- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (April 9) | Tariff policies continue to shake global markets; Musk-linked $RFC memecoin surges

Bitget Daily Digest (April 9) | Tariff policies continue to shake global markets; Musk-linked $RFC memecoin surges

远山洞见

2025/04/09

Today's preview

1. The U.S. House of Representatives will hold a hearing on cryptocurrency market structure legislation on April 9.

2. U.S. SEC has delayed resolution on BlackRock's Ethereum ETF options trading until April 9.

3. Movement (MOVE) will unlock approximately 50 million tokens at 8:00 PM today (UTC+8), representing 2.04% of the current circulating supply, valued at around $18.5 million.

4. Saga (SAGA) will unlock approximately 133 million tokens at 4:00 PM today (UTC+8), representing 118.54% of the current circulating supply, valued at around $35.1 million.

5. U.S. EIA crude oil inventory data for the week ending April 4 will be released today. The previous reading was 6.165 million barrels.

Key market highlights

1. The White House Press Secretary announced that the additional 104% tariff on Chinese imports took effect at noon (ET) today, April 9. In a post on Truth Social, U.S. President Donald Trump stated that he has spoken with the acting President of South Korea on issues such as trade surpluses and tariffs, and that similar discussions are underway with multiple countries. He added,"China also wants to make a deal, badly, but they don't know how to get it started. We're waiting for their call. It will happen!" According to Bloomberg,

the U.S. move to impose "reciprocal tariffs" has rattled global markets. Since April 3, global stock markets have shed $10 trillion in value, with the U.S. tech giants alone losing a combined $1.65 trillion in market cap.

2. World Liberty Financial (WLFI), a Trump-affiliated crypto project, has released a governance proposal

to airdrop a small amount of the USD1 stablecoin to all WLFI holders. This airdrop, intended as a functional test and a gesture of appreciation to early supporters, will take place on Ethereum mainnet. The exact amount will depend on the number of eligible wallets and the overall budget.

3. Elon Musk's memecoin, $

RFC, defied the broader market trend, surging over 200% in just 48 hours and reaching a market cap of nearly $66 million. The project is backed by the right-wing parody account Retard Finder, which has gained over 500,000 followers in the past month. Known for frequent interactions with Musk, the account has earned a reputation as his "unofficial mouthpiece."

Each time Musk engages with the RFC official account, the token spikes — turning $RFC into one of the few breakout performers amid the current market slump.

4. The U.S. Department of Justice has issued an official memo on crypto-related legal policy, stating that developers will not be held liable for how their code is used by criminals. Responsibility will instead fall on the bad actors themselves.

The DOJ clarified that its enforcement efforts will focus on actual crimes such as fraud and terrorism financing, rather than targeting developers. The memo also emphasizes the need to protect legitimate blockchain users and businesses, support fair access to banking services, and reduce enforcement pressure on crypto platforms and mixers. This could signal a broader easing of restrictions under the Trump administration and inject fresh momentum into the crypto industry.

Market overview

1. $BTC continues its slow downward trend, briefly dipping to the $76,000 level. The broader market is also in decline, with increasing divergence — memecoins like $RFC and $LUCE are surging, while $BAN, $NEIRO, and others are leading the losses on the platform.

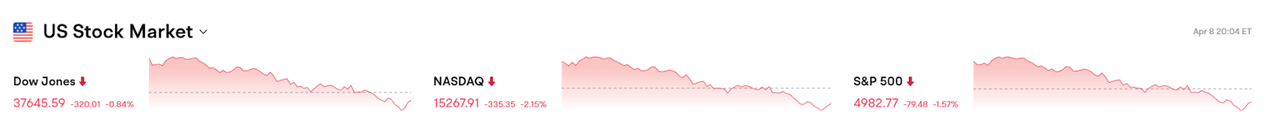

2. Tariff news has crushed hopes for a U.S. stock market rebound, as the S&P 500 and Dow have posted four consecutive days of losses. The 2-year U.S. Treasury yield plunged nearly 20 basis points intraday. Oil prices have also fallen for a fourth straight day, hitting a four-year low with a peak drop of over 4%. Offshore RMB briefly weakened to 7.42.

