- Bitget

- Research

- Daily Research Report

- Bitget Research: Notcoin Trading Volume Surpasses $4.6 Billion, Ton Ecosystem Memecoins Surge

Bitget Research: Notcoin Trading Volume Surpasses $4.6 Billion, Ton Ecosystem Memecoins Surge

Tommy & Jarseed

2024/06/03

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

Bitcoin's trend was relatively flat over the weekend, staying within the $67,000 to $69,000 range. Meanwhile,

memecoins on the Ton chain saw an increase of over 50%.

-

Sectors with strong wealth creation effect: TON ecosystem memecoins, and GameFi sector.

-

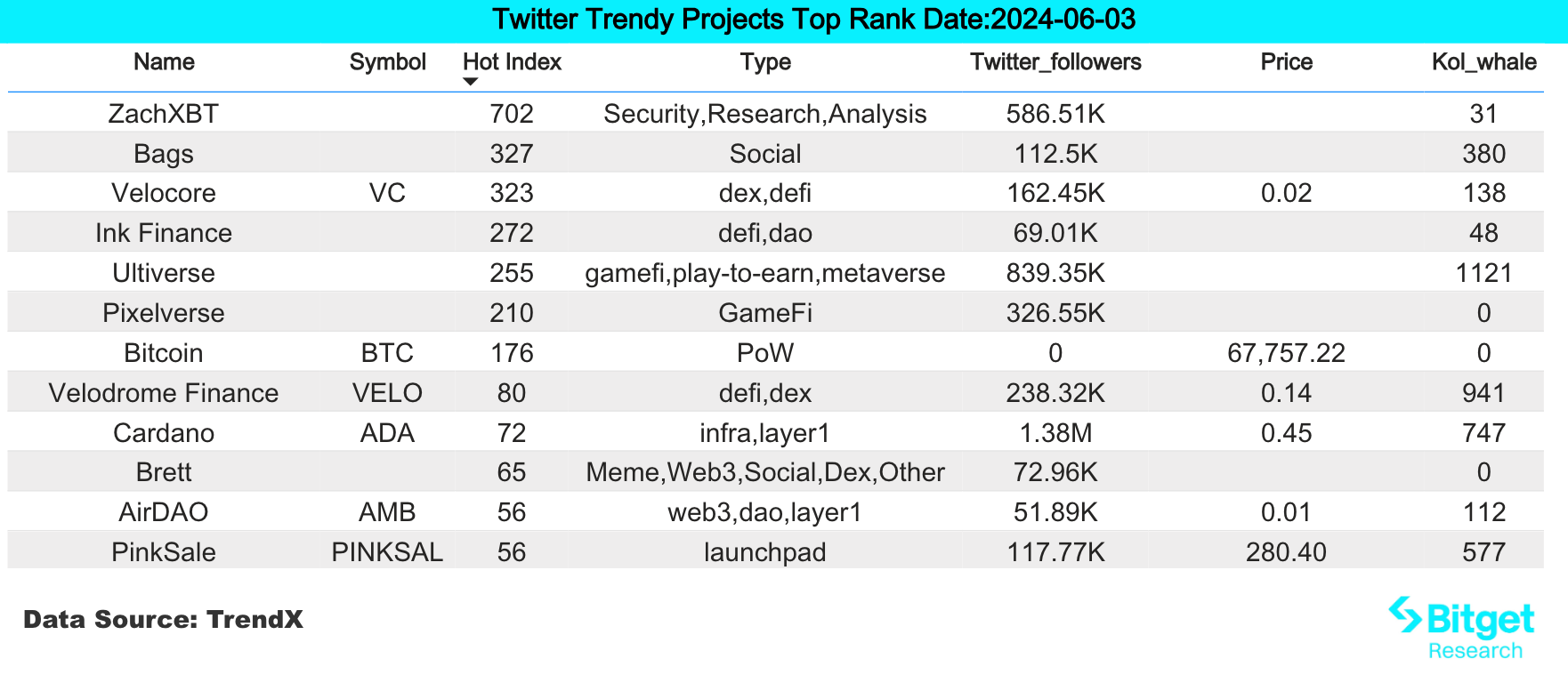

Top searched tokens and topics: MON Protocol, Ultiverse, NOT, and Monad.

