Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.56%

Altcoin season index:0(Bitcoin season)

BTC/USDT$101937.17 (+5.09%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.56%

Altcoin season index:0(Bitcoin season)

BTC/USDT$101937.17 (+5.09%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.56%

Altcoin season index:0(Bitcoin season)

BTC/USDT$101937.17 (+5.09%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$318.6M (1D); +$1.27B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

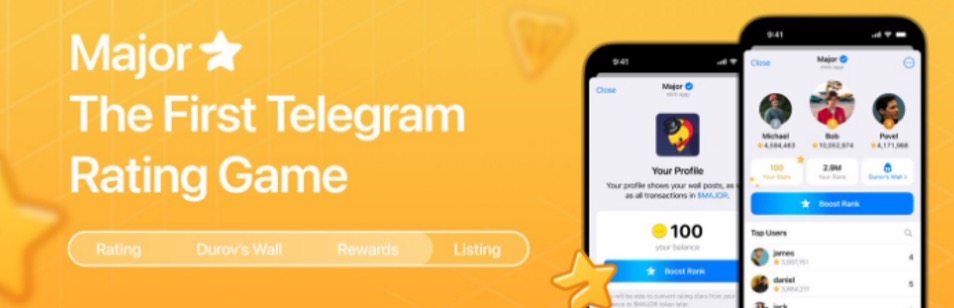

Major presyoMAJOR

Listed

BumiliQuote pera:

USD

$0.1925+0.06%1D

Huling na-update 2025-02-03 21:56:08(UTC+0)

Market cap:$16,045,604.99

Ganap na diluted market cap:$16,045,604.99

Volume (24h):$140,022,812.5

24h volume / market cap:872.65%

24h high:$0.1977

24h low:$0.1492

All-time high:$36.75

All-time low:$0.1492

Umiikot na Supply:83,349,870 MAJOR

Total supply:

99,999,999MAJOR

Rate ng sirkulasyon:83.00%

Max supply:

99,999,999MAJOR

Mga kontrata:

EQCuPm...U_MAJOR(TON)

Higit pa

Ano ang nararamdaman mo tungkol sa Major ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Major ngayon

Ang live na presyo ng Major ay $0.1925 bawat (MAJOR / USD) ngayon na may kasalukuyang market cap na $16.05M USD. Ang 24 na oras na dami ng trading ay $140.02M USD. Ang presyong MAJOR hanggang USD ay ina-update sa real time. Ang Major ay 0.06% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 83,349,870 .

Ano ang pinakamataas na presyo ng MAJOR?

Ang MAJOR ay may all-time high (ATH) na $36.75, na naitala noong 2024-11-27.

Ano ang pinakamababang presyo ng MAJOR?

Ang MAJOR ay may all-time low (ATL) na $0.1492, na naitala noong 2025-02-03.

Bitcoin price prediction

Kailan magandang oras para bumili ng MAJOR? Dapat ba akong bumili o magbenta ng MAJOR ngayon?

Kapag nagpapasya kung buy o mag sell ng MAJOR, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget MAJOR teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

Ayon sa MAJOR 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ayon sa MAJOR 1d teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ayon sa MAJOR 1w teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ano ang magiging presyo ng MAJOR sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni MAJOR, ang presyo ng MAJOR ay inaasahang aabot sa $0.2808 sa 2026.

Ano ang magiging presyo ng MAJOR sa 2031?

Sa 2031, ang presyo ng MAJOR ay inaasahang tataas ng -4.00%. Sa pagtatapos ng 2031, ang presyo ng MAJOR ay inaasahang aabot sa $0.4153, na may pinagsama-samang ROI na +169.70%.

Major price history (USD)

The price of Major is -86.30% over the last year. The highest price of MAJORNEW in USD in the last year was $36.75 and the lowest price of MAJORNEW in USD in the last year was $0.1492.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+0.06%$0.1492$0.1977

7d-30.54%$0.1492$0.2869

30d-68.64%$0.1492$0.6418

90d-58.21%$0.1492$36.75

1y-86.30%$0.1492$36.75

All-time-82.52%$0.1492(2025-02-03, Ngayong araw )$36.75(2024-11-27, 69 araw ang nakalipas )

Major impormasyon sa merkado

Major's market cap history

Major holdings by concentration

Whales

Investors

Retail

Major addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Major na mga rating

