- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (April 1) | Strategy buys another 22,048 BTC; Trump's "reciprocal tariffs" plan to be revealed

Bitget Daily Digest (April 1) | Strategy buys another 22,048 BTC; Trump's "reciprocal tariffs" plan to be revealed

远山洞见

2025/04/01

Today's preview

1. The U.S. March ISM manufacturing PMI will be released today, with the previous reading at 50.3.

2. The U.S. February JOLTs job openings will be released today, with the previous reading at 7.74 million.

3. American Bitcoin will hold a press conference tonight at 8:30 PM (UTC+8).

4. Sui (SUI) is unlocking approximately 64.19 million tokens today, representing 2.03% of the current circulating supply, valued at around $152 million.

5. ZetaChain (ZETA) is unlocking approximately 44.26 million tokens today, representing 6.05% of the circulating supply, valued at around $13.2 million.

Key market highlights

1. Details of Trump's "reciprocal tariffs" are expected soon, with market sentiment growing increasingly tense.

U.S. Treasury Secretary Bessent revealed that Trump will announce a new round of tariffs at 3:00 PM on Wednesday (3:00 AM, Thursday Hong Kong time). The White House confirmed that senior officials, including the Treasury Secretary, Commerce Secretary, and U.S. Trade Representative, have submitted an implementation plan that includes no exemption clauses. Trump previously stated that the tariffs, covering key sectors including agriculture, will take effect on April 2. Tariffs on Mexico and Canada will be deferred until that date. The rollout of this tariff plan could mark a major turning point in April's macroeconomic landscape.

2. Investment firm Strategy purchased 22,048 BTC during the week of March 24–30 at an average price of $86,969, totaling approximately $1.92 billion. As of yesterday, the firm holds 528,185 BTC, acquired at a total cost of around $35.63 billion,

with an average purchase price of $67,458 per BTC.

3. Vitalik and CZ make memecoin moves—one sells, the other burns. Ethereum co-founder Vitalik Buterin sells off his holdings of $

DHN and $

LEDOG, converting them for USDC. Meanwhile, CZ's donation wallet burned $1.1 million worth of $Broccoli (0xa14), $540,000 of $

Broccoli (0x6d5), and $1.95 million worth of $

Tutorial. These on-chain moves could hint at upcoming hype around certain memecoins.

4. After U.S. President Trump's son Eric Trump posts on social media urging investors to "buy ETH now," ETH drops to $1820—a 46.5% decline— marking its lowest market dominance since 2020. In contrast, a related project, WLFI, bucks the trend and increased its ETH holdings by 300% over the past three months. Additionally,

American Bitcoin will hold a press conference at 8:30 PM (8:30 AM ET) on April 1, led by co-founder Eric Trump and the Hut 8 executive team, to outline their vision and strategic roadmap.

Market overview

1. Bitcoin continues its downward trend with volatility, while broader market performance remains mixed. According to SoSoValue, Hyperliquid Ecosystem and LSDFi sectors are leading the gains, with tokens like $HYPE, $PURR, and $PENDLE defying the trend and showing strong growth.

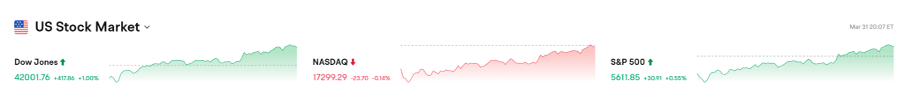

2. The SP 500 staged a late-day rally to close higher but still ended Q1 with a 4.6% loss. In contrast, Chinese stocks rose 13% over the quarter. Gold hit record highs for the third consecutive day, surging nearly 20% in Q1—the largest quarterly gain in 38 years.

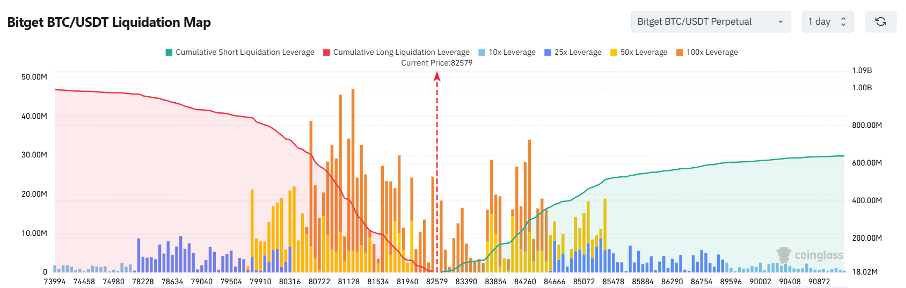

3. Currently standing at 82,579 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,579 USDT could trigger

over $220 million in cumulative long-position liquidations. Conversely, a rise to 83,579 USDT could lead to

more than $80 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

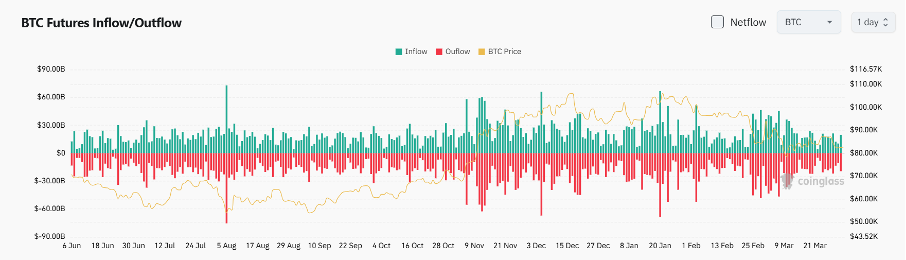

4. Over the last 24 hours, BTC spot saw $19.7 billion in inflows and $19.3 billion in outflows, resulting in

a net inflow of $

400

million.

