XRP Above $2 Is About to Secure Its Highest Yearly Close in History

Despite the ongoing XRP price consolidation, market data shows the altcoin is on track to secure its highest yearly close in history.

Despite the ongoing XRP price consolidation, market data shows the altcoin is on track to secure its highest yearly close in history.

Notably, XRP has faced a bearish spell since it reclaimed the seven-year peak of $2.9 on Dec. 3. The altcoin collapsed nearly 19% three days after this top, and has continued to witness pressure from the bears despite occasional recovery attempts.

XRP’s Battle at $2

Amid this bearish phase, analysts have more reason to be confident in XRP’s price prospects. In a recent commentary, market watcher Dom confirmed that XRP might actually be on track to secure a historic close on the yearly timeframe.

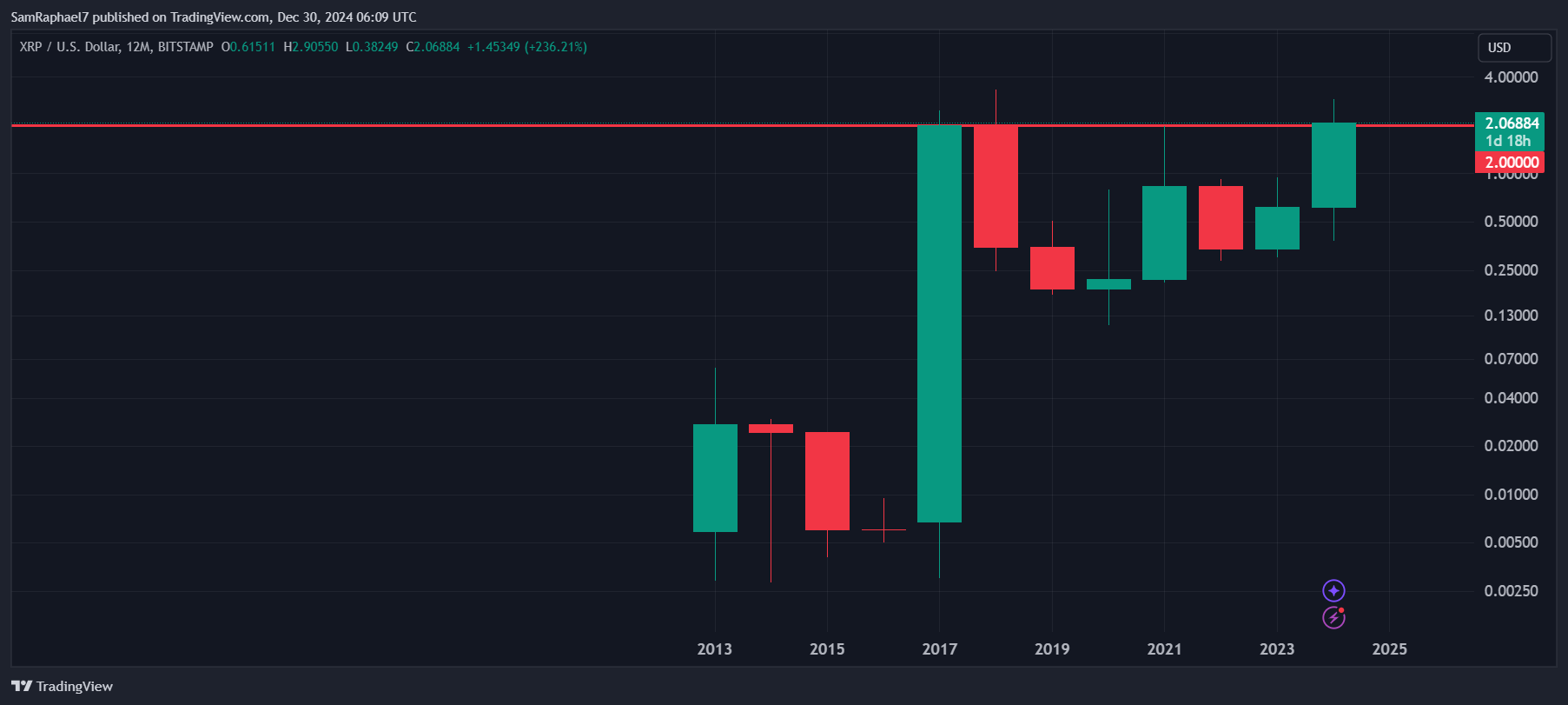

$XRP yearly candle overview

When you zoom out, you can see $2 is really the only level that matters

2017 candle closed at $1.99

2021 candle wicked to $1.99

Two more days to close above $2 to break the "cycle cap" pattern pic.twitter.com/mSu7on4s2d

— Dom (@traderview2) December 29, 2024

For context, XRP has always faced resistance at the $2 price mark since it captured it in the 2017/2018 market rally. Despite its meteoric run during this cycle, XRP was unable to secure a yearly close above the $2 price.