Mga average na rating mula sa komunidad

4.2

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

MAJOR sa lokal na pera

1 MAJOR To MXN$3.941 MAJOR To GTQQ1.491 MAJOR To CLP$189.751 MAJOR To UGXSh707.761 MAJOR To HNLL4.91 MAJOR To ZARR3.621 MAJOR To TNDد.ت0.621 MAJOR To IQDع.د252.071 MAJOR To TWDNT$6.361 MAJOR To RSDдин.21.921 MAJOR To DOP$11.871 MAJOR To MYRRM0.861 MAJOR To GEL₾0.551 MAJOR To UYU$8.31 MAJOR To MADد.م.1.941 MAJOR To OMRر.ع.0.071 MAJOR To AZN₼0.331 MAJOR To KESSh24.831 MAJOR To SEKkr2.141 MAJOR To UAH₴8.05

- 1

- 2

- 3

- 4

- 5

Huling na-update 2025-02-03 21:56:08(UTC+0)

Paano Bumili ng Major(MAJOR)

Lumikha ng Iyong Libreng Bitget Account

Mag-sign up sa Bitget gamit ang iyong email address/mobile phone number at gumawa ng malakas na password para ma-secure ang iyong account.

Beripikahin ang iyong account

I-verify ang iyong pagkakakilanlan sa pamamagitan ng paglalagay ng iyong personal na impormasyon at pag-upload ng wastong photo ID.

Bumili ng Major (MAJOR)

Gumamit ng iba't ibang mga pagpipilian sa pagbabayad upang bumili ng Major sa Bitget. Ipapakita namin sa iyo kung paano.

I-trade ang MAJOR panghabang-buhay na hinaharap

Pagkatapos ng matagumpay na pag-sign up sa Bitget at bumili ng USDT o MAJOR na mga token, maaari kang magsimulang mag-trading ng mga derivatives, kabilang ang MAJOR futures at margin trading upang madagdagan ang iyong inccome.

Ang kasalukuyang presyo ng MAJOR ay $0.1925, na may 24h na pagbabago sa presyo ng +0.06%. Maaaring kumita ang mga trader sa pamamagitan ng alinman sa pagtagal o pagkukulang saMAJOR futures.

Sumali sa MAJOR copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Pagkatapos mag-sign up sa Bitget at matagumpay na bumili ng mga token ng USDT o MAJOR, maaari ka ring magsimula ng copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Major balita

Malapit nang ilunsad ang pangunahing tampok sa pagpapaupa ng NFT

Bitget•2024-12-11 02:56

![[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!](/price/_next/static/media/cover-placeholder.a3a73e93.svg)

[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!

Bitget Announcement•2024-11-14 13:40

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Major.

Ano ang kasalukuyang presyo ng Major?

The live price of Major is $0.19 per (MAJOR/USD) with a current market cap of $16,045,604.99 USD. Major's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Major's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Major?

Sa nakalipas na 24 na oras, ang dami ng trading ng Major ay $140.02M.

Ano ang all-time high ng Major?

Ang all-time high ng Major ay $36.75. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Major mula noong inilunsad ito.

Maaari ba akong bumili ng Major sa Bitget?

Oo, ang Major ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Major?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Major na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng Major (MAJOR)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Major online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Major, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Major. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

Pranjal65

10h

Hey everyone!

Let’s take a look at ADA and its price action today. ADA has broken below the ascending channel, signaling a potential bearish continuation. The price dropped under 0.7765 USDT, which previously acted as support. This breakdown suggests that selling pressure is increasing, and buyers need to step in to regain control.

If $ADA reclaims 0.7765 USDT, a push toward 0.95 - 1.00 USDT could be possible. A strong recovery above this level would indicate that bulls are still in the game and could drive the price higher. On the other hand, if the price fails to hold, a deeper correction may be in play. If rejection occurs around 0.7765 USDT, ADA could drop further, testing the 0.63 USDT zone. Below that, the 0.4836 USDT level aligns with Fibonacci retracement and could act as another key demand zone. If the bearish trend continues, ADA might even reach 0.2910 USDT, a historically significant support level.

Traders should be cautious around 0.7765 USDT, as it is a crucial resistance now. If ADA flips this level back to support, bullish momentum could return. Otherwise, a further decline is likely, with 0.63 USDT as the next major test. Watching price action closely at these levels will provide insight into ADA’s next move. Stay prepared and trade wisely!

HOLD0.00%

MOVE0.00%

john_austin

10h

Ethereum Drops to $2.5K: Should You Buy the Dip? 📊

February 3, 2025, at 9:30 AM, $ETH experienced a sharp 17.8% decline, bringing its price down to $2,556. This sudden drop has sparked discussions among investors about whether this is a buying opportunity or a sign of further decline.

