Bitget:全球日交易量排名前 4!

BTC 市占率60.49%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87100.15 (-0.64%)恐懼與貪婪指數46(中性)

比特幣現貨 ETF 總淨流量:+$84.2M(1 天);+$769.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.49%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87100.15 (-0.64%)恐懼與貪婪指數46(中性)

比特幣現貨 ETF 總淨流量:+$84.2M(1 天);+$769.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.49%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87100.15 (-0.64%)恐懼與貪婪指數46(中性)

比特幣現貨 ETF 總淨流量:+$84.2M(1 天);+$769.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Monsterra (MSTR) 價格MSTR

上架

報價幣種:

TWD

NT$0.03930+6.42%1D

價格走勢圖

TradingView

最近更新時間 2025-03-25 11:13:03(UTC+0)

市值:NT$2,603,674.27

完全稀釋市值:NT$2,603,674.27

24 小時交易額:NT$165,930.32

24 小時交易額/市值:6.37%

24 小時最高價:NT$0.04150

24 小時最低價:NT$0.03725

歷史最高價:NT$37.33

歷史最低價:NT$0.03165

流通量:66,255,556 MSTR

總發行量:

98,700,000MSTR

流通率:67.00%

最大發行量:

--MSTR

以 BTC 計價:0.{7}1363 BTC

以 ETH 計價:0.{6}5750 ETH

以 BTC 市值計價:

NT$863,127.58

以 ETH 市值計價:

NT$124,447.63

合約:

0xE397...86925f9(Avalanche C-Chain)

更多

您今天對 Monsterra (MSTR) 感覺如何?

注意:此資訊僅供參考。

Monsterra (MSTR) 今日價格

Monsterra (MSTR) 的即時價格是今天每 (MSTR / TWD) NT$0.03930,目前市值為 NT$2.60M TWD。24 小時交易量為 NT$165,930.32 TWD。MSTR 至 TWD 的價格為即時更新。Monsterra (MSTR) 在過去 24 小時內的變化為 6.42%。其流通供應量為 66,255,556 。

MSTR 的最高價格是多少?

MSTR 的歷史最高價(ATH)為 NT$37.33,於 2022-08-16 錄得。

MSTR 的最低價格是多少?

MSTR 的歷史最低價(ATL)為 NT$0.03165,於 2025-03-16 錄得。

Monsterra (MSTR) 價格預測

MSTR 在 2026 的價格是多少?

根據 MSTR 的歷史價格表現預測模型,預計 MSTR 的價格將在 2026 達到 NT$0.04809。

MSTR 在 2031 的價格是多少?

2031,MSTR 的價格預計將上漲 +2.00%。 到 2031 底,預計 MSTR 的價格將達到 NT$0.1293,累計投資報酬率為 +243.00%。

Monsterra (MSTR) 價格歷史(TWD)

過去一年,Monsterra (MSTR) 價格上漲了 -99.24%。在此期間,MSTR 兌 TWD 的最高價格為 NT$8.79,MSTR 兌 TWD 的最低價格為 NT$0.03165。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h+6.42%NT$0.03725NT$0.04150

7d+4.86%NT$0.03593NT$0.04819

30d-39.40%NT$0.03165NT$0.1724

90d-75.27%NT$0.03165NT$0.2672

1y-99.24%NT$0.03165NT$8.79

全部時間-99.39%NT$0.03165(2025-03-16, 9 天前 )NT$37.33(2022-08-16, 2 年前 )

Monsterra (MSTR) 市場資訊

Monsterra (MSTR) 持幣分布集中度

巨鯨

投資者

散戶

Monsterra (MSTR) 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Monsterra (MSTR) 評級

社群的平均評分

4.6

此內容僅供參考。

Monsterra (MSTR) (MSTR) 簡介

Monsterra (MSTR) 代幣:下一個區塊鏈遊戲的巨人?

區塊鏈技術和加密貨幣已經迅速而穩固的進入各行各業,而最近的熱門趨勢就是將這些創新技術應用於遊戲領域。位於這個科技前沿的,就是Monsterra (MSTR) 代幣,一個由Monsterra遊戲平台推出,以創新方式連接遊戲世界和金融系統的加密貨幣。

Monsterra (MSTR) 代幣是什麼?