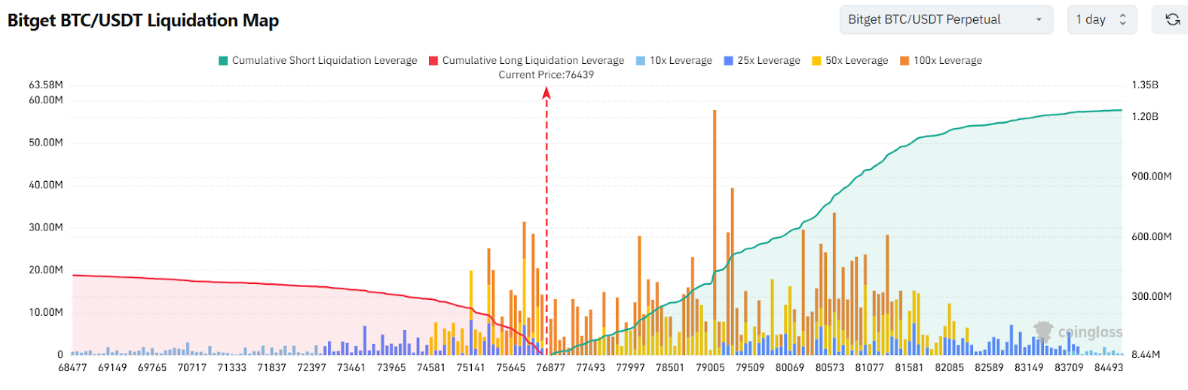

3. Currently standing at 76,439 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 75,439 USDT could trigger

over $210 million in cumulative long-position liquidations. Conversely, a rise to 77,439 USDT could lead to

more than $70 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

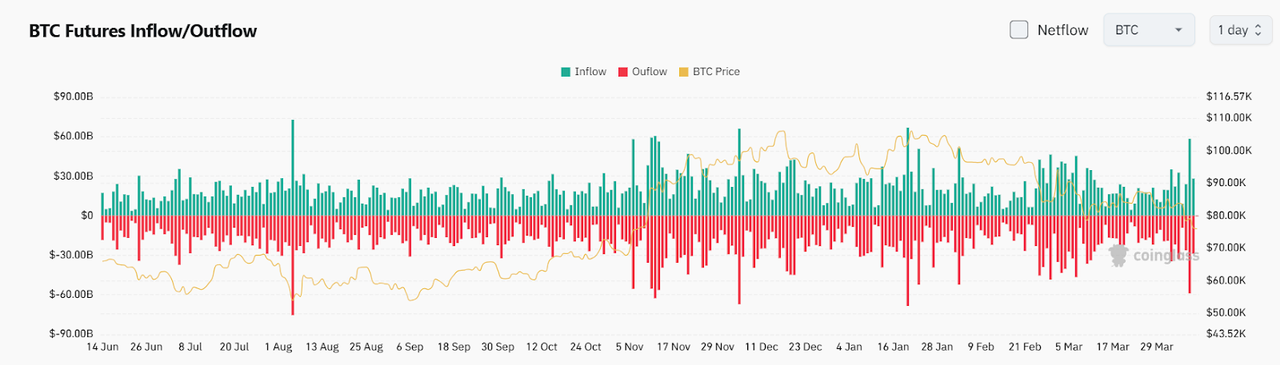

4. Over the past 24 hours, the BTC spot market recorded $28.1 billion in inflows and $28.7 billion in outflows, resulting in a

net outflow of $600 million.

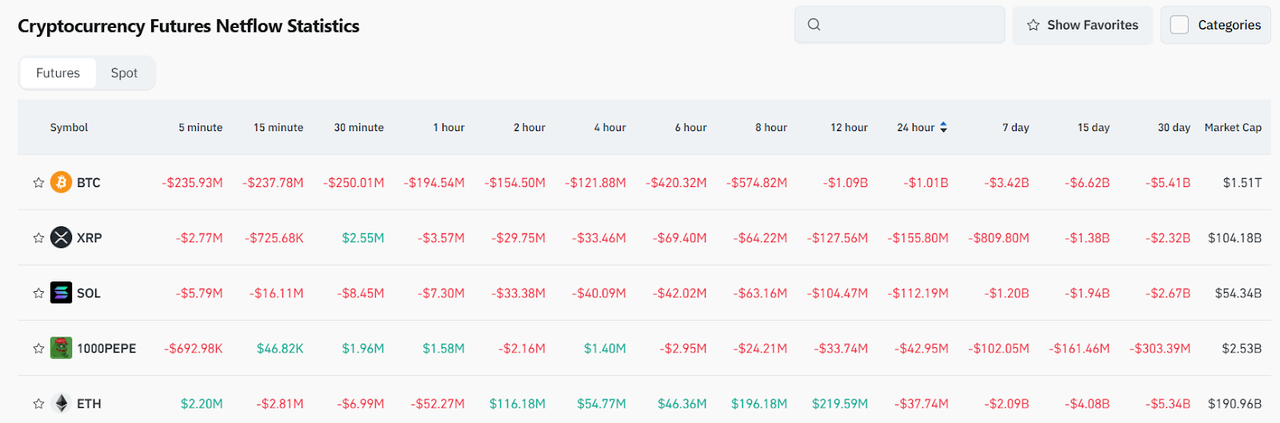

5. In the last 24 hours, $BTC, $XRP, $SOL, $PEPE and $ETH led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Matrixport: The RMB is approaching a key resistance level, and Bitcoin could be on the verge of another breakout.

X post:

https://x.com/Matrixport_CN/

Standard Chartered: XRP could hit $

12.5

before the end of Trump's presidency.

