CME Basis Collapse + Pectra Upgrade: Is Ethereum's Rally to $3000 Imminent?

Has Ethereum's Comeback Moment Begun?

Original Article Title: "Ethereum Sees Short Squeeze: Will CME Basis Collapse, Rate Cut, and Pectra Upgrade Drive ETH Above $3000?"

Original Article Author: Alvis

Section 1: Market Phenomenon and Data Retrospect: Price Surge from $1385 to $1750

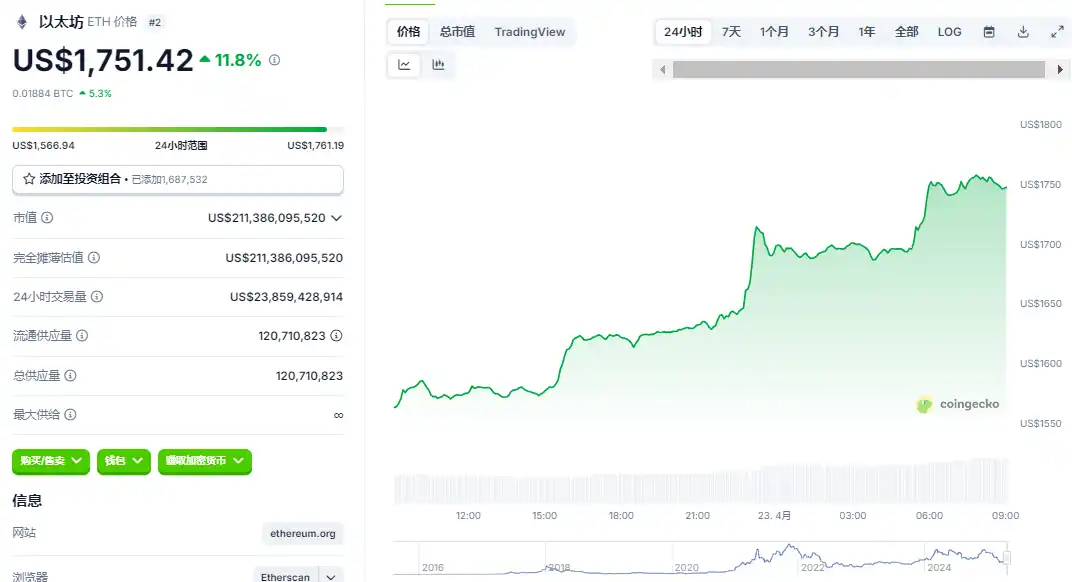

On April 23, 2025, Ethereum (ETH) staged a thrilling price resurgence. Its price climbed from the yearly low of $1385 on April 6 to break through the $1750 mark on April 23, with a cumulative gain of 26.3% in two weeks. The single-day highest surge exceeded 10%. Coinglass data shows that in the past 24 hours, Ethereum's liquidation amount exceeded $120 million.

Behind this round of rally lies not only the liquidity release from the closure of short-term market arbitrage positions but also the reshaping of risk appetite under the expectation of a macroeconomic policy shift. Moreover, it is necessary to seek long-term value support from the endogenous driving force of the blockchain ecosystem.

From a technical perspective, after breaking through $1600 on April 9, ETH continuously pierced through the key resistance levels of $1688 and $1700. The daily MACD indicator formed a golden cross above the zero axis, confirming a short-term bullish trend with a three red soldiers pattern.

The weekly level is more noteworthy: the Bollinger Band midline (around $1720) was powerfully surpassed.

The ETH/BTC exchange rate rebounded from a historical low of 0.01765 to 0.0191, showing the market's restored confidence in the Ethereum ecosystem.