Monsterra (MSTR) 是一種基於以太坊區塊鏈的ERC-20 加密貨幣。這個遊戲平台為玩家提供了一個可以在虛擬世界中飼養、買賣和交換怪獸的地方。MSTR 代幣在這個生態系統中起著關鍵作用,提供了一種在遊戲內部進行交易與投資的方式。

Monsterra (MSTR) 代幣的功能

MSTR代幣在Monsterra生態系統中扮演著不可或缺的角色。MSTR代幣可以被用來購買虛擬產品,如遊戲中的怪獸、工具和其他虛擬產品。此外,MSTR也能夠發起投票權,讓MSTR的持有者能夠對遊戲的發展方向、新功能等方面发起投票,增加了玩家在遊戲中的參與感和擁有感。

未來展望

隨著區塊鏈遊戲日益普及,Monsterra和其MSTR代幣無疑將享有越來越多的關注。為了能持續提升遊戲體驗並保持其在市場的競爭力,Monsterra 團隊定會持續引入更多創新功能並改進遊戲的各個方面。

Monsterra (MSTR) 代幣是區塊鏈遊戲領域的重要一環,它展示了加密貨幣和遊戲結合的未來趨勢。對於那些對區塊鏈遊戲感興趣的玩家和投資者來說,MSTR代幣無疑值得進一步的關注和研究。

MSTR 兌換當地法幣匯率表

1 MSTR 兌換 MXN$0.021 MSTR 兌換 GTQQ0.011 MSTR 兌換 CLP$1.11 MSTR 兌換 UGXSh4.371 MSTR 兌換 HNLL0.031 MSTR 兌換 ZARR0.021 MSTR 兌換 TNDد.ت01 MSTR 兌換 IQDع.د1.561 MSTR 兌換 TWDNT$0.041 MSTR 兌換 RSDдин.0.131 MSTR 兌換 DOP$0.081 MSTR 兌換 MYRRM0.011 MSTR 兌換 GEL₾01 MSTR 兌換 UYU$0.051 MSTR 兌換 MADد.م.0.011 MSTR 兌換 AZN₼01 MSTR 兌換 OMRر.ع.01 MSTR 兌換 KESSh0.151 MSTR 兌換 SEKkr0.011 MSTR 兌換 UAH₴0.05

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-25 11:13:03(UTC+0)

如何購買 Monsterra (MSTR)(MSTR)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 Monsterra (MSTR) 兌換為 MSTR

我們將為您示範使用多種支付方式在 Bitget 上購買 Monsterra (MSTR)

了解更多交易 MSTR 永續合約

在 Bitget 上註冊並購買 USDT 或 MSTR 後,您可以開始交易衍生品,包括 MSTR 合約和槓桿交易,增加收益。

MSTR 的目前價格為 NT$0.03930,24 小時價格變化為 +6.42%。交易者可透過做多或做空 MSTR 合約獲利。

Monsterra (MSTR) 動態

美國股市進一步擴大盤中漲幅,特斯拉上漲超過10.46%

Bitget•2025-03-24 18:57

Strategy 宣布增持 6911 顆比特幣,總持有量突破 50 萬顆

Zombit•2025-03-24 16:11

美國盤前加密貨幣股和科技股下跌,MicroStrategy下跌0.92%

Bitget•2025-03-21 14:35

Strategy將STRF優先股發行規模提高至7.225億美元

Bitget•2025-03-21 12:43

購買其他幣種

用戶還在查詢 Monsterra (MSTR) 的價格。

Monsterra (MSTR) 的目前價格是多少?

Monsterra (MSTR) 的即時價格為 NT$0.04(MSTR/TWD),目前市值為 NT$2,603,674.27 TWD。由於加密貨幣市場全天候不間斷交易,Monsterra (MSTR) 的價格經常波動。您可以在 Bitget 上查看 Monsterra (MSTR) 的市場價格及其歷史數據。

Monsterra (MSTR) 的 24 小時交易量是多少?

在最近 24 小時內,Monsterra (MSTR) 的交易量為 NT$165,930.32。

Monsterra (MSTR) 的歷史最高價是多少?

Monsterra (MSTR) 的歷史最高價是 NT$37.33。這個歷史最高價是 Monsterra (MSTR) 自推出以來的最高價。

我可以在 Bitget 上購買 Monsterra (MSTR) 嗎?

可以,Monsterra (MSTR) 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 Monsterra 指南。

我可以透過投資 Monsterra (MSTR) 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Monsterra (MSTR)?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 Monsterra (MSTR)(MSTR)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Monsterra (MSTR))具有市場風險。Bitget 為您提供購買 Monsterra (MSTR) 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Monsterra (MSTR) 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

