News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 8) | Tariff headlines spark major market swings; Strategy did not increase BTC holdings last week2XRP Bounces from Key Support – But Familiar Fractal Raises Bearish Concerns3Cardano Developer Donates $460K in ADA to Cardano Treasury Despite Market Dip

Is Ethereum (ETH) on the Verge of a Price Correction?

Newscrypto·2024/07/01 15:55

Solution: FatBoy Brings Fun to the Crypto Ecosystem

Cryptodaily·2024/07/01 14:37

German and US governments move millions in Bitcoin and Ethereum

Cryptopolitan·2024/07/01 14:16

Crypto Market Undervalued Despite Bitcoin’s $63K Surge, Says Analyst

Coinedition·2024/07/01 13:25

Inside the Fetch.ai AI Token Merger: A Two-Phase Process with Coinbase Caveat

Coinedition·2024/07/01 13:25

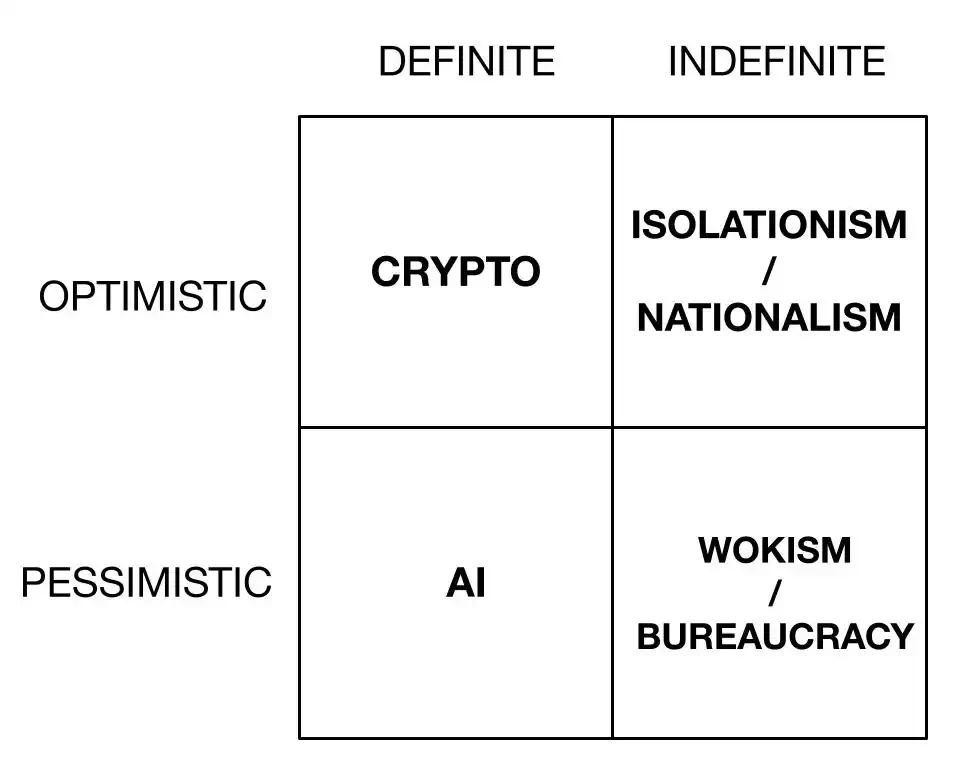

Why can we still trust cryptocurrencies?

Odaily·2024/07/01 13:11

Could Bitcoin hit $73,000 in July? AMBCrypto's June report explores possibilities

Cryptodaily·2024/07/01 09:19

Was sub-$60K a bear trap? 5 things to know in Bitcoin this week

Cointelegraph·2024/07/01 09:01

Bitcoin Weekend Trading Volumes Hit Record Low in 2024

DailyCoin·2024/07/01 08:55

Vitalik's new article: How to shorten Ethereum's transaction confirmation time?

BlockBeats·2024/07/01 08:16

Flash

- 19:59BTC falls below $77,000, down 1.93% intradayOn April 9, the market shows that BTC has just fallen below $77,000 and is now at $76,979.90 per coin, down 1.93% intraday.

- 19:58U.S. Two and Ten Year Treasury Yield Curve Spread Widens to 48 Basis PointsGold Finance reports that the spread between the U.S. two and ten year Treasury yield curves widened to 48 basis points, the steepest level since May 2022....

- 19:56SEC Objects to ‘Urgent Motion for Dispositive Evidence’The SEC just filed an objection to an ‘Urgent Motion for Dispositive Evidence’ filed by Justin W. Keener on April 4, and the objection is in favour of Ripple. The SEC opposed the motion because they stated that: 1) the district court did not have jurisdiction over the request because the case had been moved to the Second Circuit; 2) Keener had not filed a proper motion to intervene; and 3) it was not necessary because, as SEC attorneys pointed out, Ripple was sufficiently competent to determine on its own the issues involved. "For these reasons, the SEC requests that Judge Torres deny the motion in its entirety.