Feds and SEC Uncover $200 Million Crypto Trading Scheme by Ramil Palafox

U.S. prosecutors and the Securities and Exchange Commission (SEC) charged Ramil Palafox for operating a $200 million crypto trading scheme.

The SEC alleges Palafox, a U.S. and Philippine national, misled 90,000 investors through PGI Global by promising profits from Bitcoin and forex trading.

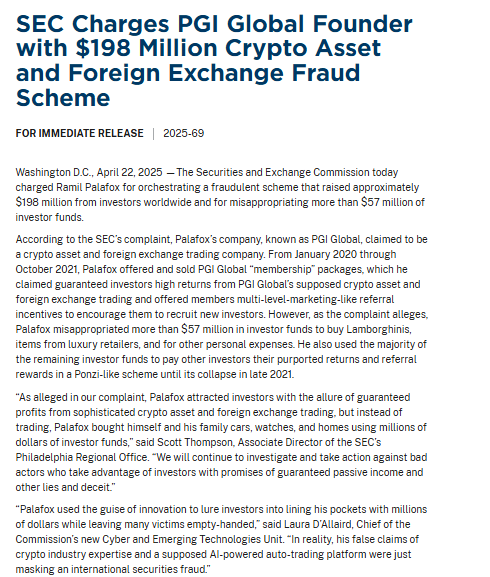

According to the SEC’s April 22 statement, Palafox collected funds from January 2020 to October 2021.

The agency claims he ran PGI Global using a multilevel marketing system and misused at least $57 million. The firm collapsed in 2021, leaving most investors with losses.

PGI Global Fraud Charges SEC Statement. Source: U.S. Securities and Exchange Commission

PGI Global Fraud Charges SEC Statement. Source: U.S. Securities and Exchange Commission

The SEC said PGI Global promoted an AI-based auto-trading platform. Palafox reportedly organized events in Las Vegas and Dubai to attract new investors.

The gatherings served as recruitment platforms, offering bonuses to those who brought in more people.

SEC: PGI Global Was a Ponzi-Style Crypto Trading Scheme

The SEC complaint describes PGI Global as a Ponzi-style operation. Instead of investing the money, the firm used new deposits to pay earlier participants.

The agency said the model involved referral bonuses and misleading claims about trading activity.

Scott Thompson, associate director of the SEC’s Philadelphia office, said in a public statement,

“Palafox attracted investors with the allure of guaranteed profits from sophisticated crypto asset and foreign exchange trading, but instead of trading, Palafox bought himself and his family cars, watches, and homes using millions of dollars of investor funds.”

The SEC charged Ramil Palafox with violations of anti-fraud and registration rules. It also seeks a permanent ban preventing him from offering securities or crypto products, recovery of funds, and civil penalties.

Federal Prosecutors Add Criminal Charges Against Ramil Palafox

The U.S. Department of Justice also filed charges against Palafox. The sealed indictment was submitted on March 13 in the Eastern District of Virginia. It includes wire fraud, money laundering, and illegal monetary transactions.

Prosecutors say Palafox falsely promised daily returns between 0.5% and 3%. They claim he misrepresented PGI Global’s trading practices, licenses, and revenue. Most funds were never used to buy or trade Bitcoin, according to the indictment.

Authorities listed several assets linked to the alleged $200 million fraud . These include over $1 million in cash and 17 luxury cars.

Vehicles include two Teslas, two Lamborghinis, a Ferrari 458 Speciale, and two Porsches. They also listed designer bags, watches, jewelry, and shoes.

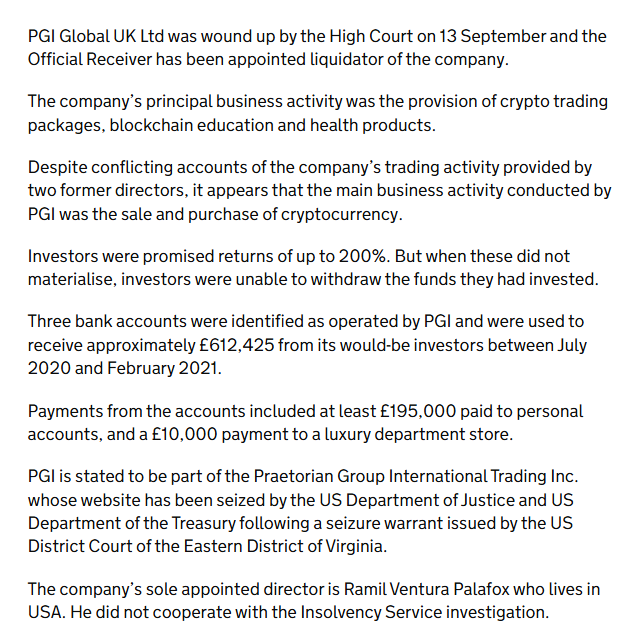

DOJ Seized PGI Global Website After UK Court Shutdown

PGI Global was registered under multiple related entities. One of these, Praetorian Group International Trading Inc., had its website seized by the U.S.

Department of Justice in 2021. The move followed a shutdown of its UK-based operations by court order.

PGI Global UK Liquidation Details. Source: UK Insolvency Service

PGI Global UK Liquidation Details. Source: UK Insolvency Service

Authorities said PGI Global operated globally, raising funds from multiple countries. Palafox used international events to recruit more participants into the crypto trading scheme. The SEC stated that these actions misled investors about the nature of the business.

SEC Case Against Ramil Palafox Follows Other Crypto Enforcement

This is the SEC’s first crypto enforcement case under new Chair Paul Atkins , who was sworn in on April 22. The agency continues to pursue crypto-related fraud cases, with a separate action against Nova Labs concluded earlier this month.

Nova Labs was accused of selling unregistered securities linked to Helium HNT token mining devices. The case ended in a settlement and a $200,000 penalty, without a formal admission of wrongdoing.

The SEC and federal prosecutors are continuing investigations into related companies and individuals connected to the PGI Global crypto trading scheme.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH Rebounds at $1,787 Mark With Upside Target to $82,000

Market Movers: Leading 4 Cryptos Post Gains Between 50% and 80 %+

New spot margin trading pair — ZORA/USDT!

Bitcoin Surpasses Google to Become World’s 5th Largest Asset