Cointelegraph

4小時前

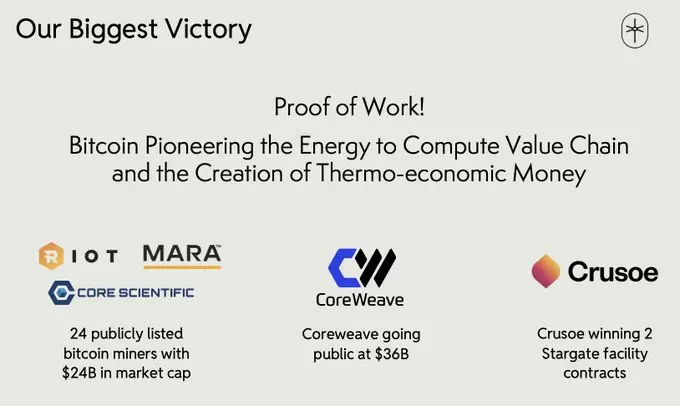

🔥 NOW: Michael Saylor says, "Bitcoin is a magnet for capital" in response to VanEck's Matthew Sigel post showing BTC's outsized capital raising impact.

While $MSTR represents just 0.07% of US equities by value, Bitcoin-related offerings account for 16% of all equity raised in 2024.

BTC-0.44%

S+2.95%

Coinedition

15小時前

Bitcoin’s Corporate Backers Grow: Top 70 Companies Now Hoard 670K+ BTC

The trend of institutional investors embracing Bitcoin continues to gain momentum, with the “HODL Top 70” list of companies now collectively holding a staggering 670,153 BTC.

This increasing accumulation of Bitcoin by corporate entities reflects a growing confidence in the cryptocurrency’s long-term value proposition. In the past week alone, five companies further expanded their digital asset portfolios, adding a total of 7,349 BTC to their already substantial reserves.

Which Companies Are Leading the Charge in Bitcoin Accumulation?

When it comes to individual corporate Bitcoin holdings, Strategy (MSTR) remains the undisputed leader , currently possessing an impressive 506,137 BTC. The company’s well-known and aggressive Bitcoin accumulation strategy keeps it significantly ahead of all other publicly traded firms in this space.

Following Strategy is Marathon Digital (MARA) with a substantial 46,374 BTC, maintaining its position as a key player in the Bitcoin mining industry. Riot Platforms (RIOT) holds 18,692 BTC, further demonstrating its strong commitment to Bitcoin as a core asset in its treasury.

Related: Strategy (Formerly MicroStrategy) Launches $2.1 Billion Share Sale to Fund Further Bitcoin Acquisitions

Tesla (TSLA) continues to hold a significant amount of Bitcoin, retaining 11,509 BTC, which reflects its sustained investment in the cryptocurrency despite the market’s inherent volatility.

Cleanspark (CLSK) has accumulated 11,177 BTC, further solidifying its position within the Bitcoin mining sector. Hut 8 (HUT) closely follows with 10,237 BTC, remaining one of the industry’s leading Bitcoin mining companies.

Coinbase (COIN), a major cryptocurrency exchange, holds 9,480 BTC, ensuring it has significant exposure to Bitcoin’s price fluctuations.

Block (formerly known as Square) owns a notable 8,485 BTC, underscoring its long-term belief in Bitcoin’s potential as a transformative technology and asset. Galaxy Digital (GLXY), a prominent investment firm focused on digital assets, holds 4,848 BTC, showcasing its commitment to Bitcoin as a key component of the evolving financial landscape.

Bitcoin Group SE (BTGGF), a European institutional investor, has accumulated 3,605 BTC, further strengthening its presence in the Bitcoin market.

Metaplanet recently increased its holdings, now reaching a total of 3,350 BTC. This strategic move aligns with the company’s publicly stated bullish outlook on Bitcoin’s future.

Semler Scientific (SMLR) holds 3,192 BTC, maintaining a significant corporate stake in the cryptocurrency. Hive Digital (HIVE) possesses 2,620 BTC, supporting its operations in the digital asset mining space.

Cango (CANG) has also increased its exposure to Bitcoin, now holding 1,944 BTC. Exodus (EXOD) follows with 1,900 BTC, using Bitcoin as part of its reserves to support its digital wallet services.

BitFuFu (FUFU) owns 1,800 BTC, reflecting the broader trend of increasing institutional adoption of Bitcoin. Nexon (NEXOF) holds 1,717 BTC, demonstrating continued corporate confidence in Bitcoin’s long-term value as an asset.

Related: Bitcoin Bet Pays Off: Strategy₿ (MSTR) Outperforms Top Stocks

Fold (FLD) has accumulated 1,485 BTC, highlighting its ongoing commitment to the cryptocurrency ecosystem. Canaan (CAN), a major manufacturer of Bitcoin mining hardware, holds 1,355 BTC, maintaining its presence within the Bitcoin industry.

