Maintaining a 10%+ APY, Latest DeFi Bear Market Strategies

Original Article Title: Yields Opportunities in a Risk-off Environment

Original Author: @ClBlockchain, crypto writer

Original Translation: zhouzhou, BlockBeats

Editor's Note: The article introduces various opportunities to earn yield by providing liquidity in the current risk-off environment, covering on-chain strategies such as Sonic, Arbitrum, and Hyperliquid. This includes Shadow (Sonic's main DEX) earning high APR and Sonic Points through liquidity provision, Rings Protocol x Pendle earning stable yield through scUSD, Pear Protocol (Arbitrum) capturing high funding rates through reverse trading, and Harmonix (Hyperliquid) conducting low-risk arbitrage through HYPE Delta-neutral treasury.

The following is the original content (lightly edited for readability):

Since the November 2024 election, the crypto market has retraced about 25% from its peak of $3.7 trillion, with the total market cap dropping to $2.76 trillion as of March 10, 2025. The market is currently clearly in a risk-off mode. In this environment, stablecoins, Delta-neutral products, and yield farming opportunities typically attract more attention and users.

Below are some innovative yield opportunities on different blockchains, yes, we still love loyalty rewards.

Yield Farming on Sonic

@ShadowOnSonic

Shadow is the core decentralized exchange on Sonic that utilizes a concentrated liquidity mechanism to provide users with a high-yield annual percentage rate. Its primary strategy involves providing liquidity on both S and staked S (with minimal impermanent loss) and hedging risks through shorting.

Expected Returns:

30-80% APR (Liquidity Provision Yield)

Sonic Points Rewards

Pros and Cons:

High APR (Significant liquidity mining rewards)

Requires active liquidity management

Operation Steps:

Buy S, and convert part of it to stS through beets.fi (ratio depends on liquidity range).

Open a 1x short position on @HyperliquidX or @vertex_protocol to hedge price volatility risk.

@Rings_Protocolx@pendle_fi

Rings offers scUSD, a yield-bearing stablecoin backed by USDC and ETH. The strategy involves minting scUSD and earning yield through its treasury, while also passively acquiring Sonic points by holding scUSD, or providing liquidity on @pendle_fi for additional rewards.

Pros and Cons:

No need for active management

Pendle has a strong track record

Requires trust in Rings' stablecoin and Veda treasury

Operation Steps:

Mint scUSD by collateralizing stablecoins on Rings.

Stake scUSD to earn a 5% yield + Sonic points.

On Pendle:

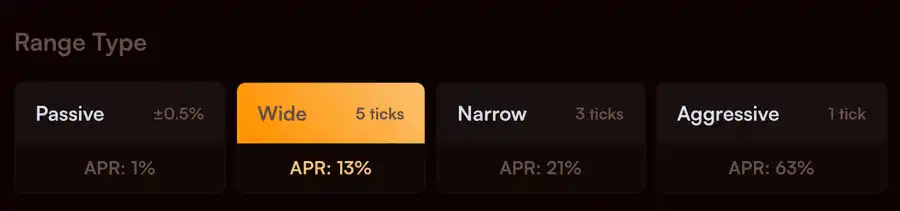

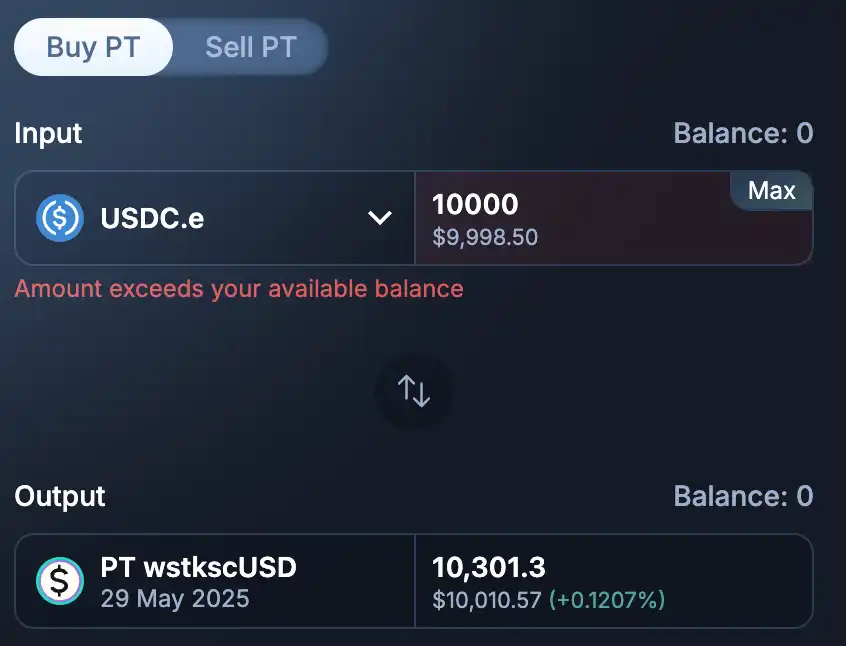

· Buy wstkscUSDPT to enjoy a 13.75% APR and hold until the maturity date (May 29, 2025).