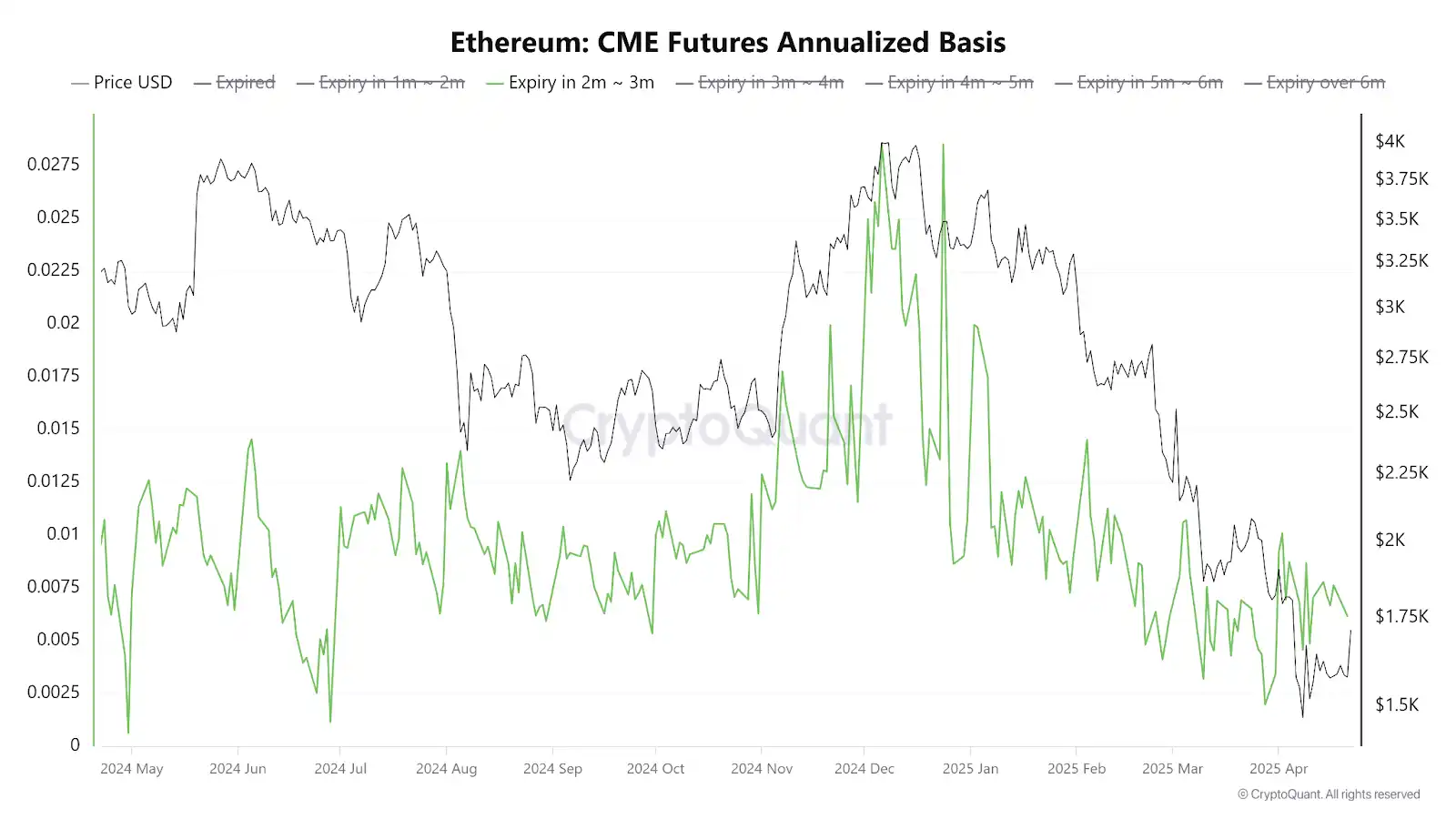

During this process, the Chicago Mercantile Exchange (CME) ETH basis collapsed from 20% in November 2024 to 5% in April 2025, marking the exhaustion of bearish momentum dominated by arbitrage capital and clearing the way for a price rebound.

Section 2: Deconstructing the Surge Factors: Arbitrage Closure, Macro Shift, and Ecosystem Recovery's Triple Drive

1. Arbitrage Capital Clearance Triggered by Futures Basis Convergence

ETH CME Futures Annualized Basis

The essence of CME Basis (price difference between futures price and spot price) is the market's pricing of future liquidity.

In the fourth quarter of 2024, the 20% Basis level far exceeded the concurrent U.S. Treasury bond yield, attracting hedge funds to construct an arbitrage portfolio of "buy spot ETF + short futures." The sustainability of this strategy relies on two premises: first, maintaining a high Basis to cover funding costs, and second, market liquidity sufficient to support position rolling. However, the risk asset sell-off triggered by Trump's tariff policy (April 6th ETH plummeted to $1385) rapidly narrowed the Basis to 5%. After the arbitrage profit space disappeared, institutions were forced to sell off spot ETF positions, further exacerbating the price decline.

