Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

FTX Users' Debt priceFUD

How do you feel about FTX Users' Debt today?

Price of FTX Users' Debt today

What is the highest price of FUD?

What is the lowest price of FUD?

FTX Users' Debt price prediction

What will the price of FUD be in 2026?

What will the price of FUD be in 2031?

FTX Users' Debt price history (USD)

Lowest price

Lowest price Highest price

Highest price

FTX Users' Debt market information

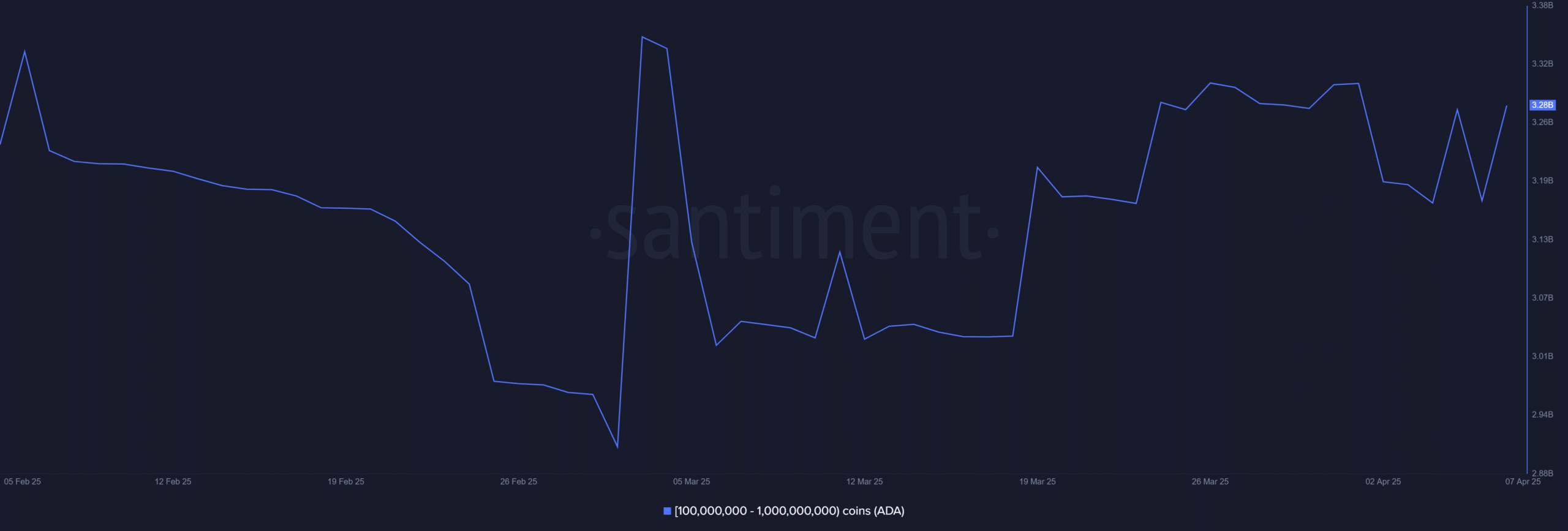

FTX Users' Debt holdings by concentration

FTX Users' Debt addresses by time held

FTX Users' Debt ratings

About FTX Users' Debt (FUD)

The Historical Significance and Key Features of Cryptocurrencies

Cryptocurrencies have revolutionized the financial world and have created a new monetary paradigm that is digital, decentralized, and borderless. This article aims to highlight their historical significance and key features.

Historical Significance of Cryptocurrencies

Cryptocurrencies, especially the pioneering Bitcoin, emerged in the aftermath of the 2008 financial crisis. An individual, or a group of individuals, under the pseudonym Satoshi Nakamoto, designed Bitcoin as a response to the perceived failure of central banks and traditional banking systems. It was a slap on the face of modern monetary theory, proposing a shift from trust-based, centrally administered systems to a trustless and decentralized system.

Since Bitcoin's introduction, the cryptocurrency market has rapidly expanded. Many alternative cryptocurrencies (altcoins) entered the market, with each bearing its unique features. Cryptocurrencies have been adopted for extensive online transactions, investment ventures, and even as a means to fundraise for projects (Initial Coin Offerings). They have slowly permeated traditional financial systems, highlighting their historical significance. For instance, consider BGB, an anonymous, safe, and fast transaction-enabling cryptocurrency that has gained popularity over the years.

Key Features of Cryptocurrencies

- Decentralization

Cryptocurrencies are decentralized, implying they are not controlled by any central authority like a government or financial institution. Instead, cryptocurrencies are managed through distributed ledger technologies, such as blockchain.

- Anonymity Privacy

Cryptocurrency transactions offer a high level of anonymity and privacy. While all transactions are visible in the blockchain, identities are masked, promoting privacy.

- Transparency

Simultaneously offering anonymity and transparency might seem contradictory, but such is the profoundness of cryptocurrencies. Every cryptocurrency transaction is logged onto the blockchain, making it publicly visible and hard to alter, promoting transparency.

- Security

Cryptocurrencies are considered secure due to the cryptographic technology they utilize. This makes them immune to counterfeiting and fraud, which is frequently associated with traditional banking systems.

- Speed and Accessibility

Cryptocurrency transactions are rapid and can be made anytime, anywhere, as long as there is internet access.

- Inflation Resistant

Most cryptocurrencies, like Bitcoin and BGB, have a cap on the total number of coins that can exist. This helps in reducing the problem of inflation that plagues traditional fiat currencies.

Conclusion

The rise of cryptocurrencies marks a significant shift in our conception and handling of money. These digital assets have inherent features like decentralization, privacy, transparency, security, speed, and inflation resistance that make them a fascinating alternative to traditional monetary systems. Although they face challenges like regulatory scrutiny and market volatility, the historical significance of cryptocurrencies cannot be overlooked as innovation in the finance arena and emancipation from traditional banking systems continues to unfold.

FUD to local currency

- 1

- 2

- 3

- 4

- 5

FTX Users' Debt news

Experts say that this represents the faith that Ethereum has built over the past five years, which has now reset at the market level.

Ethereum returns to a key support zone amid market correction, suggesting a potential undervaluation opportunity.Correction and Fear Fuel OpportunityWhat This Could Mean Going Forward

New listings on Bitget

Buy more

FAQ

What is the current price of FTX Users' Debt?

What is the 24 hour trading volume of FTX Users' Debt?

What is the all-time high of FTX Users' Debt?

Can I buy FTX Users' Debt on Bitget?

Can I get a steady income from investing in FTX Users' Debt?

Where can I buy FTX Users' Debt with the lowest fee?

Where can I buy crypto?

Video section — quick verification, quick trading

FUD resources

Bitget Insights

Related assets