Why Did Ethereum Drop?📊

Ethereum’s recent plunge can be attributed to a combination of macroeconomic factors, market sentiment, and technical corrections. Some key reasons include:

1. Market-Wide Correction: The broader cryptocurrency market, including Bitcoin, also saw significant losses, suggesting a general market correction rather than an Ethereum-specific issue.

2. Regulatory Concerns: Recent regulatory developments in major markets like the U.S. and Europe may have contributed to panic selling.

3. Liquidation of Leveraged Positions: The sharp drop could have triggered automatic liquidations of leveraged positions, accelerating the decline.

4. Macroeconomic Factors: Uncertainty in global financial markets, rising interest rates, and reduced liquidity could be putting pressure on risk assets, including Ethereum.

Will Ethereum Recover?📊

Historically, Ethereum has shown resilience after sharp declines, often bouncing back stronger. Several factors suggest a potential recovery:

• Strong Fundamentals: Ethereum remains the leading smart contract platform, with growing adoption in decentralized finance (DeFi) and NFTs.

• Key Support Levels: Technical analysts are watching crucial support levels around $2,400 and $2,200. A bounce from these levels could confirm a price floor.

• Upcoming Upgrades: Ethereum’s continuous upgrades, such as improvements to scalability and security, could restore investor confidence.

Should You Buy the Dip?📊

Buying the dip can be a profitable strategy, but it comes with risks. Here are some key considerations:

Reasons to Buy:📊

✔ Ethereum is fundamentally strong and widely adopted.

✔ Previous dips have often led to significant price rebounds.

✔ Long-term investors may see this as an entry opportunity at a discount.

Reasons to Wait:📊

❌ Prices could fall further before stabilizing.

❌ Regulatory uncertainty could impact Ethereum’s future growth.

❌ The broader market trend remains bearish in the short term.

✅Ethereum’s sharp drop to $2,500 presents a potential buying opportunity, but caution is advised. Investors should assess their risk tolerance, consider market conditions, and avoid making impulsive decisions. If you believe in Ethereum’s long-term growth, this dip might be an attractive entry point, but it’s crucial to stay updated on market trends and manage risks effectively

ETH0.00%

BITCOIN0.00%

CCN

11h

🚨 Major crypto shakeout! Trump's new trade tariffs triggered a $400B market cap loss and $2.2B in liquidations. 📊

MAJOR0.00%

S0.00%

AceVod

13h

Crypto Market in Turmoil: $2.24 Billion Liquidated as Trump’s Tariffs Spark Panic

The cryptocurrency market has experienced a dramatic shake-up, with over $2.24 billion in liquidations occurring within just 24 hours. This massive event affected more than 730,000 traders, marking one of the most significant liquidation events in recent months. The turbulence was triggered by a combination of factors, including market speculation, overleveraged trading positions, and heightened geopolitical tensions following former U.S. President Donald Trump’s announcement of new tariffs on China, Canada, and Mexico.

Massive Liquidations: A Breakdown

-----------------------------------

According to data from leading market analytics platforms, Ether (ETH) was the hardest hit, with liquidations surpassing $609.9 million from both long and short positions. This highlights Ethereum's high volatility, even as it remains the second-largest cryptocurrency by market capitalization.

Exchanges played a critical role in this liquidation wave. Binance, the world’s largest cryptocurrency exchange, led the liquidation tally, accounting for 36.8% of the total due to its extensive user base and high leverage offerings. Other exchanges, including OKX, Bybit, Gate.io, and HTX, also recorded massive liquidation volumes.

One of the key trends observed was the overwhelming dominance of long position liquidations, which made up $1.88 billion (84%) of the total liquidations. This suggests that a large number of traders were betting on further price increases, only to be caught off guard by the market downturn.

Bitcoin and Ethereum Hit Hard

-----------------------------------

The market-wide sell-off saw Bitcoin ( $BTC ) plummet to a three-week low, trading at around $94,476.18 at its lowest point. This drop was particularly notable as Bitcoin had recently been on a strong upward trend.

Meanwhile, Ethereum ( $ETH ) experienced an even more dramatic decline, falling by 24% to $2,494.33. The sharp drop in ETH prices led to cascading liquidations, forcing many leveraged traders out of their positions.

Other altcoins also suffered significant losses, with many experiencing double-digit percentage declines within hours.

The Trump Tariff Effect on Crypto

-----------------------------------

While technical market factors played a role, a major catalyst for the crash was Donald Trump's announcement of new tariffs on imports from China, Canada, and Mexico.

Historically, increased tariffs and trade tensions have had a negative impact on risk assets, including cryptocurrencies. Investors tend to move away from speculative assets like Bitcoin and Ethereum during times of geopolitical uncertainty, opting instead for safe-haven assets such as gold and the U.S. dollar.

