Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Bancor priceBNT

How do you feel about Bancor today?

Price of Bancor today

What is the highest price of BNT?

What is the lowest price of BNT?

Bancor price prediction

When is a good time to buy BNT? Should I buy or sell BNT now?

What will the price of BNT be in 2026?

What will the price of BNT be in 2031?

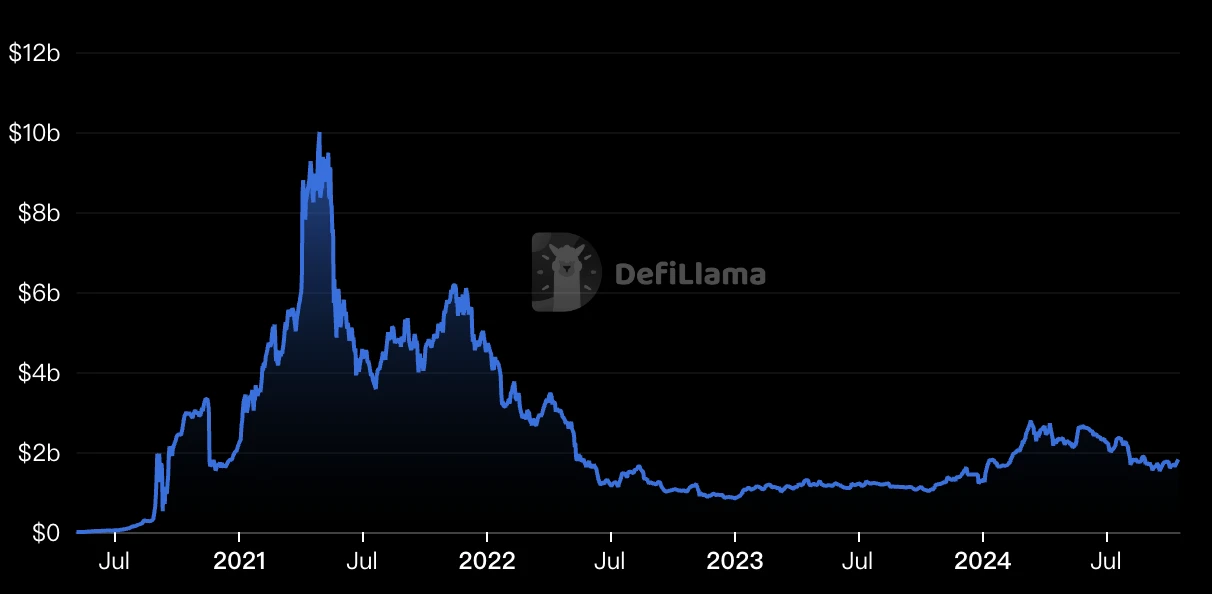

Bancor price history (USD)

Lowest price

Lowest price Highest price

Highest price

Bancor market information

Bancor market

Bancor holdings

Bancor holdings distribution matrix

Bancor holdings by concentration

Bancor addresses by time held

Bancor ratings

About Bancor (BNT)

What Is Bancor?

Bancor is a decentralized protocol offering an automated, on-chain liquidity mechanism that facilitates seamless token exchanges without the need for traditional cryptocurrency exchanges. Launched in 2017 by Eyal Hertzog, Galia Benartzi, and Guy Benartzi, Bancor introduced the concept of a network for liquidity that transcends the limitations of order-book-based exchanges. Named in tribute to John Maynard Keynes's proposed international reserve currency, Bancor has become synonymous with innovation in the blockchain space.

The Bancor network operates on the principle of providing liquidity for a multitude of tokens, especially targeting those with smaller market caps. By utilizing smart contract technology, Bancor enables users to convert various ERC-20 compatible tokens with reduced friction and lower fees. This not only enhances the liquidity of less liquid tokens but also offers a decentralized alternative to the market-making process typically controlled by centralized financial institutions.

Resources

Whitepaper: https://resources.carbondefi.xyz/pages/CarbonWhitepaper.pdf

Official Website: https://bancor.network/

How Does Bancor Work?

At the heart of Bancor's functionality are its liquidity pools, which are smart contracts containing reserves of different cryptocurrencies. When a user wishes to exchange tokens, the Bancor protocol calculates the value and facilitates the trade directly within the pool, using its native Bancor Network Token (BNT) as an intermediary. This innovative approach eliminates the need for a counterparty, providing continuous liquidity regardless of trade volume or order book depth.

Bancor's unique point lies in its protection against impermanent loss, a common risk in liquidity provision where providers may lose value if the price of pooled assets diverges. Bancor's solution allows liquidity providers to deposit a single asset while maintaining exposure only to that asset, a feature not commonly found in other decentralized exchanges (DEXs). This single-sided liquidity provision, coupled with the protocol's impermanent loss protection, positions Bancor as a user-friendly platform for both novice and experienced liquidity providers.