This sustained and growing institutional adoption signals a strong and enduring corporate belief in Bitcoin’s potential as a valuable long-term investment asset.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

BTC-0.44%

CORE-1.26%

Michael Saylor_

22小時前

$MSTR has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, @Strategy holds 506,137 BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin. $STRK

BTC-0.44%

STRK+0.22%

Crypto News Flash

2天前

MicroStrategy to Raise $711M for Bitcoin—Bullish Signal for BTC?

Strategy, previously named MicroStrategy , is scaling up its Bitcoin mission . Through a combination of confidence and capital, the firm has registered an offering of 8.5 million shares of its 10% Series A Perpetual Strife Preferred Stock at $85 per share. The scheme is anticipated to generate an enormous $711.2 million, funds heading straight into Bitcoin and boosting its day-to-day finances.

Strategy announces pricing of its Strife Perpetual Preferred Stock ($STRF) Offering and upsizes the deal from $500M to $722.5M $MSTR https://t.co/GJVCRwIQ0Y

— Michael Saylor⚡️ (@saylor) March 21, 2025

The offering that will be closing on Tuesday, March 25, 2025, guarantees investors a 10% annual dividend return. Strategy’s decision to raise almost $211 million more than planned reflects strong investor demand and, perhaps, a growing conviction in the long-term value of Bitcoin. Initially, the company targeted to sell $500 million with only 5 million shares of the same stock.

Strategy purchased a whole batch of 130 BTC this week for $10.7 million, which means they spent $82,982 on each BTC on average. The most recent transaction raised the value of the company’s Bitcoins to 499,226, which is around 2.37% of all the Bitcoins that are currently in circulation.

Founder and chairman Michael Saylor hasn’t been shy about his endgame. “Bitcoin is our strategy,” he has made clear through both word and wallet. By using this, a novel model has arisen within Strategy in which not only crypto is being held, but its use has led to the establishment of a fully functional business model.

Some companies might take a small step, but Strategy goes the whole hog. After the sale of 123,000 shares of 8.00% Series A Perpetual Strike Preferred Stock, the company rose to the sum of $10.7 million. The exact amount was used to buy 130 Bitcoins. Furthermore, in a world where treasuries typically mean cash or bonds, this kind of discipline is unique.

As a matter of fact, Strategy actually has not sold any A Class common stock in the recent past to imply its determination based on the progressive financial task and only through the current and future Bitcoin-centric strategy. This is not only a crypto investment , it is a financial philosophy in action.

Strategy is one such example. Reports show that 170 institutions, including governments and fund managers, are now holding around 3.1 million Bitcoins in their treasuries. The message is loud—Bitcoin is no longer fringe. It is now an integral part of the financial mainstream that defends against inflation and currency instability.

To expand its capital firepower, Strategy has greenlit plans to issue up to $21 billion worth of its 8.00% Series A Perpetual Strike Preferred Stock using an at-the-market offering program. This may seem excessive, but in the volatile world of crypto, liquidity is king, and boldness gets rewarded—or punished—with equal speed.

On the dividend front, the company also declared a quarterly payout of $1.24 per share on its existing 8.00% Series A Perpetual Strike Preferred Stock. Starting in 2025, these payments will land every quarter, sweetening the deal for investors willing to ride out the volatility.

BTC-0.44%

UP-1.75%

Aicoin-EN-Bitcoincom

3天前

Strategy Prices $722.5M Preferred Stock Offering for Bitcoin Acquisitions

Strategy’s (Nasdaq: MSTR/STRK) cumulative dividends will accrue at 10% annually on a $100 stated value per share, payable quarterly starting June 30, 2025. Unpaid dividends trigger compounded rates starting at 11% annually, increasing by 1% each quarter up to 18%. Dividends are declared at the board’s discretion and paid in cash.

Strategy said it may redeem all shares if outstanding stock falls below 25% of the original issuance or due to tax events. The redemption price includes the liquidation preference—initially $100 per share—adjusted daily based on the highest of the stated amount, recent sale prices, or a 10-day trailing average.

Holders can demand repurchases at par plus unpaid dividends if a “fundamental change” occurs. Morgan Stanley, Barclays, Citigroup, and five other firms are joint book-runners. The SEC-registered offering follows a prospectus filed Feb. 18, 2025.

Proceeds will fund general corporate needs, including bitcoin purchases and working capital. Strategy, formerly Microstrategy, holds bitcoin as its primary treasury reserve asset. The company holds 499,226 BTC after a $10.7 million purchase that took place in mid-March. While BTC has been down in value, Strategy’s cache of BTC is still up by 27%.

With the fresh new capital, Strategy’s stash of bitcoin is likely to climb over the 500,000 BTC range in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到[email protected],本平台相关工作人员将会进行核查。

BTC-0.44%

UP-1.75%

相關資產

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 Monsterra (MSTR)。