「Tide Capital」Opportunities of Patience and Greed: Short-term BTC Holders Are Selling Their Final…

The overall market is entering a period of consolidation, with large-cap altcoins deflating the bubble. Funds are flowing from altcoins to BTC and ETH, and the market is approaching its bottom. We…

Remain patient and seize buying opportunities during downturns.

Abstract

The overall market is entering a period of consolidation, with large-cap altcoins deflating the bubble. Funds are flowing from altcoins to BTC and ETH, and the market is approaching its bottom. We are optimistic about BTC’s short-term prospects, with a range of $25,000 to $30,000 for consolidation. The current market sentiment is overly pessimistic, and there is a possibility of a relief bounce. The Fed’s interest rate hikes are coming to an end, and the expectations for rate cuts in the future may bring a wave of upward market movements. The remaining time this year presents a good opportunity for positioning.

Macro: Interest Rate Hikes Nearing an End, Waiting for Rate Cuts

Over the past month, overall inflation in the United States has been trending downward, and the labor market’s heat is subsiding. The US macroeconomy is moving towards a soft landing, and the adjustment of US stocks is relatively manageable. There don’t seem to be any unexpected factors on the horizon. The Fed’s interest rate hikes are coming to an end, with the possibility of one more hike, but its impact is diminishing, no longer the primary focus of the market.

However, the key issue for the cryptocurrency market is the high-interest rate environment. Recently, both the 10-year US Treasury yield and DXY have been rising, putting significant pressure on risk assets. In a high-interest rate environment with ongoing balance sheet reduction, risk assets are struggling to perform well. Due to the strong performance of the US economy, the Fed’s determination to combat inflation remains firm, and rate cuts may still be some time away. The Fed may not start cutting rates until the third quarter of next year, and investors need to remain cautious and patient.

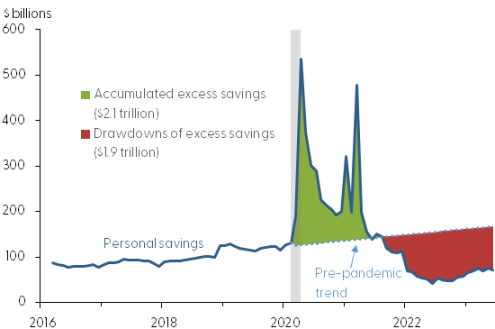

Retail investors are running out of excess funds. During the pandemic, the US government provided a substantial amount of fiscal stimulus to residents, boosting not only the economy but also directing a significant amount of funds into the financial markets, inflating bubbles in small-cap stocks and cryptocurrencies. However, as time has passed, excess savings among US residents have gradually declined. The Federal Reserve Bank of San Francisco predicts that excess savings among residents will be exhausted by the third quarter of 2023, which will have an impact on the economy, inflation, and employment. The United States is one of the world’s largest economies, and with excess savings among its residents nearing depletion, it indicates that retail investors are running out of excess funds, making it difficult for the capital markets to replicate the performance of a bull market.

Institutional investors are also becoming more cautious. So far this year, institutional investors have been reducing their investments in the cryptocurrency market, with primary financing significantly lower compared to the previous two years. In August, financing amounted to only $283 million, essentially returning to the levels of 2019–2020. Even in the sharp market downturn of 2022, monthly average financing exceeded $1 billion. From a positive perspective, the market is completing the process of deflating the bubble, which is very similar to the characteristics of the bottom of the previous market cycle.

Overall, there is a lack of favorable changes in the macro environment. The Fed maintains a relatively hawkish stance, and rate cuts may not occur until the third quarter of next year. Retail investors are running out of excess savings, institutional investors are becoming more cautious, and the market is unlikely to see a major rally. Instead, it is more likely to experience a period of consolidation and investors need to remain patient. Specifically, when the market drops to its lows, we should not be excessively pessimistic, and when the market rises to its highs, we should not be excessively optimistic.

Crypto: Liquidity Shortage, Altcoins Deflating the Bubble

The ETF narrative has subsided, and the market has entered a stalemate. The news of a Bitcoin spot ETF stimulated the market’s rise at the end of June, but the SEC’s decision to delay it in August led to a comprehensive retreat of the bulls. According to Bloomberg analysts, the first ultimate deadline is January 10th for Ark, and the SEC may postpone the final decision until the end of the year, which is 3–4 months away from now. It is currently challenging for this to become a factor driving the market higher. Although the news of Grayscale’s victory temporarily boosted the market, BTC failed to regain its position above the 120-day moving average, and the gains were completely wiped out just two days later, leading the market back into a stalemate.