Further distinguishing itself, Bancor has introduced features like single-sided exposure and liquidity mining rewards, making it an attractive platform for a wide range of users. With the advent of Bancor V3 and beyond, the protocol continues to innovate, offering instant impermanent loss protection and dual-sided rewards, enhancing the overall DeFi experience.

What Is BNT Token?

BNT is the native token of the Bancor ecosystem. Available on Ethereum, Solana, and Gnosis Chain, BNT serves multiple purposes within the network. It acts as the default reserve currency for all tokens in the Bancor system, facilitating trades and ensuring liquidity. Users can stake BNT in various liquidity pools to earn a share of transaction fees and rewards, with the added benefit of participating in the governance of the Bancor protocol.

BNT's utility extends beyond just facilitating trades; it's integral to the protocol's features, like single-sided deposits and impermanent loss protection. By staking BNT, users can earn higher rewards compared to other tokens, incentivizing participation and investment in the Bancor network. As the protocol evolves and the demand for decentralized liquidity solutions grows, BNT's role as a key player in the DeFi space is likely to expand, potentially increasing its value and significance within the blockchain ecosystem.

What Determines Bancor's Price?

The price of Bancor (BNT), like any cryptocurrency, is influenced by a complex interplay of factors, chief among them being supply and demand dynamics within the market. Demand for BNT is driven by its utility within the Bancor network as the default reserve currency for tokens and as a staking token for earning transaction fees and governance rights. As more users engage with the platform to provide liquidity or to execute trades, the demand for BNT increases, which can positively impact its price. Conversely, if the platform experiences a decrease in user activity or faces competition from other DeFi protocols, this could lead to reduced demand and a potential decrease in BNT's price.

Market sentiment also plays a crucial role in determining the price of BNT. News about protocol upgrades, partnerships, or broader sector trends can lead to speculative trading where investors buy or sell BNT based on their expectations for the future. For instance, announcements about new features that mitigate risks, such as impermanent loss protection, can generate positive sentiment and attract more liquidity providers to the platform, thereby increasing the token's value. On the other hand, negative news or security concerns can lead to a loss of confidence and a subsequent drop in price.

Furthermore, the overall liquidity of BNT across exchanges and its integration into other blockchain ecosystems can affect its price. The easier it is to purchase and use BNT, the more accessible it becomes to a broader audience, potentially leading to an increase in price. Additionally, the inherent volatility of the cryptocurrency market means that Bancor's price is often subject to wider market movements and fluctuations in the prices of major cryptocurrencies like Bitcoin and Ethereum, which can act as indicators for the rest of the market, including BNT. Investors and users must stay informed and consider these multifaceted factors when assessing Bancor's price dynamics within the ever-evolving landscape of cryptocurrency and blockchain technology.

For those interested in investing or trading BNT, one might wonder: Where to buy Bancor? You can purchase Bancor on leading exchanges, such as Bitget, which offers a secure and user-friendly platform for cryptocurrency enthusiasts.

BNT to local currency

- 1

- 2

- 3

- 4

- 5

How to buy Bancor(BNT)

Create Your Free Bitget Account

Verify Your Account

Buy Bancor (BNT)

Trade BNT perpetual futures

After having successfully signed up on Bitget and purchased USDT or BNT tokens, you can start trading derivatives, including BNT futures and margin trading to increase your income.

The current price of BNT is $0.5195, with a 24h price change of -2.60%. Traders can profit by either going long or short onBNT futures.

Join BNT copy trading by following elite traders.

Bancor news

Dan Tapiero said Bitcoin will reach $100,000 regardless of the US election results.

Tim Draper made statements about Bitcoin and altcoin investments.

Buy more

FAQ

What is the current price of Bancor?

What is the 24 hour trading volume of Bancor?

What is the all-time high of Bancor?

Can I buy Bancor on Bitget?

Can I get a steady income from investing in Bancor?

Where can I buy Bancor with the lowest fee?

Where can I buy Bancor (BNT)?

Video section — quick verification, quick trading

Bitget Insights

Related assets

Bancor Social Data

In the last 24 hours, the social media sentiment score for Bancor was 3, and the social media sentiment towards Bancor price trend was Bullish. The overall Bancor social media score was 0, which ranks 461 among all cryptocurrencies.

According to LunarCrush, in the last 24 hours, cryptocurrencies were mentioned on social media a total of 1,058,120 times, with Bancor being mentioned with a frequency ratio of 0.01%, ranking 363 among all cryptocurrencies.

In the last 24 hours, there were a total of 185 unique users discussing Bancor, with a total of Bancor mentions of 62. However, compared to the previous 24-hour period, the number of unique users decrease by 5%, and the total number of mentions has decrease by 5%.

On Twitter, there were a total of 1 tweets mentioning Bancor in the last 24 hours. Among them, 100% are bullish on Bancor, 0% are bearish on Bancor, and 0% are neutral on Bancor.

On Reddit, there were 19 posts mentioning Bancor in the last 24 hours. Compared to the previous 24-hour period, the number of mentions decrease by 30% .

All social overview

3