News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Recently, as market liquidity recovers, the crypto market—led by key assets like BTC and ETH—has started to rebound. Leading DeFi assets have continued to update their products amid six months of market volatility, maintaining their market dominance and leading positions. With the upcoming U.S. presidential election, both candidates are likely to propose favorable policies regarding DeFi and Web3 applications, potentially bolstering the sector. As a result, leading DeFi assets are expected to benefit from an early boost in liquidity recovery and may outperform the broader market in the coming months.

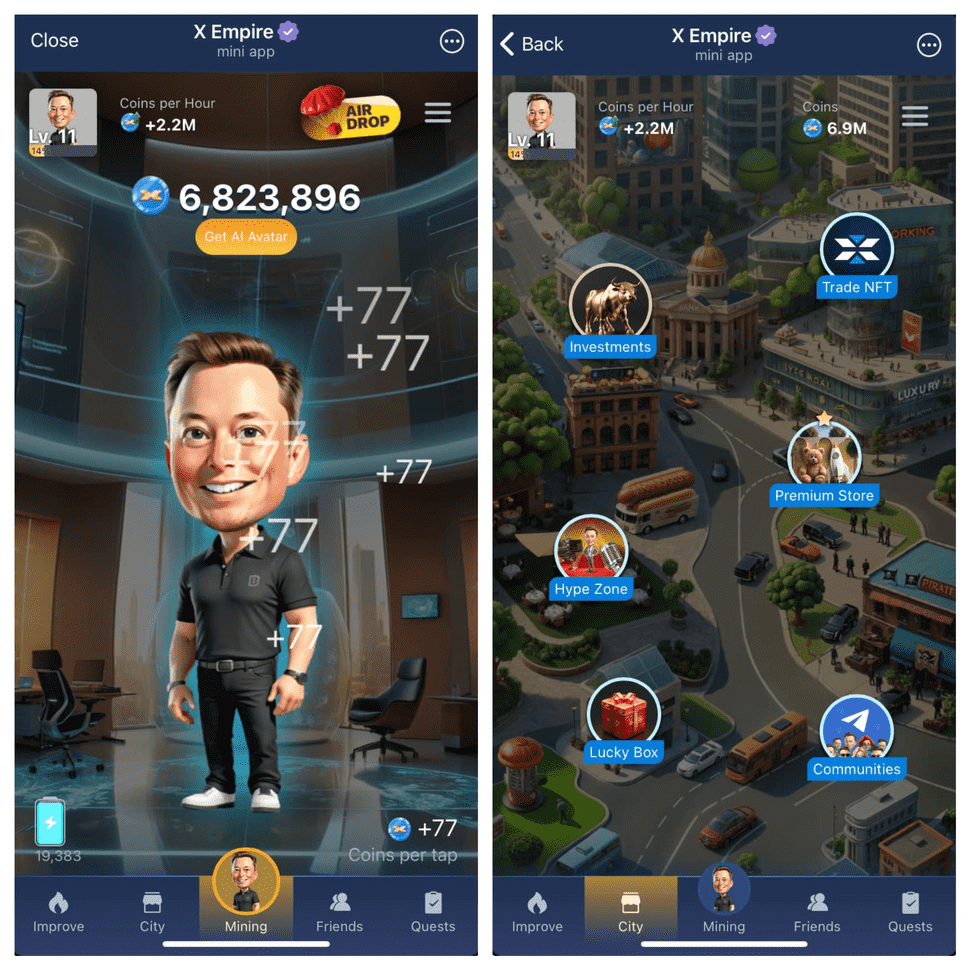

The countdown is on—X Empire is about to make serious waves! In just a few days, the X token airdrop and listing will drop on October 24, 2024, and this is your chance to be part of something HUGE. Whether you’ve been playing along or are ready to jump in, the excitement is real, and this airdrop could be your gateway to the next big thing in crypto. With the token listing on major exchanges, it's time to get ready for a game-changing moment. In this guide, we’ll cover how you can participate in the airdrop, key features, and how to link your TON wallet. It’s fast, it’s exciting, and it’s happening soon—are you ready to join the empire? Let’s dive in!

Just 2 days left until the end of the Chill Phase! Prepare for the X Empire Investment Fund on October 15-16, 2024, to decide which cards we should invest in. Make sure you join in on the excitement and bonuses—time is running out!

- 19:11Trump: will respond to EU counter tariffsUS President Donald Trump says he will respond to the EU's counter tariffs.

- 19:09Institutions: Inflation data doesn't seem to leave room for Fed rate cutsInflation data does not signal a rate cut to the Federal Reserve, writes Steven Blitz, chief U.S. economist at TS Lombard. Although the CPI fell from 3 per cent to 2.8 per cent in February, ‘there are enough anomalies in the data to cast doubt on any attempts to view it as a trend.’ Blitz said commodity prices excluding food and energy grew at a seasonally adjusted annual rate of 2.7% in February, an improvement from 3.5% in January, but still volatile. He said this was ‘the category where the impact of tariffs was most pronounced in the first round.’ Eventually, employment will continue to rise, and so will inflation.

- 18:59Spot gold hits $2940/oz upwards, up 0.82% on the daySpot gold touched $2940 per ounce upwards, up 0.82% on the day.