BlackRock CEO Forecast: Will a Recovery Follow the Crypto Market Crash ?

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Whether the crypto market recovers soon depends on several macro and internal market factors:

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Whether the crypto market recovers soon depends on several macro and internal market factors:

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

Ripple acquires prime broker Hidden Road for $1.25 billion to expand institutional services

Ripple is acquiring Hidden Road in a $1.25 billion deal, marking the second billion-dollar-plus acquisition involving a crypto company this year—following FTX’s $1 billion purchase of BlockFi.

Ripple ( XRP ) is acquiring prime brokerage firm Hidden Road for $1.25 billion as part of its strategy to attract more institutional investors through a wider range of services. The deal will be primarily cash-based, along with a portion paid in XRP and Ripple stock. Marc Asch, the founder of Hidden Road, will continue to lead the brokerage under Ripple.

“Ripple needs to make sure we have the infrastructure in place to appeal and expand to a larger segment of the biggest bulge bracket institutions,” CEO Brad Garlinghouse told Fortune.

Garlinghouse told CNBC that he anticipates the deal will be finalized by the third quarter of 2025 at the latest.

Brad Garlinghouse explained that the acquisition came about after Hidden Road faced growth challenges due to balance sheet constraints and began seeking external capital to scale.

As part of the acquisition, Hidden Road will integrate Ripple’s stablecoin , RLUSD, into its offerings and may also utilize the XRP blockchain for more efficient transaction settlements. Ripple plans to invest billions into Hidden Road to scale its operations and meet the growing demand for prime brokerage services in the crypto market.

Founded in 2018 by Marc Asch, Hidden Road has quickly become a major player in the crypto prime brokerage space, competing with the likes of FalconX and Coinbase Prime. The firm reported $3 trillion in fund transfers in 2024. Previously, it raised $50 million in a Series A funding round backed by Castle Island Ventures, Coinbase Ventures, and Citadel Securities.

最低價

最低價 最高價

最高價

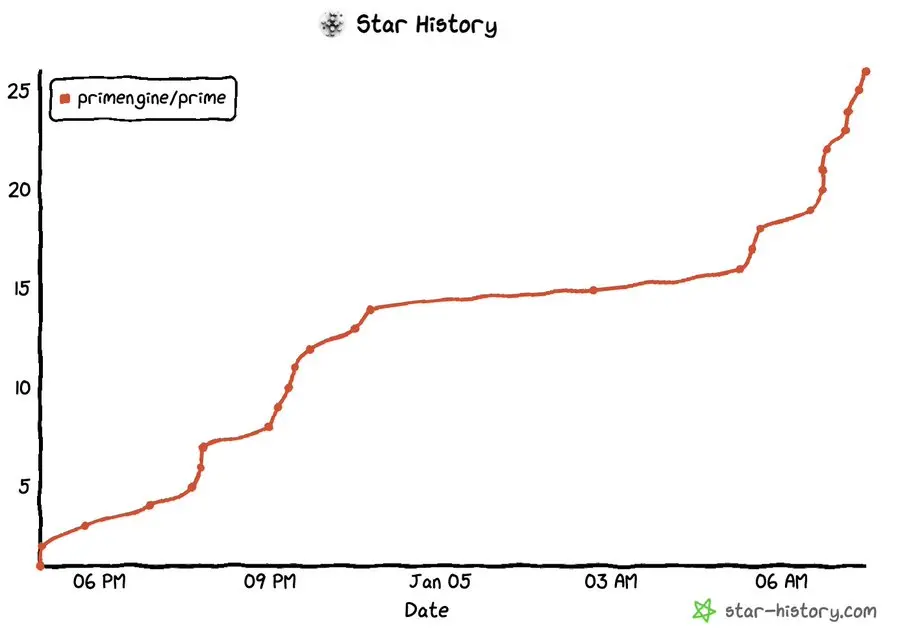

Echelon Prime 社群媒體數據

過去 24 小時,Echelon Prime 社群媒體情緒分數是 2.7,社群媒體上對 Echelon Prime 價格走勢偏向 看跌。Echelon Prime 社群媒體得分是 67,171,在所有加密貨幣中排名第 306。

根據 LunarCrush 統計,過去 24 小時,社群媒體共提及加密貨幣 1,058,120 次,其中 Echelon Prime 被提及次數佔比 0%,在所有加密貨幣中排名第 454。

過去 24 小時,共有 23 個獨立用戶談論了 Echelon Prime,總共提及 Echelon Prime 40 次,然而,與前一天相比,獨立用戶數 減少 了 39%,總提及次數減少。

Twitter 上,過去 24 小時共有 3 篇推文提及 Echelon Prime,其中 33% 看漲 Echelon Prime,67% 篇推文看跌 Echelon Prime,而 0% 則對 Echelon Prime 保持中立。

在 Reddit 上,最近 24 小時共有 0 篇貼文提到了 Echelon Prime,相比之前 24 小時總提及次數 減少 了 0%。

社群媒體資訊概況

2.7