Trading volumes are declining, and interest is weak. Since BTC and ETH began to consolidate in mid to late July, trading volumes have significantly decreased, and trading interest in the market is quite low. Currently, BTC’s total trading volume is approaching the level it was at after the FTX liquidation event. Both buyers and sellers are in a wait-and-see mode.

Insufficient funds in the market, altcoins are deflating the bubble. Apart from BTC and ETH, the total market capitalization of cryptocurrencies has approached the bottom range of June, and altcoins are continuing to show a downward trend. XRP has completely erased the gains it made after winning the SEC lawsuit, and ARB has fallen below its June low, with only a few low-cap altcoins experiencing Pump Dump rallies with the participation of market makers. Former on-chain star projects like UNIBOT, BITCOIN, and OX have seen even larger declines, indicating a lack of market funds and confidence.

Overall, funds are flowing from altcoins to BTC, and altcoins are completing the process of deflating the bubble. Compared to the lows earlier this year, BTC still has an increase of around 60%, while many altcoins have turned negative in terms of returns. The market is gradually digesting the overvaluation of many altcoins in a downward, low-volatility manner, completing the final consolidation phase of the bear market. The market has adjusted to lower levels, and there is limited downside potential. In the absence of major negative news, the decline brings opportunities rather than risks.

What We Are Bullish About

Short-term: BTC is expected to consolidate between $25,000 and $30,000. Given the current situation, there are no significant macro changes, and there are no clear bullish or bearish factors in the market. BTC is highly likely to consolidate within the range of $25,000 to $30,000. Currently, market sentiment is overly pessimistic, and impatient investors have exited their positions. The deflation of altcoins’ bubble is largely complete, and a casual rally doesn’t require a significant amount of capital. Even a recovery rally has the potential to push BTC back to around $30,000.

Medium-term: The Fed’s interest rate hikes are coming to an end, waiting for rate cut trades. Looking back at the previous interest rate hike cycle, after the Fed paused interest rate hikes, BTC bottomed out and rose sharply from $3,300 in February to $13,000 in June. Markets often anticipate the Fed’s rate cut, and by the time the rate cut is implemented, a significant uptrend may already be well underway. While it may be too early to talk about rate cuts at the moment, we are very close to the final interest rate hike, and the future market outlook is promising.

Conclusion

Short-term BTC holders are selling their final bags at $26,000, while patient investors see extraordinary opportunities. We maintain a cautiously optimistic stance on the current market, while also having a positive outlook for $BTC next year. Remain patient and seize buying opportunities during downturns.

Tide Capital

Tide Capital is a research-driven digital asset investment and trading firm. We study macro and fundamentals to capture beta and alpha opportunities from crypto waves to financial tides. Driven by value, we aim to invest in early-stage projects with significant growth potential. Concurrently, we assess market cycles to inform our investment decisions, trading in the public market to achieve returns.

website: tidecap.com

mail: [email protected]

twitter: twitter.com/tidecap_com

medium: tidecap.medium.com

Disclaimer The information and data presented in this article are obtained from public sources, and Tide Capital makes no guarantees regarding their accuracy and completeness. Any predictions, speculations, or opinions contained in this article are statements about future events and may differ significantly from actual results due to limitations in data timeliness, assumption validity, uncertainty factors, and unforeseeable risks. Any advice and opinions in this article are for reference purposes only and do not constitute recommendations to buy or sell any digital assets. They do not constitute investment advice or solicitations. The strategies that Tide Capital may adopt may be the same, different, or unrelated to those inferred by readers based on this article. Investors should carefully consider any decisions and seek appropriate legal and financial advice when necessary. Any misunderstanding or misuse of the content in this article does not constitute the responsibility of the author or the publishing institution.免责声明:文章中的所有内容仅代表作者的观点,与本平台无关。用户不应以本文作为投资决策的参考。

你也可能喜欢

ZORAUSDT 现已上线合约交易和交易BOT

曾在 ETH 交易中亏损 360 万美元的鲸鱼再度增持 1,734 枚 ETH,约合 311 万美元

CryptoQuant CEO:仍认为牛市周期已结束,若 BTC 突破 10 万美元将承认判断有误

A2A与MCP协议落地Web3 AI Agent的三大"死亡盲区"

倘若Google推出的A2A和Anthropic的MCP协议成为web3 AI Agent发展的黄金通信标准,会发生什么?