After the arbitrage capital exited, ETH pricing power returned to the spot market supply-demand relationship. According to Glassnode on-chain data, the 824,000 ETH accumulated around $1546 became a key support level, and whale addresses' accumulation behavior in this area (such as a single withdrawal of 6528 ETH from Bitfinex) indicates that value investors are starting to enter the market.

2. Macro Policy Shift and Risk Appetite Restoration

The dramatic shift in market expectations for the Fed's monetary policy constitutes another core variable. After Trump pressured Powell to "cut interest rates immediately" on April 17th, the market's probability of a rate cut in June surged from 32.8% to 61.8%.

This change led to a new annual low for the U.S. Dollar Index at 98.2790, while gold and cryptocurrencies strengthened as safe-haven assets outside the dollar. It is worth noting that ETH's rally resonated with the three major U.S. stock indexes (Dow Jones +2.66%, Nasdaq +2.7%), reflecting a global capital reallocation trend from a "cash is king" strategy to risk assets.

The easing of geopolitical risks further catalyzed the upward trend. U.S. Treasury Secretary Benson's statement about the "possible easing of U.S.-China trade tensions" reduced market concerns about supply chain disruptions. From a behavioral finance perspective, this expectation correction reduced ETH's beta coefficient (relative to market volatility) from 1.2 to 0.9, lowering the risk premium requirement and driving the valuation center of gravity upward.

3. Ethereum Ecosystem's Endogenous Value Restructuring

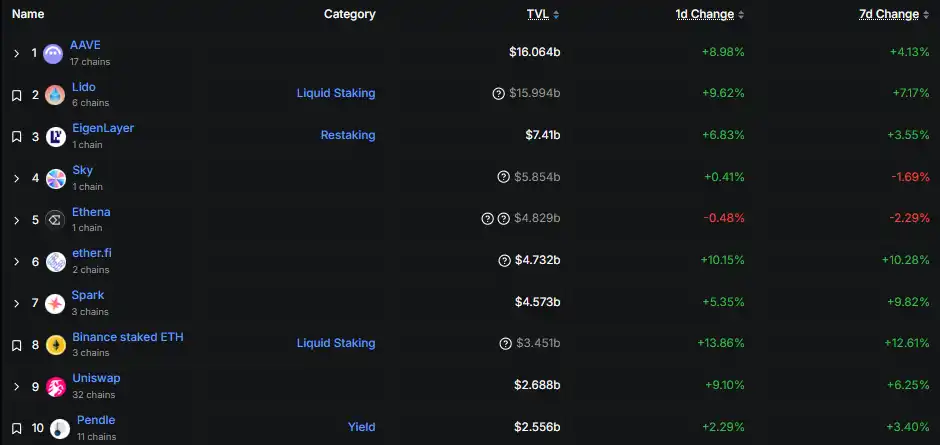

Technological upgrades and ecosystem expansion constitute long-term value support. The Pectra upgrade, launching on April 25th, introduces EIP-7732 (account abstraction optimization) and a Layer2 scaling solution, reducing the cost of a single transaction to below $0.001 and increasing TPS (transactions per second) to 20,000.

This directly stimulated the recovery of the DeFi Total Value Locked (TVL): as of April 23, the Ethereum DeFi protocol TVL reached $467 billion, an 18% increase from the March low point, with top protocols such as MakerDAO and Aave contributing 60% of the increment.

The structural inflow of institutional funds is equally crucial. In the $500 million RWA (Real World Assets) tokenization fund issued by BlackRock, 47% of the underlying assets are settled through the Ethereum network, demonstrating traditional finance's recognition of the Ethereum settlement layer.

Furthermore, the expected approval of an Ethereum spot ETF by the US SEC through staking may trigger a fund's syphoning effect similar to the 2024 Bitcoin ETF. According to the 10x Research model, if approved, this will bring in at least $5 billion in net inflows.

