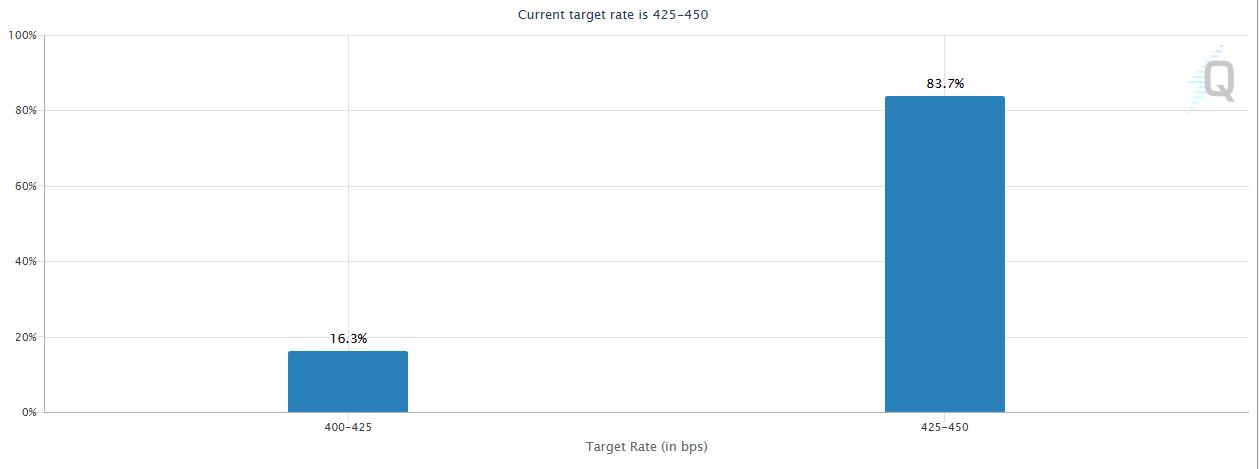

During his recent address at the Economic Club of Chicago, Powell made it clear that a near-term rate cut is unlikely, attributing this to economic uncertainties and trade policy risks. This statement aligns with the current market perception, where expectations for a regulatory easing have drastically shifted, with CME FedWatch data now showing only a 16% probability of a rate reduction in May.

The immediate reaction from the equity markets was negative, as stocks dipped modestly in response to Powell’s comments. Investor sentiment has been notably affected by the absence of dovish signals, with Powell remarking, “We should not rush to lower interest rates. We have every reason to wait for more clarity before considering any changes to Fed policy.”

Despite the overall market turmoil, the crypto sector displayed remarkable resilience. Optimism regarding rate cuts had largely dissipated following the hawkish FOMC minutes released last week, coupled with a cooler-than-expected CPI print.

Fed’s Interest Rate Cut Probability for May. Source: CME FedWatch

In addition to his remarks on rates, Powell made several observations about the current landscape of digital assets. He stated, “Cryptocurrency is becoming more popular,” indicating the Federal Reserve’s growing recognition of the sector’s significance. He underscored the importance of establishing a legal framework for stablecoins, proposing that the Federal Reserve is supportive of easing certain banking regulations on cryptocurrency.

The Mixed Impact on the Crypto Market Amidst Regulatory Signals

The dual message delivered by Powell—no immediate changes to interest rate policy yet a positive view on crypto regulation—yielded a muted response in the cryptocurrency markets. Bitcoin and other major cryptocurrencies maintained stability, with Bitcoin hovering around $84,500. This indicates that the digital asset market is absorbing the macroeconomic signals without significant downturns, contrasting with risk-off sentiment in traditional equities.

Moreover, Powell recognized that economic growth may have slowed early in 2025 and highlighted that tariffs imposed during the previous administration could pose ongoing uncertainties for the economy. He reiterated that the Federal Reserve is not near an end to its quantitative tightening measures and hinted at the need for difficult policy decisions should inflation show signs of resurgence.

While the Fed confirmed its preparedness to provide U.S. dollar liquidity to global central banks if necessary, Powell dismissed the notion of a Fed “put,” affirming that the independence of the central bank is governed by legal standards rather than market fluctuations. This highlights the delicate balancing act the Fed must perform in supporting economic stability while navigating complex global financial landscapes.

Conclusion

The outlook presented by Powell reflects a cautious yet optimistic view towards cryptocurrency regulation amidst a challenging economic environment. Observers note that while interest rates are set to remain steady for the time being, the relaxed stance on crypto banking regulations could pave the way for enhanced legitimacy and integration of digital assets within the broader financial system. As the market navigates these challenges, stakeholders will need to watch closely for further developments both in interest rate decisions and in the evolving regulatory landscape of cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum active addresses surpass 15M as Buterin sets 2025 goals

Strategy stock closes April with 32% surge

North Carolina House passes state crypto investment bill

Bitcoin Sees Strongest April Since 2020 With 14.7% Gain

Bitcoin rose 14.7% in April—almost double its median monthly return—marking its best April performance since 2020.Bitcoin Defies History With Huge April RallyBreaking Down the NumbersLooking Ahead: What’s Next for BTC?