Stake Rewards Shift: Aptos Challenges Users to Engage More Actively

In Brief Aptos proposes to reduce stake rewards to encourage active user participation. Smaller validators may face exclusion due to declining revenues from stake rewards. The Aptos Foundation is urged to support smaller validators through alternative revenue sources.

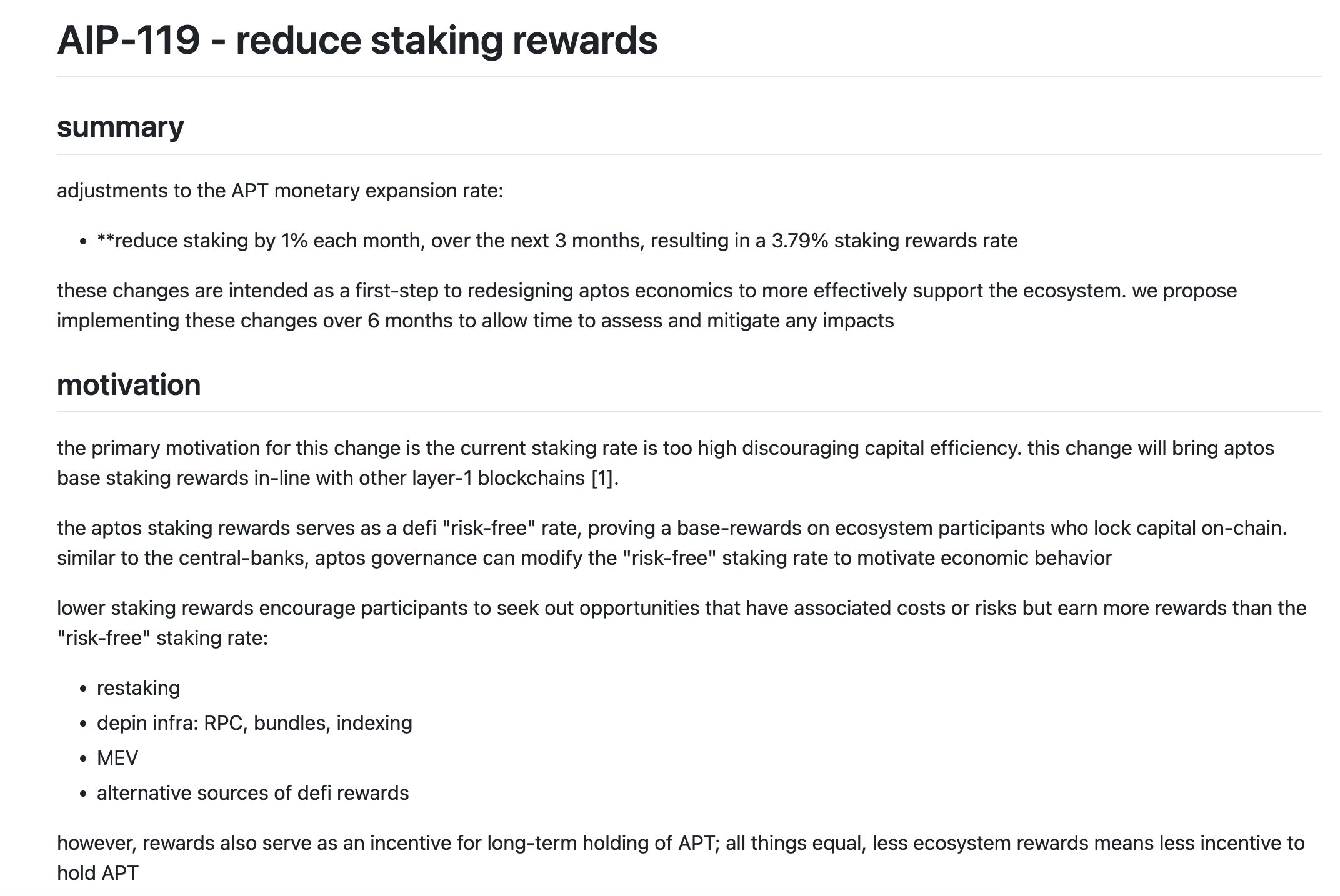

Aptos (APT), an altcoin focused on enhancing active participation among its users, has proposed a gradual reduction in stake rewards. This initiative aims to limit passive earnings that do not contribute to the network’s growth, redirecting users towards more engaging and profitable activities. If accepted, the current stake reward rate of approximately 7% will decrease to 3.79% within three months. The proposal, known as AIP-119, is backed by Sherry Xiao, the Director of Production Engineering at Aptos Labs, and Moon Shiesty, a developer from the Mirage protocol. The community has four weeks to provide feedback on this proposal.

The Impact of Reduced Stake Rewards on Smaller Validators

The reduction in Aptos stake rewards could pose significant challenges for smaller validators. Already facing high operational costs and technical demands, smaller validators may find themselves at risk of exclusion from the network due to declining revenues. One validator expressed concerns, stating, “Such inflation cuts can harm decentralization significantly when imposed without a strong authorization program.”

Proposal to Reduce Aptos Stake Rewards

Proposal to Reduce Aptos Stake Rewards

In response to these potential impacts, developers like Moon Shiesty have urged the Aptos Foundation to implement a support program similar to Solana’s stake matching model. Such a program could provide smaller validators with an opportunity to recover lost income. Additionally, Shiesty recommended that validators explore alternative revenue streams, emphasizing the need to incentivize contributions to the ecosystem, such as through RPC services, MEV, data indexing, or transaction packaging.

No Room for Passive Validators

Xiao stressed that the proposal should not only reduce stake reward rates but also reassess the stake shares of inactive validators. These shares should be redirected to more active contributors, fostering a more suitable incentive structure for long-term growth within the altcoin network.

Currently, Aptos boasts an annual stake yield of around 7%, significantly higher than Ethereum $1,605 ‘s 3.1%. However, some blockchains like Cosmos offer rewards that can reach 15% for ATOM coins. The stake reward rate of Aptos is closely aligned with Avalanche ‘s AVAX coin, which offers a 7.6% stake reward. The intention behind lowering stake yields is to guide users towards higher-yielding, albeit riskier, investment options instead of relying on “zero-risk” passive income.

Last month, the Solana $139 network also presented a similar proposal for voting, which ultimately failed. The proposal, known as SIMD-228, aimed to convert a fixed inflation model into a dynamic one tied to staking participation. However, it was rejected due to concerns about jeopardizing decentralization, indicating that similar discussions are unfolding within Aptos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges to $94K Amid Global Market Shifts

PancakeSwap Hits Record High with $205.3 Billion Trading Volume in Q1 2025 Amid User Surge

Kuwait declares cryptocurrency mining illegal

RockawayX launches $125 million new fund, mainly investing in Solana ecosystem projects