Article:

https://www.coindesk.com

Bernstein: Bitcoin is showing strong resilience, with institutional adoption expected to further reinforce its market position.

X post:

https://x.com/DeItaone/

News updates

1. A Democratic SEC commissioner opposes defining stablecoins as non-securities. TD Cowen warns this could stall legislative progress.

2. The U.S. Department of Justice clarifies that crypto developers are not liable if their code is misused by criminals.

3. The White House Press Secretary confirms that an additional 104% tariff on Chinese imports will take effect starting April 9.

4. Brazilian central bank to release regulations concerning virtual assets soon.

5. Fed's Austan Goolsby: Tariff implementation far exceeds Fed's model predictions.

Project updates

1. CBOE submits 19b-4 application for Canary SUI ETF to the SEC.

2. Bitget Wallet launches the Super DEX program with a total incentive pool of 10,000 BGB.

3. The PancakeSwap community proposes Tokenomics 3.0 for CAKE, aiming for an annual deflation rate around 4%.

4. GoPlus has completed its third round of GPS token buybacks, with the total buyback amount now exceeding 100 million tokens.

5. Linea's product lead: Token generation event (TGE) will take place after the market shifts from bearish to bullish.

6. WLFI proposes a new plan to test its airdrop feature by distributing a small amount of USD1 to all token holders.

7. Over the past seven days, the stablecoin market cap on Tron increased by $396 million, while that on Berachain saw a $270 million decrease.

8. CBOE plans to launch new Bitcoin futures in collaboration with FTSE Russell. If approved, the trading will open on April 28.

9. Curve's founder continues to sell at the top, having offloaded more than 3 million CRV tokens to date.

10. Wintermute launches a social media Layer 2 network called "QuoteChain".

Highlights on X

1. @Michael_Liu93: The market is a slave to expectations

In trading, it's not really about how bad the reality is — it's about how much worse people expect it to get. Once all the negative news has played out, the market can be considered "priced in." At that point, it's time to shift from "what’s actually happening" to "what hasn’t been expected yet". Take tariffs, for example — 100%, 200%, even 300% — they're just bargain power. As long as both sides return to the negotiating table, the potential for a more optimistic outcome always exists compared to what's currently priced in. Now that the worst-case scenario has played out, this might actually be the least appropriate time to panic.

2. @kiki520_eth: The market enters liquidation period, the real cycle has not yet begun

Markets are in a liquidation period, with airdrop causing losses, too many KOLs emerging, and project valuations halving. Everything is being reset, leaving both newcomers and veterans overwhelmed. For most, it's now payback season; but for a few, it's a golden window to reallocate and reposition. I use a barbell strategy, with BTC as the corner stone on one end, and betting on most aggressive on-chain portal assets like PARTI and HYPE on the other. Drop all middle-ground projects and stick to right-side trading — never blindly try to catch the bottom. Instead of trying to predict the future, be present and ready to act when a new narrative emerges. KOLs should lean into their strengths: be bold, understand human nature, and ride market sentiment. Every cycle's end marks the beginning of a new one — what matters most isn't prediction, but the stamina to stay in the game.

3. AB Kuai.Dong: Ethereum's reward dilemma & the BTCFi trap — real challenges for serial entrepreneurs

In a closed-door chat with Metis founder Kevin Liu, several entrepreneurs reached a consensus: To sustain its ecosystem prosperity, Ethereum must move beyond being a "social experiment". The mainnet should be a stable, secure, and sustainable foundation, and Layer 2 should start "paying taxes" to reinforce mainnet security. Otherwise, the ETH supply and demand model will only deteriorate. Meanwhile, BTCFi projects are stuck in a high-valuation, high-expectation trap despite the potential. Babylon is a textbook case: its technical solution is easy to replicate, and its token model struggles in the withdrawal pressure post-launch. Entrepreneurs believe that BTCFi might follow a path similar to many Ethereum Layer 2 — chaos and shakeouts before someone builds a standardized framework like the OP Stack. Only when tech, tokenomics, and product evolve in an alignment can BTCFi produce real winners.

4. 0xSun: The golden window for shorting altcoins is closing — now it's about finding the true bottom

After two months of low-leverage altcoin shorting, I've begun shifting strategies: from concentrated positions to diversified ones, from heavy to light exposure. This is because old coins have already crashed deep, and new coins are pricing in fast, whereas smart money is now leveraging short-side sentiment — triggering squeezes or holding positions with negative funding. The game has changed since earlier this year. Shorting is now riskier, and less experienced traders might even get wrecked. I'm also not rushing to buy the dip. While Trump's tariffs have accelerated the panic sell-off, macro uncertainty is still high. I'd rather wait for clearer signals from on-chain sentiment before making a move. The next opportunity won't come from chasing the highs or panic-buying the dip. It will come from recognizing when the cycle resets and the true bottom appears.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.