Particularly, in 2017, XRP witnessed a massive increase of 33,066%, after it soared from the starting price of $0.00678. Nonetheless, it closed 2017 with a price of $1.99, below the $2 mark despite previously soaring to a peak price of $2.47 in December 2017.

Meanwhile, in 2018, XRP collapsed 82.49% and closed the year at $0.3484. From this level, the altcoin failed to reclaim the $2 mark for three years. Its next attempt at hitting this price was in April 2021, when it soared to a peak price of $1.96 and then faced intense resistance, unable to reach $2.

XRP on Track to Close First Yearly Candle Above $2

Now, after seven years, XRP recovered the $2 price level in December 2024, soaring to a top of $2.9 following the uptrend it registered last month. While the bears have since triggered massive selling pressure, XRP has held firm above $2.

XRP 12M Chart

XRP 12M Chart

With just a day left to end 2024, if XRP maintains the $2 level, this would mark the first yearly close above $2 in its entire history. Most market analysts believe this event would be historic, possibly marking the start of an explosive run for XRP.

Notable crypto trader Steph also called attention to this potential bullish close, highlighting its importance for the market. “We’re all gonna be super rich,” the market watcher suggested in a recent disclosure on X.

Prevalent Selling Pressure

However, XRP appears to be facing intense pressure, as the bears attempt to push it below $2 before the close of 2024. With a 1.15% slump this morning, XRP now trades at an 11-day low of $2.06, retesting the lower trendline of a bull flag formed on the daily timeframe.

XRP 1D Chart

XRP 1D Chart

Notably, the bulls need to defend the bull flag’s lower trendline zealously, as a breach underneath it would ultimately lead to a drop below the $2 price territory for XRP, invalidating its push to close its first yearly candle above it.

Meanwhile, despite the bearishness in December, XRP has sustained a 5.47% monthly gain, forming a bullish green inverted hammer candle. This candlestick suggests potential bullish reversal, having appeared during the latest downtrend.

XRP Monthly Inverted Hammer

XRP Monthly Inverted Hammer

For the uninitiated, the long upper wick indicates buyers tried to push prices higher, but sellers pulled back some gains. Still, the close above the open indicates growing buyer strength. If XRP can hold the $2 level at the close of December, the next candlestick could mark the start of the anticipated price reversal.

免责声明:文章中的所有内容仅代表作者的观点,与本平台无关。用户不应以本文作为投资决策的参考。

你也可能喜欢

Matrixport 投研:全球流动性上升可能不再推动 BTC 价格上涨

全球流动性与 BTC 价格的关系逐渐减弱,加密货币原生驱动因素或将成为关键指标

重塑金融体系:FDIC改革能否应对加密货币时代的挑战?

美国联邦存款保险公司(FDIC)代理主席特拉维斯·希尔提出了一系列改革优先事项,包括审查现行法规、拥抱创新和重新评估银行合并审批流程。然而,改革面临现实挑战,需要在确保金融体系安全的同时推动经济活力。FDIC 应采取谨慎、分阶段的方式推进改革,以避免监管漏洞和实施延迟。 摘要由 Mars AI 生成 本摘要由 Mars AI 模型生成,其生成内容的准确性、完整性还处于迭代更新阶段。

特朗普儿子参与Dominari的比特币ETF投资

公开上市公司Dominari Holdings宣布采用比特币储备策略,投资200万美元购买黑石iShares比特币信托基金(IBIT)股份。该公司与特朗普家族关系密切,唐纳德·特朗普·朱尼尔和埃里克·特朗普近期加入其顾问委员会。通过受监管的ETF获取比特币敞口,简化合规和会计处理,凸显特朗普家族对加密货币的兴趣和参与。 摘要由 Mars AI 生成 本摘要由 Mars AI 模型生成,其生成内容的准确性、完整性还处于迭代更新阶段。