News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 30) | Trump Media&Technology Group Plans to Launch Truth Social Utility Token, US SEC Delays Approval of Several Cryptocurrency ETFs2SEC Delays Spot XRP ETF Decision Until June 173Solana Surpasses 400 Billion Transactions as SOL Tests Key Support

Urgent Warning: Why Firing Fed Chair Jerome Powell Could Trigger Financial Instability

BitcoinWorld·2025/04/19 18:00

Injective (INJ) Rebound in Sight? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe·2025/04/19 16:33

Solana (SOL) Gains Momentum With Key Breakout — Is Render (RENDER) Gearing Up For A Similar Move?

CoinsProbe·2025/04/19 16:33

Bittensor (TAO) Mirrors Past Bullish Breakout Setup — Minor Pullback Before Major Liftoff?

CoinsProbe·2025/04/19 16:33

Hyperliquid (HYPE) Leads the Way – Is Jupiter (JUP) Set to Follow the Same Fractal Path?

CoinsProbe·2025/04/19 16:33

Is Avalanche (AVAX) Poised for an Upside Move? This Solana (SOL) Fractal Says It Is!

CoinsProbe·2025/04/19 16:33

Kaspa (KAS) and Bittensor (TAO) at Decision Points – Will They Break Out?

CoinsProbe·2025/04/19 16:33

Vitalik Buterin Suggests RISC-V Architecture to Enhance Ethereum’s Scalability and Competitiveness

Coinotag·2025/04/19 16:00

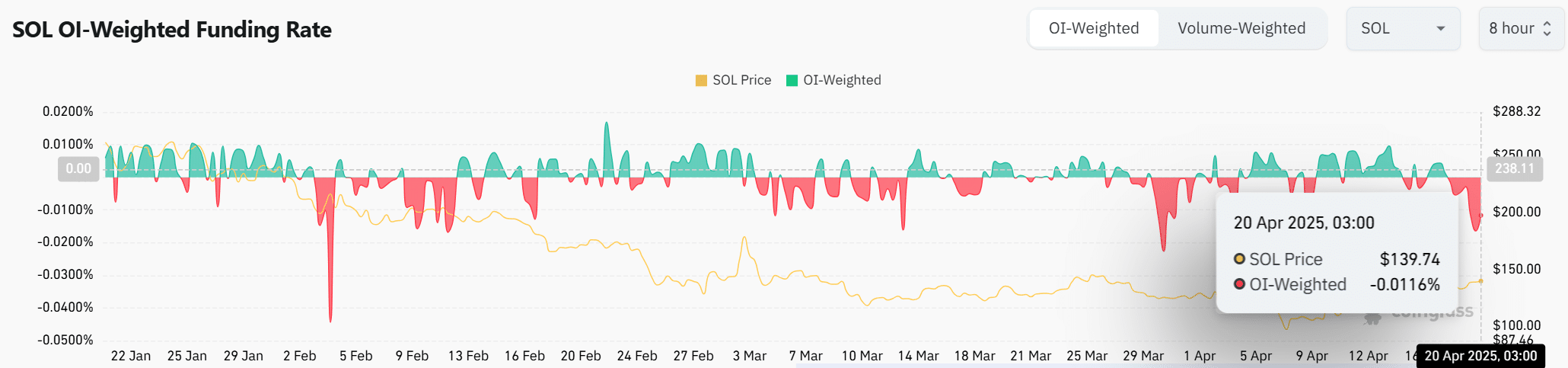

Could Solana’s Whale Accumulation and DeFi Growth Signal a Potential Breakout Above $144?

Coinotag·2025/04/19 16:00

Flash

- 08:44Data: Yua Mikami Meme $MIKAMI Fundraising Reaches 14,354 SOL, Over $2.1 MillionAccording to ai_9684xtpa, the Yua Mikami Meme coin MIKAMI has raised 14,354 SOL, valued at over $2.1 million. The fundraising highlights so far are summarized as follows: A total of 10,461 addresses participated, with an average contribution of 1.35 SOL ($200) per address; 94.4% of the addresses contributed less than 1 SOL, while only 0.1% of the addresses contributed more than 100 SOL, accounting for 17.8% of the total funds; The current TOP1 address EH7ZU...3Pkvh contributed 574 SOL ($84,000), with a 7D win rate of 33%, nearly investing the entire account balance.

- 08:35ALPACA Liquidations Exceed $50 Million in 24 Hours, Surpassing BTC and Ranking FirstAccording to Coinglass data, ALPACA token liquidations in the past 24 hours exceeded $50 million, mainly in short positions, with 24-hour liquidations totaling $50.187 million, surpassing BTC ($43.475 million).

- 08:29Data: The trading volume of Hong Kong virtual asset ETFs is approximately HKD 11.0516 million todayAccording to Hong Kong stock market data, as of the close, the trading volume of all Hong Kong virtual asset ETFs was approximately HKD 11.0516 million. Among them: CSOP Bitcoin ETF (3042.HK/9042.HK/83042.HK) had a trading volume of HKD 2.219 million, and CSOP Ether ETF (03046.HK/09046.HK/83046.HK) had a trading volume of HKD 327,100; Hua An Bitcoin ETF (03439.HK/09439.HK) had a trading volume of HKD 821,200, and Hua An Ether ETF (03179.HK/09179.HK) had a trading volume of HKD 253,100; Bosera Bitcoin ETF (03008.HK/09008.HK) had a trading volume of HKD 1.2302 million, and Bosera Ether ETF (03009.HK/09009.HK) had a trading volume of HKD 6.2009 million. Note: All the above virtual asset ETFs have HKD and USD counters, with only the two CSOP ETFs having an additional RMB counter.