-

Potential airdrop opportunities: Tonstakers and MYX Finance.

Data collection time: June 3, 2024, 4:00 AM (UTC)

1. Market Environment

Bitcoin's trend was relatively flat over the weekend, staying within the $67,000 to $69,000 range. However, with the rise of Notcoin, memecoins such as FISH, REDO, and ANON on the Ton chain surged by over 50%. Concurrently, various risk assets began to decline, including U.S. stocks. Although the Nasdaq index is still near its historical high, it fell by about 2% this week, and the SP 500 index dropped by about 1.5%.

U.S. economic data continues to show signs of stagflation, with the April core PCE price index rising by 2.8% year-on-year, matching expectations and maintaining last month's rate. The Chicago PMI for May fell to 35.4, below the expected 41 and April's 37.9, marking drops only seen during the severe global financial crisis of 2008-2009 and the COVID-19 lockdowns in March/April 2020.

2. Wealth Creation Sectors

2.1 Sector Movements – Ton Ecosystem Memecoins (FISH and REDO)

Primary reason: NOT reached a new high after breaking $0.029, then dropped to $0.024112. With a 24-hour trading volume of $4.646 billion, NOT ranks fourth in trading volume, just behind Bitcoin,

Ethereum, and

USDT. Influenced by NOT, all memecoins in the Ton ecosystem rose.

Gainers: FISH increased by 155.13% today, and REDO by 71.68%.

Factors affecting future market conditions:

-

Future trading activity: Currently, a major shortcoming in the Ton ecosystem is the relatively fewer active traders compared to other chains, which results in significantly lower trading volumes. If trading volumes continue to rise due to NOT's influence, the wealth effect could become more pronounced.

-

Future support from Pantera for the Ton ecosystem: Dan Morehead, founder of Pantera Capital, mentioned on social media that Pantera recently made its largest investment in the Telegram TON blockchain project, increasing attention to the Ton ecosystem. If project financing and product launches can be implemented promptly, the prosperity of the Ton ecosystem could arrive sooner.

2.2 Sector Movements – GameFi Sector (NYAN and ALICE)

Primary reason: A game publishing and AI platform Ultiverse announced on X that the TGE for ULTI token is imminent, allowing users to claim an airdrop and announcing its upcoming listing on OKX. Ultiverse's token launch triggered a new wave of interest in blockchain gaming.

Gainers: NYAN increased by 61.92% this month, and ALICE by 60.56%.

Factors affecting future market conditions:

-

Last week saw a total of 22 funding rounds, slightly down from the previous week, with a total amount of approximately $794.48 million and an average funding amount of $28.7036 million. The majority of financing occurred in other sectors, with significant investments in asset management payments, DeFi, and infrastructure. An increase in funding for the Metaverse/GameFi sectors could continue to support the popularity of GameFi.

-

Guild development and user growth: Over time, some blockchain gaming guilds have developed unique business models, offering services such as leasing blockchain game NFT assets, training in gaming skills, and spreading knowledge about blockchain transactions. The expansion of guild business models and user base contributes to the increased activity in blockchain gaming.

2.3 Sectors to Focus on Next — Bitcoin L2 Chains

Primary reason: As Bitcoin prices stabilize, there is renewed interest in the Inscription and Rune segments. BounceBit has seen a rise of over 50% in the past two weeks, with Bitcoin Layer 2 chains performing well amid sector rotations.

Specific tokens:

-

CKB: A Bitcoin Layer 2 project based on the RGB++ scaling protocol, CKB has stayed true to its original vision as a Layer 2 solution. It adopts isomorphic binding with Bitcoin and further improves the Bitcoin ecosystem.