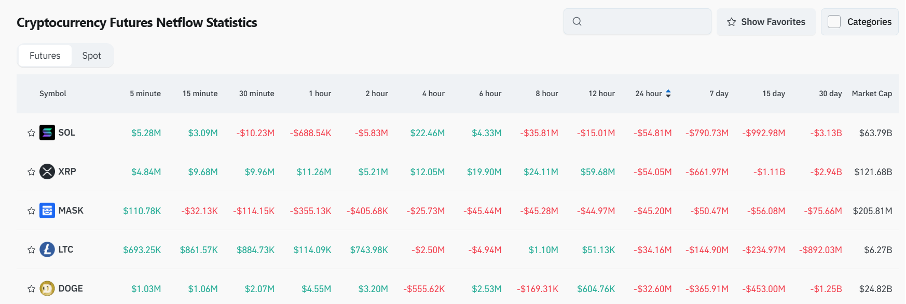

5. In the last 24 hours, $SOL, $XRP, $MASK, $LTC, and $DOGE led in

net outflows in futures trading, signaling potential trading opportunities.

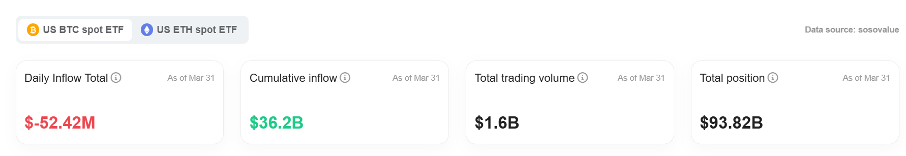

6. According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $52.4231 million, with cumulative inflows at $36.195 billion, with total positions reaching $93.811 billion.

Institutional insights

Matrixport: Ethereum approaching price levels last seen during the FTX collapse; fundamentals remain weak

10x Research: Tariff pressure and inflation data disrupt BTC's rally; $80,000 breakdown is likely to happen this week

News updates

1. Brazil bans certain pension funds from investing in crypto.

2. U.S. House of Representatives to hold hearing on crypto market structure legislation.

3. U.S. crypto investors must file 2024 tax returns by April 15.

4. Australian regulators warn that crypto ATMs pose money laundering and fraud risks.

Project updates

1. Elon Musk denies rumors that the U.S. government plans to adopt Dogecoin.

2. Berachain sees $195.55 million in net cross-chain bridge inflows over the past seven days, leading all L1s.

3. HyperEVM's circulating $HYPER surpasses 5.8 million tokens, with a weekly gain of nearly 100%.

4. Chainlink's payment abstraction feature is live, enabling LINK payments for user fees.

5. Yescoin postpones its TGE and plans another snapshot of wallet addresses soon.

6. Yapper community to roll out new penalty system to crack down on malicious behavior.

7. X2Y2, an NFT trading platform, plans to officially shut down operations on April 30.

8. Four.memecoin rolls out upgrades: standardized contracts, V2 liquidity additions, and LP token burns.

9. Hashgraph plans to launch a Hedera-based institutional private blockchain in Q3.

10. CZ burned $3.6 million worth of tokens, including Broccoli and Tutorial.

Highlights on X

1. Haotian: External hype can't hide crypto's internal weaknesses — real breakthroughs take time

The crypto market has entered a phase of "collapsed consensus expectations." Prices may still show some strength, but most projects are now dismissed as "trash," with real innovation and practical applications in short supply. Memecoins and new listings have become end goals, not starting points, leading to a disconnect between market hype and actual value. The industry's issues are systemic: lack of transparency, frequent manipulation, and short-term profit chasing. What the space really needs is time — for cleansing, reflection, and a reset of the valuation system. The real opportunities will belong to builders who bring innovation, execution, and a long-term mindset.

2. @mscryptojiayi: Is your crypto strategy on point?

Lately, many people on X have been blaming project teams, exchanges, and funds — yet few take a hard look at their own investment logic. Ironically, funds were among the hardest-hit players this cycle. Exchanges, by nature, are gambling platforms that provide tools and liquidity — not charities that guarantee returns. And if a project is using all its funds just to pump its token, it's probably not going to last. Instead of hoping someone else pumps the price, rethink your own strategy. Lower your expectations, improve your entry quality — that's how you survive and thrive through market cycles.

3. @daidaibtc: How to play small-cap tokens? Avoid the hype traps, focus on timing

Most small-cap tokens right now lack strong hands or major backers. Their supply structure is pure PVP, with derivatives driving the action and little momentum in spot markets. The old strategy of buying "cheap" coins no longer works — market pricing logic has changed. Timing now matters more than bargain-hunting. Stay away from hype-driven tokens without strong backing, especially those not listed on spot markets—they’re often just liquidity traps. Instead of chasing the pump, wait for support zones or a recovery in market sentiment. Only small-cap tokens with real upside logic, event catalysts, or emotional traction are worth betting on.

4. AB Kuai.Dong: FORM keeps rallying — Four memecoin dominates BNB Chain

FORM (formerly BNX) has seen a strong rebound in price, backed by real fundamentals: Four memecoin's platform revenue has exceeded 10,000 BNB, with over 230,000 users. The project team has consistently participated in every major on-chain trend — from derivatives to GameFi to today's memecoin boom. While many older BNB Chain projects have faded into the background, FORM has seized the memecoin wave and claimed the top spot on the chain. Compared to Solana's Pump.fun, Four memecoin currently has no rival on BNB Chain. Its platform effect continues to grow, and there may be more upside ahead.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.