Ethereum Reaches A Critical Threshold... What If It's Time To Buy?

Ethereum’s dominance in the crypto market has fallen to its lowest level in 5 years, raising questions but also optimism among some analysts. While massive sell-offs continue, several technical indicators suggest a potential entry point for investors seeking a rebound.

Ethereum at a Crossroads in the Crypto Market

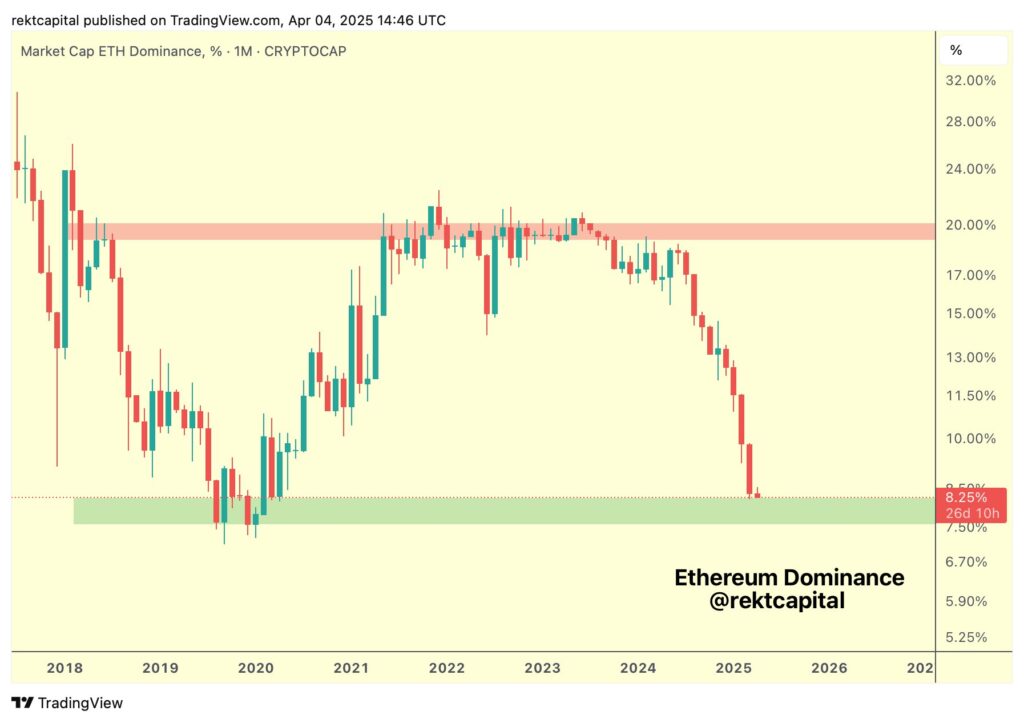

Since June 2020, Ethereum’s dominance — meaning its capitalization relative to the entire crypto market — has dropped from 20% to 7.3% in April 2025. This decline indicates a loss of investor interest in favor of other digital assets. However, some analysts see this weakness as a buying signal.

Ethereum dominance.

Ethereum dominance.

Historically, ETH bounces back when it reaches this “green zone” of support on its dominance chart. “Can we expect a repeat of history?” wonders Rekt Capital, suggesting an accumulation opportunity. CryptoAnup shares this optimistic view: “When Ethereum’s dominance hits a floor, it is often the beginning of a new bullish cycle.”

Encouraging Technical Signals… Despite Massive Sell-Offs

Despite these positive signals, crypto whale behavior casts a shadow. Wallets holding between 100,000 and 1 million Ethereum sold 1.19 million units this week, worth an estimated $1.8 billion. Meanwhile, only 40% of ETH in circulation are currently in profit — a 4-year low.

Venturefounder sees this as a strong signal: “If this rate drops below 30%, it triggers one of the rare buying signals of the past decade.” Another indicator: Ethereum’s current price meets its realized value, that is, the average price at which each ETH was last transferred. Historically, this convergence often precedes a significant recovery.

Ethereum’s Fundamentals Remain Solid

Despite a 60% drop since its late 2024 peak, Ethereum remains the leading DApp platform, generating over a billion dollars in revenue in Q1 2025. Moreover, the Pectra (May 2025) and Fusaka (end 2025) upgrades promise major technical improvements likely to revive investor confidence.

While technical indicators reach critical thresholds, Ethereum’s current weakness may actually hide a rare opportunity. Between on-chain signals and solid fundamentals, the time seems ripe to closely watch the crypto market’s evolution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New York City plans to use AI to predict bad behavior in subway systems

Share link:In this post: The Metropolitan Transportation Authority (MTA) said it plans to use AI to detect potential problems on subway platforms. The Agency confirmed it won’t use facial recognition in surveillance. MTA added that the effort resulted from riders’ safety concerns following unprovoked subway system attacks.

US Treasury announces new Series I bond rate of 3.98% for May-October

Share link:In this post: The Treasury set the new Series I bond rate at 3.98% from May 1 to October 31, 2025. The rate includes a 2.86% variable portion and a 1.10% fixed rate, both updated by the Treasury. Bondholders’ interest rates shift based on when they bought the bonds, not when new rates are announced.

US economy shrank in first three months of the year as fears of tariff impact grow

Investors are still waiting for more concrete signs that the US is working on trade deals with other countries

Prosecutors push for 20-year sentence for ex-Celsius CEO