This latest tariff announcement comes at a time when the global economy is already facing inflationary pressures and recession fears. The impact of the tariffs could further strain international trade relationships, adding another layer of uncertainty to financial markets.

Comparisons to Previous Market Crashes

-----------------------------------

The scale of this liquidation event has drawn comparisons to past crypto market crashes, including:

1. The FTX Collapse (November 2022) – When FTX, one of the largest crypto exchanges, went bankrupt, the market saw billions in liquidations as investors panicked.

2. The COVID-19 Crash (March 2020) – During the early days of the pandemic, the crypto market saw a massive drop, with Bitcoin losing over 50% of its value in a matter of days.

3. China’s Crypto Ban (2021) – When China officially banned cryptocurrency trading, the market experienced a major downturn, with billions in liquidations.

Each of these events led to significant losses, but they also paved the way for future recoveries. The question now is whether the market will quickly rebound from this latest downturn or if further declines are ahead.

Investor Sentiment: Fear Dominates

-----------------------------------

Investor sentiment has shifted sharply towards fear, as indicated by the Crypto Fear & Greed Index, which has dropped significantly. In times of extreme fear, many traders become hesitant to enter the market, leading to lower trading volumes and increased volatility.

However, some experienced investors view extreme fear as a potential buying opportunity. Historically, bear markets have provided smart investors with chances to accumulate assets at discounted prices before the next bull run.

What’s Next for the Crypto Market?

-----------------------------------

1. Short-Term Volatility Expected – Given the magnitude of the liquidations, the market is likely to remain volatile in the coming days. Traders should expect sharp price movements as investors react to macroeconomic news.

2. Potential for a Recovery – If historical trends hold, the market could stabilize and even rebound as investors regain confidence.

3. Regulatory Concerns – Governments worldwide are watching the crypto space closely, and events like this may lead to increased discussions about stricter regulations for leveraged trading.

For now, traders and investors should exercise caution, manage their risk exposure wisely, and stay informed about global economic developments that could impact the market further.

Conclusion

-----------------------------------

The recent $2.24 billion liquidation event has shaken the cryptocurrency market, serving as a harsh reminder of the risks associated with leveraged trading and speculative investments. With Bitcoin and Ethereum suffering major losses, and geopolitical tensions adding to uncertainty, the market remains in a highly unpredictable state.

Whether this marks the beginning of a prolonged downtrend or a temporary shakeout remains to be seen. However, one thing is certain: volatility in the crypto market is here to stay.

HTX0.00%

BTC0.00%

Jack*Liam

13h

This is a timely and relevant observation about the Bitcoin market. Here's a breakdown of what you've pointed out and some additional context:

Key Points:

* BTC Price Dip: Bitcoin has indeed experienced a dip below the $100,000 mark. This highlights the volatility inherent in the cryptocurrency market.

* US Tariffs and Uncertainty: You correctly link this price movement to new U.S. tariffs. Trade policies and economic factors can create uncertainty in global markets, and Bitcoin, like other assets, can be affected by this.

* Technical Indicators and Volatility: Technical analysis often points to short-term volatility in such situations. Traders and analysts use various indicators to try and predict price movements, but these are not always accurate.

* Institutional Interest: Despite the dip, it's important to note that institutional interest in Bitcoin remains strong. This suggests that larger players are still accumulating Bitcoin, which can be a positive sign for long-term price potential.

* US Bitcoin Reserve Speculation: The ongoing speculation about a potential US Bitcoin Reserve is a significant factor. If the US were to hold Bitcoin as part of its reserves, it could lend further legitimacy to the cryptocurrency and potentially drive demand.

Additional Context:

* Market Sentiment: Overall market sentiment plays a crucial role in Bitcoin's price. News, regulatory developments, and even social media trends can influence investor behavior.

* Regulation: The regulatory landscape for cryptocurrencies is still evolving. Any major regulatory changes in key jurisdictions can have a significant impact on Bitcoin's price.

* Adoption: The increasing adoption of Bitcoin by businesses and individuals is a key driver of its long-term value. As more people use Bitcoin for transactions and as a store of value, demand could continue to grow.

Looking Ahead:

It's important to remember that the cryptocurrency market is highly dynamic. While Bitcoin has shown significant growth potential, it's also subject to significant price swings. Investors should carefully consider their risk tolerance and conduct thorough research before making any investment decisions.

Disclaimer: I am an AI chatbot and cannot provide financial advice.

SOCIAL0.00%

LINK0.00%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Major sa market cap.