Future Trend Extrapolation: Path Selection from Resistance Breakout to Trend Reversal

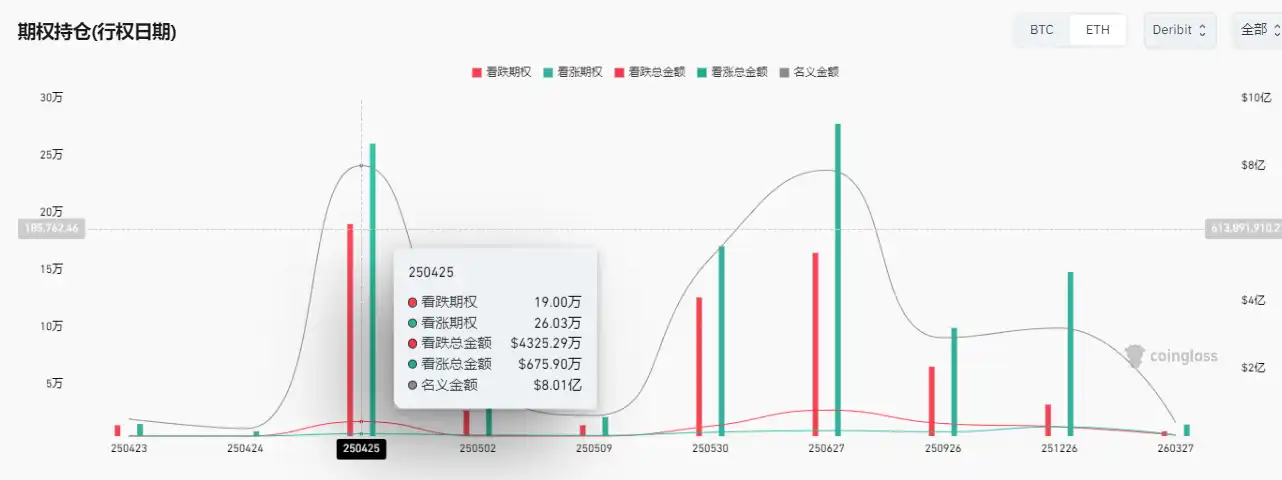

Short-term (1-3 months) price trend depends on the effectiveness of the $1688 support level.

According to options market data, in the ETH contracts expiring on April 25, the open interest of put options with a strike price of $1700 amounts to 12,000 contracts. Caution is required against bearish pressure tactics before the CPI data is released on April 25. If the support holds, the upward targets could be seen at $1830 (weekly Bollinger Bands upper band) and $1930 (Fibonacci 61.8% retracement level).

Medium-term (6-12 months) attention should focus on two major catalysts:

1. Initiation of the Fed Rate Cut Cycle: If a 25 basis point rate cut occurs in June, based on the Capital Asset Pricing Model (CAPM), ETH's expected return will increase from the current 12% to 18%, attracting approximately $20 billion in allocation-oriented funds.

2. ETF Staking Approval and RWA Expansion: If the Ethereum spot ETF is approved through staking, referencing Bitcoin ETF history, the scale of first week inflows may reach $8-12 billion.

Long-term (2-3 years) value pivot will depend on the full implementation of Ethereum's upgrade. After the sharding technology is fully deployed, network throughput is expected to reach 100,000 TPS, with Gas fees approaching zero, positioning Ethereum for absolute advantage in the Web3.0 infrastructure competition.

Epilogue: Seeking Certainty in Uncertainty

The recent surge of Ethereum is not merely a technical rebound but a result of multiple cyclical resonances: arbitrage capital liquidating to release short-term liquidity, monetary policy shifting to reshape risk premium, and technical upgrades solidifying long-term value foundation. Within the key range of 1688-1800 US dollars, investors need to be cautious of increased volatility adding to risk, but more importantly, they should focus on whether the ETH/BTC exchange rate can break through the strong-weak boundary of 0.03 - this will be a core signal confirming the revaluation of the Ethereum ecosystem's value.

As Austrian School economist Hayek said: "The denationalization of money process inevitably accompanies the diversification of the unit of account." Ethereum, as the infrastructure for decentralized finance, its price volatility is fundamentally a consensus evolutionary process of humanity towards a new type of value storage medium. In this historic process, rational investors need to identify signals in the noise, capture trends in the volatility, in order to stand undefeated in the wave of the digital economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket predicts that the probability of the US economy falling into recession this year is 53%.

Solana’s on-chain stablecoin market cap exceeds $12.8 billion, hitting a new all-time high

Atlanta Fed GDPNow model predicts US GDP growth in the first quarter to be -2.5%