News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1FARTCOIN’s Recovery Kicks Off With a Classic Pattern – Will GOAT Follow the Same Path?2Merlin Chain Expands Bitcoin Yield Opportunities in Partnership with Hemi Network3Raydium (RAY) Eyes Recovery with Key Breakout and – Is Jupiter (JUP) Setting Up for a Similar Move?

Research Report | SIREN Project Detailed Analysis & Market Valuation

远山洞见·2025/03/24 07:15

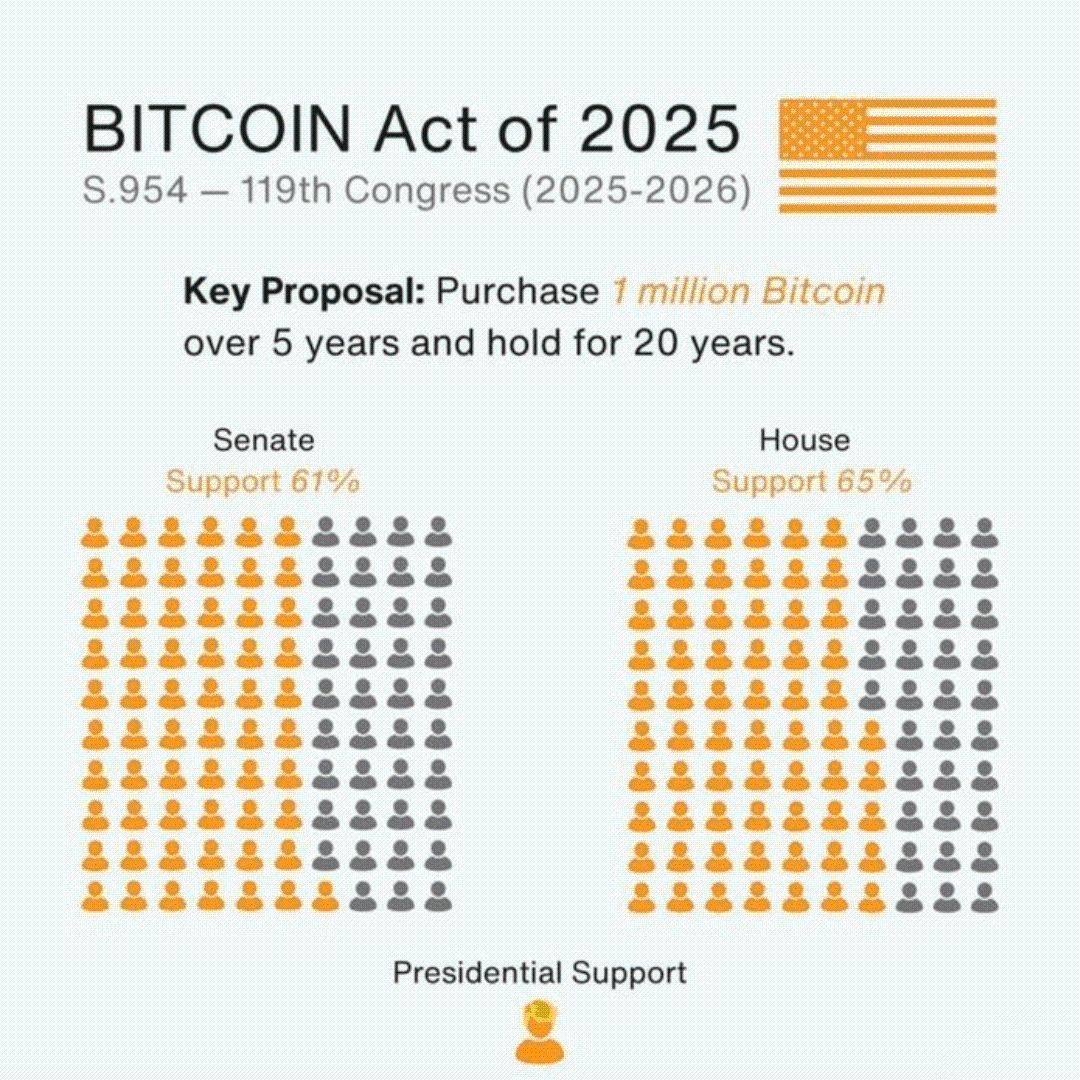

U.S. BITCOIN Act of 2025: Strategic Bitcoin Reserve Gains Majority Support in Congress