-

BB: BounceBit is a BTC restaking chain. BB has a maximum supply of 2.1 billion, with an initial circulation of 409.5 million, and is a project with investments from Binance Lab. Binance will list BB after the Megadrop is completed.

-

MERL: A Layer 2 project based on the Bitcoin network. Merlin Chain's on-chain TVL has reached $3.1 billion, the highest TVL among Bitcoin Layer 2 projects.

3. Top Searches

3.1 Popular DApps

MON Protocol

MON Protocol is a pioneer developer and publisher of blockchain-native IPs and games. Its mission is to democratize gaming and enhance community engagement. MON Protocol has launched Pixelmon Games, an immersive experience that has attracted over one million Web3-savvy gamers and fans.

MON is the native token of Mon Protocol, unlocking limitless possibilities within the gaming ecosystem. As the preferred currency for all Pixelmon games, MON facilitates in-game transactions and rewards for players and tournament participants. Additionally, MON holders benefit from a decentralized IP licensing process, community airdrops, and governance over the IP and ecosystem funds.

With Mon Protocol leading in launching blockchain-native IPs and major gaming initiatives, Bitget has also listed the MON token, allowing investors to trade MON on Bitget.

3.2 X (former Twitter)

Ultiverse

Ultiverse is dedicated to creating an AI-powered gaming world on Web3 that merges AAA-quality immersive VR with the decentralized Web3 environment, utilizing cutting-edge AI technology and DApps. This initiative aims to forge a diverse and inclusive user community.

Ultiverse has raised over $20 million through three rounds of funding. Prominent participants in the first two rounds include institutions such as Binance Labs, Sequoia Capital, Foresight Ventures, and Defiance Capital.

Ultiverse is now available on the Bitget

Pre-Market, where users can submit trades for Ultiverse's token, ULTI.

3.3 Google Search (Global and Regional)

Global focus:

Notcoin (NOT) – Notcoin is a game based on Telegram where users can earn in-game tokens by clicking on coin images, similar to the "Tap to Earn" concept. The NOT token continued to break new highs this week, with a peak increase of approximately 503% in the past week.

Regional focus:

(1) In Asia, there is a widespread interest in highly traded cryptocurrencies and sectors such as Bitcoin, real-world asset (RWA) tokens, AI-related technologies, and memecoins. This trend shows that users in the Asian

markets are keenly focused on hotspots, actively pursuing popular tokens and sectors.

(2) Attention in

Europe and the USA is centered on

blockchains and applications that have high levels of discussion. Searches reveal a keen interest in platforms like Monad, ICP, TON, FTM, and SUI, indicating that English-speaking regions are more focused on opportunities related to blockchains and ecosystem-level developments.

4. Potential Airdrop Opportunities

Tonstakers

Tonstakers is the largest liquid staking service provider in the TON ecosystem. Users can stake their TON in the protocol to earn a 3.8% APY. The project currently boasts a TVL of $240 million, indicating a high potential valuation.

It has garnered attention from the Ton Foundation and currently has 68,000 stakers. Tonstakers collaborates with Ton's core developers, Tonkeeper, and OKX, which supports its potential for future token issuance.

How to participate: 1. Visit the project's official website and select

Stake Now; 2. Connect your Ton wallet to stake.

MYX Finance

MYX Finance is a decentralized derivatives exchange operating on an MPM model, incubated by D11 Labs. It uses smart rates and risk hedging mechanisms to ensure protocol stability and sustain high returns.

In November 2023, MYX announced the completion of a $5 million seed round funding at a $50 million valuation, led by HongShan (formerly Sequoia China), with participation from Consensys, Hack VC, OKX Ventures, Foresight Ventures, Redpoint China, HashKey Capital, GSR Markets, Alti5, Leland Ventures, Cypher Capital, Bing Ventures, Lecca Ventures, among others.

How to participate: On the user level, MYX Finance is similar to other derivative DEXs. Users can trade, provide liquidity, etc. Currently integrated with Linea and Arbitrum, increasing activity on the Linea chain may also lead to future Linea airdrops.