Ethereum Metric That Historically Precedes Price Rebounds Is Flashing Bullish, Says Analytics Firm Santiment

New data from the market intelligence platform Santiment indicates that Ethereum ( ETH ) may be on the cusp of a breakout.

In a new strategy session, the crypto analytics firm says one metric that historically precedes a recovery for the top altcoin is flashing bullish.

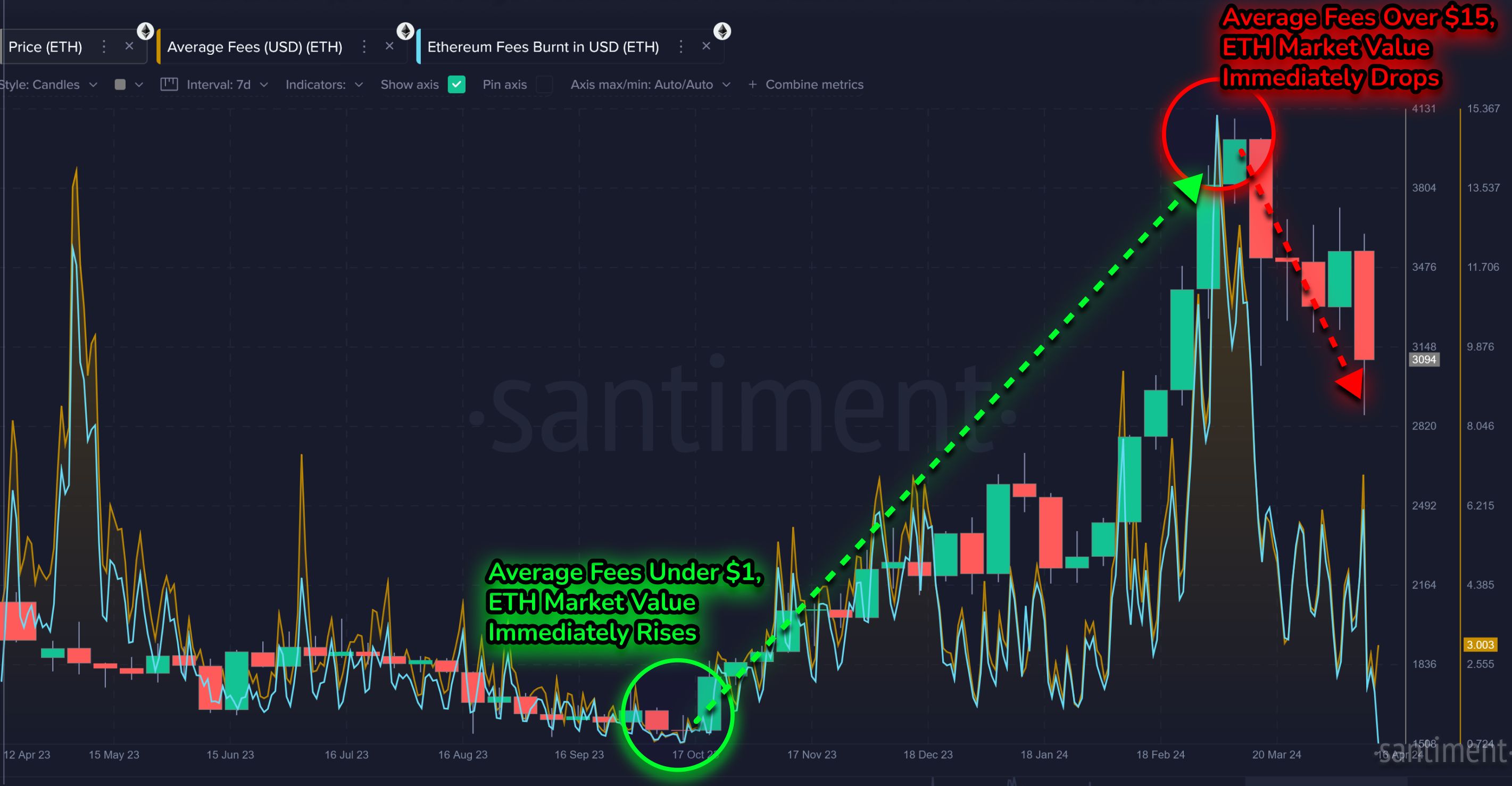

According to Santiment, Ethereum’s operation fees are currently at a low, which tends to precede a price rebound for the second-largest digital asset by market cap.

“From a trading perspective, historically low fees like this will often precede price rebounds, making buys at these levels generally considered to be lower risk than usual.

Generally, fee levels under $1 are a pretty promising sign that the crowd has become disinterested. Just remember that there is no set guaranteed ‘bottom’ or ‘top’ level every time fee costs breach below or above a certain level.”

Source: Santiment

Source: Santiment

Santiment’s chart shows that the last time ETH fees were near this price back in October 2023, ETH shot straight up afterwards, going from a price tag of about $1,600 to over $4,000 in March 2024. However, once ETH’s trading fees peaked at over $15 after it rose at that time, its price started dipping again.

Santiment goes on to note that retail traders are writing off the largest smart contract platform by volume, another sign that it’s about to skyrocket.

“Overall, Ethereum has been largely written off by the crowd. Several traders have given it a meme status as other top caps (like XRP and Cardano) enjoyed major breakouts themselves over the past year.

But remember that the more the retail community leans away from an asset (especially one with still thriving development), the higher the likelihood of an eventual surprise rebound with little resistance.”

Ethereum is trading for $1,572 at time of writing, a 1.2% decrease on the day. At the start of the year, it was valued at $3,348.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins flipped the script to surpass Visa in transaction volume

Share link:In this post: Bitwise Crypto Market Review for Q1 2025 revealed that stablecoin transactions narrowly surpassed Visa’s payments. Stablecoin transaction volume rose by over 30%, and the market’s AUM hit an all-time high of over $218 billion, with a 13.5% increase quarter-over-quarter. Visa and Bridge announced a partnership to offer stablecoin-linked Visa cards to customers across multiple countries in Latin America.

Bitcoin nears $100K as $61.6B support zone strengthens around $95K

Ethereum active addresses surpass 15M as Buterin sets 2025 goals

Strategy stock closes April with 32% surge