Earning Yield through Providing Liquidity on Arbitrum

@Pear_Protocol

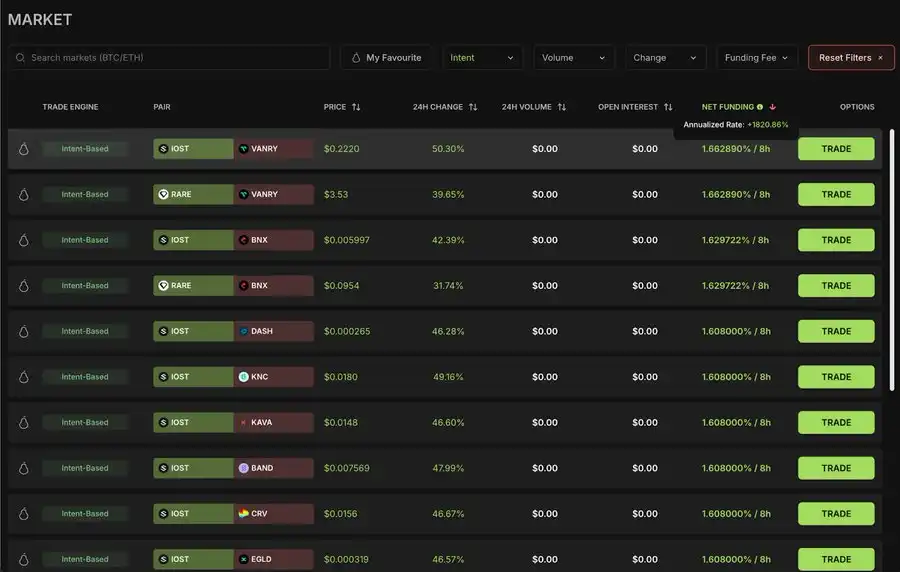

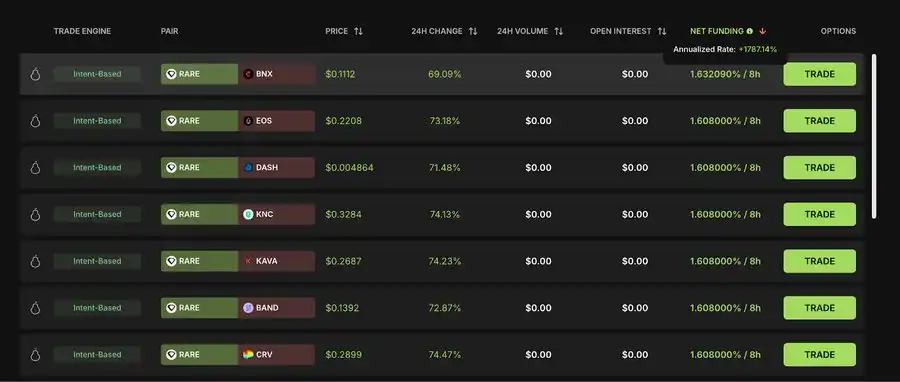

PearProtocol recently launched a new feature—the MarketPage, used to discover trading opportunities and filter out the most attractive funding rate opportunities from thousands of trading pairs.

Strategy Core: Reverse Trading to Earn Funding Rate

The core idea of this strategy is "reverse trading to earn the market sentiment premium." The opportunity arises from trading setups where the market sentiment is opposite to one's own view:

· Go long on assets that are heavily shorted by the market

· Go short on assets that are heavily longed by the market

Considering that the market often sees Open Interest liquidation, this strategy is reasonable. However, one needs to actively manage their position, monitor whether the funding rate is favorable, and whether the 24-hour funding rate change is positive.

Pros and cons:

· High funding rate reward can be obtained

· Suitable for mean reversion trading strategy

· Requires active position management

· High risk

Operating steps:

· Go to the Market Page

· Filter by Net Funding to find the best trading opportunity

After some research, you can discover high-quality trading opportunities.

Earning Yield by Providing Liquidity on Hyperliquid

@harmonixfi

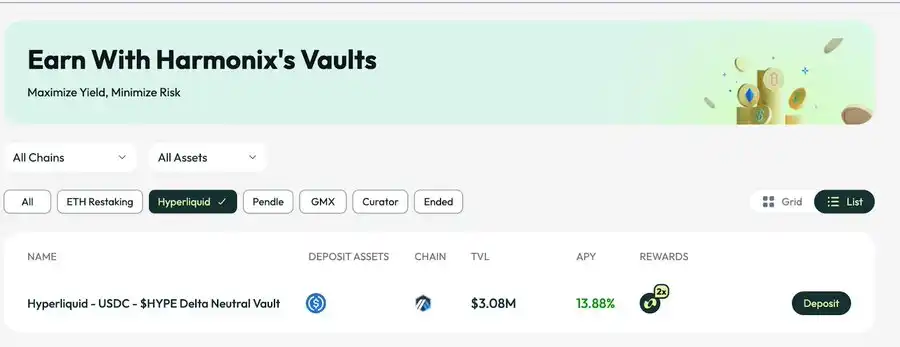

Harmonix has now launched the HYPE 'DeltaNeutral' Treasury, where users can deposit USDC to earn yield while receiving Hyperliquid Points and Harmonix Points.

This Treasury generates returns through funding rate:

Half of the deposit is used to purchase Hyperliquid's native token HYPE

The other half simultaneously opens a short position on HYPE for hedging

This is a Delta-neutral strategy that allows risk-free exposure to the Hyperliquid ecosystem. However, the HYPE funding rate may change at any time, so the overall risk is considered medium.

Pros and cons:

· High yield while also being able to position in the HL ecosystem

· Need to monitor funding rate changes weekly

Operating steps:

· Visit the Harmonix platform: https://app.harmonix.fi

· Select USDC/Hyperliquid Vault

· Deposit USDC and complete the transaction

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s 50x leveraged LINK long position has a floating profit of $1.99 million

Goldman Sachs: Baseline forecast of gold price at $3,100 by the end of 2025 has upside risk

Analysis: Whales bought more than 20,000 BTC in the past 48 hours

Deutsche Bank: Bank of England could cut interest rates to 3.5% by year-end