Cryptoticker·2025/03/24 06:00

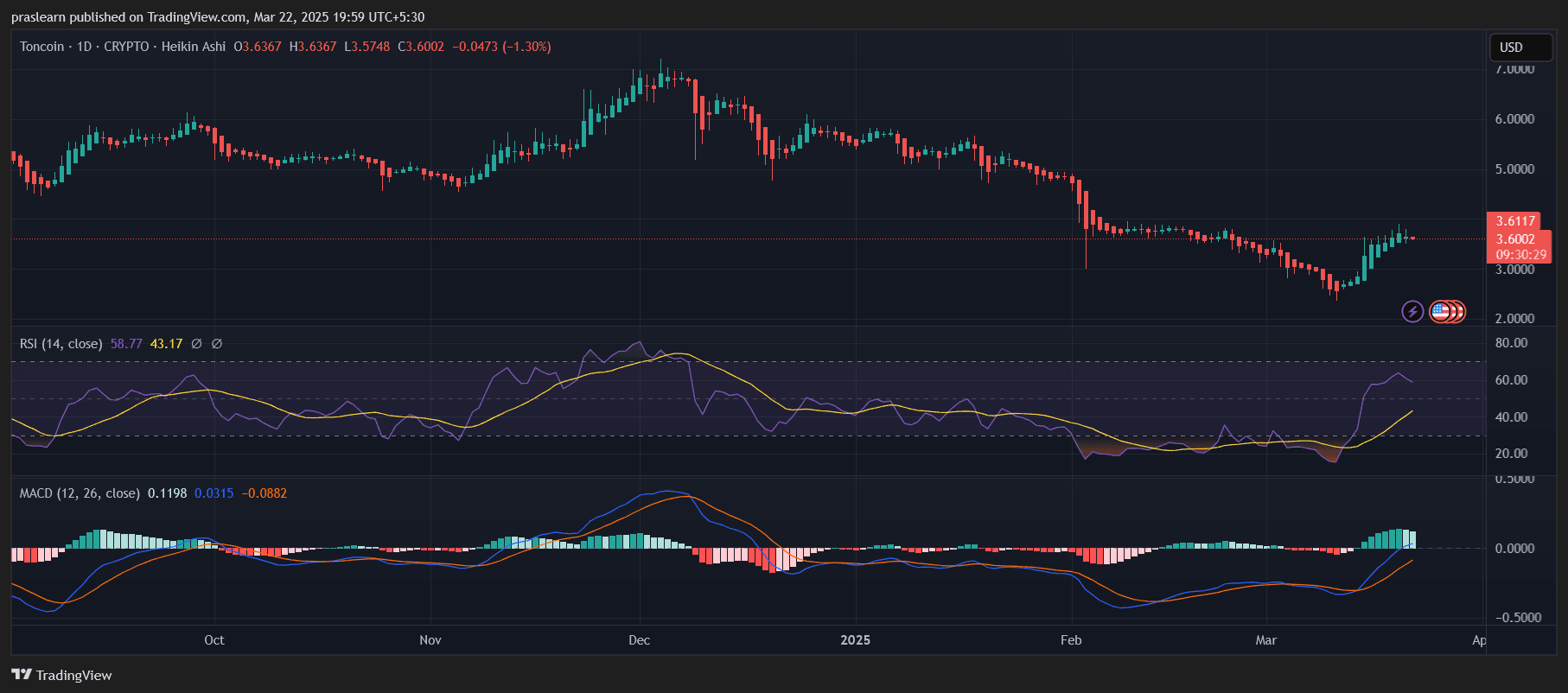

Toncoin Price Prediction: Can TON Price Reach $20?

Cryptoticker·2025/03/24 06:00

SUI Forms Another Bullish Falling Wedge – Could a Breakout Push It to New All-Time High?

CoinsProbe·2025/03/24 05:22

Render (RENDER) Gains Momentum Following Key Breakout – Is Injective (INJ) Gearing Up For A Similar Move?

CoinsProbe·2025/03/24 05:22

When SEC Official Receives Bullet: Who Is Controlling $7.44 Billion Fund to Long Bitcoin?

An SEC official has stated that they received death threats over regulatory positions, highlighting the crypto community's opposition to regulators. Meanwhile, Bitcoin ETF inflows have reversed the market downturn, and the Ethereum ecosystem is facing challenges, with the Layer 2 sybil attack exacerbating the mainnet's predicament.

BlockBeats·2025/03/24 04:18

Volatile Market Sentiment: Could Bitcoin Reclaim $90K in the Coming Days?

CryptoNews·2025/03/24 03:22

Bulls to Reclaim $2K Threshold: Big Trend Shift for Ethereum?

CryptoNews·2025/03/24 03:22

Bullish Signals for XRP Price: What Happens Next Is Critical

CryptoNews·2025/03/24 03:22

Shiba Inu Faces Challenges Ahead of Potential Bitcoin Rally as Short-Term Sell-Offs Mount

Coinotag·2025/03/23 21:11

Flash

- 07:55This year, the RWA sector grew by 237%, and the total market value doubled to 19 billion US dollarsPANews reported on March 24, according to Velo Protocol analysis, the RWA sector performed strongly in 2025, growing by 237% within the year and doubling its total market value to $19 billion. This was mainly driven by private credit, with both the number of holders and activity reaching historic highs. At the same time, the total value of stablecoins reached $225 billion. As of March 24, 2025, the top five RWAs by market value included: BlackRock's $BUIDL at approximately $1.5 billion (the largest RWA)Hashnote's $USYC (acquired by Circle in 2025) at about $800 millionTether Gold's $XAUT at around $750 millionFranklin OnChain's $BENJI at roughly $700 millionPaxos Gold's$ PAXG at approximately$650 million.

- 07:41QCP: There is a higher demand for BTC call options than put options, but the option skew may fall againThe Federal Reserve announced a slowdown in tapering, causing Bitcoin to rebound by more than 5% from below $83,000, briefly breaking through $87,000. Analysts at QCP Capital pointed out that traders' sentiment is turning bullish as call options become more expensive or there is higher demand than put options, contrasting with the situation earlier this week. However, Amberdata's Director of Derivatives Greg Magadini believes macro uncertainties still exist and option skewness may turn bearish again. (Note: The so-called "skewness" refers to the difference in volatility between put/call options in the options market).

- 07:29Matrixport: Bitcoin is attempting to break the downward trend, and arbitrage selling pressure is nearing its endChainCatcher News, Matrixport released a chart today showing that Bitcoin is attempting to break the downward trend, benefiting from the slightly dovish stance of the Federal Reserve and Trump's hint at adopting a more targeted strategy for tariffs. Compared with the past few weeks, these changes have provided a more constructive environment for the market. In addition, as the end of the quarter approaches, selling pressure from arbitrage funds is easing due to persistently low funding rates and most sell-offs are nearing their end. Although current catalysts are not enough to support Bitcoin in setting new historical highs, market prospects have significantly improved.