Three steps to complete Bitget spot

margin trading: Transfer > Trade > Repay!

Step 1: Transfer Funds to Your Spot Margin Account

The first step to Spot Margin trading on Bitget is to transfer funds from your main account to your Spot Margin account. This can be done through the "Transfer" function on the platform. Make sure you transfer enough funds to cover any potential losses.

Tip: For the Cross margin account, the principal is mixed in one account. For the Isolated margin account, you need to transfer funds to the trading pair account you want to trade.

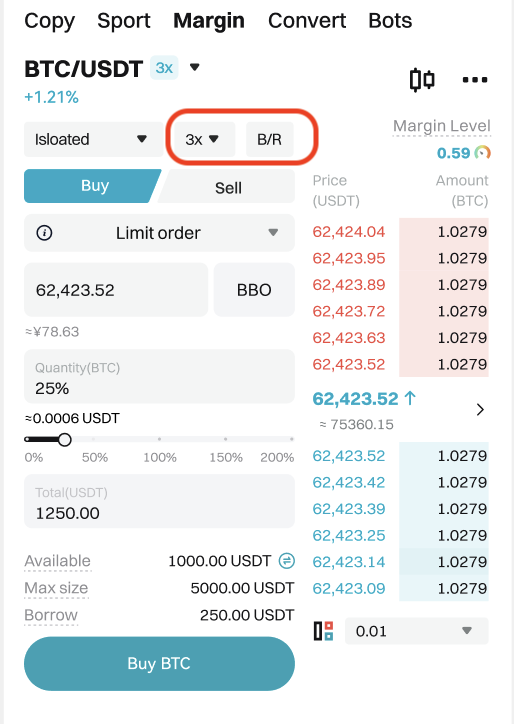

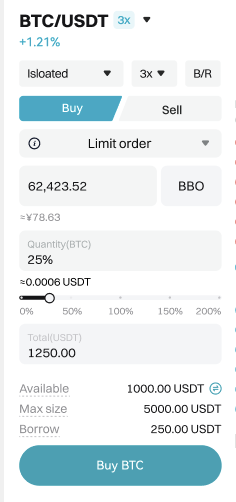

Step 2: Trade

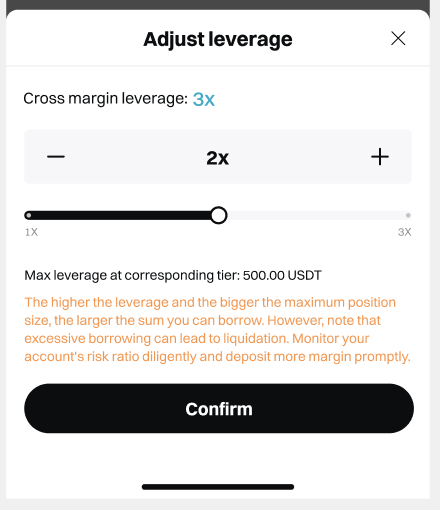

You can adjust your maximum position size — consisting of your transferred margin plus the maximum borrowing amount — by adjusting your leverage.

Auto-borrow: By default, the system automatically borrows funds. The borrowing amount will be calculated based on the position size when trading.

Set your trading volume by setting a percentage or entering a value.

Keep an eye on the risk ratio after opening a position. You can reduce the risk ratio by transferring in more margin or partially closing the position.

Step 3: Close the trade and repay the loan

Monitor your positions closely and close them when your TP/SL targets are reached.

You repay in the same coin that you borrowed. There are two re

payment methods:

A: Manual repay: Use

Repay to navigate to the repayment page to settle the borrowed amount and interest.

B: Auto-repay: Select

Assets >

Quick Repayment to close the position and repay the loan. In isolated margin mode, select

Position >

Close at Market Price to automatically repay with available assets after the trade is completed.

Disclaimer

Margin trading can provide you with more trading funds for spot trading, but it also comes with trading risks. In Bitget's spot margin product, forced liquidation or reduction will be triggered when the risk ratio is equal to or greater than 1. Therefore, we strongly recommend that you monitor your position's risk ratio and supplement principle or set stop-loss orders in a timely manner.