Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.59%

New listings on Bitget: Pi Network

BTC/USDT$82385.60 (+9.10%)Fear and Greed Index39(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$326.3M (1D); -$595.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.59%

New listings on Bitget: Pi Network

BTC/USDT$82385.60 (+9.10%)Fear and Greed Index39(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$326.3M (1D); -$595.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share62.59%

New listings on Bitget: Pi Network

BTC/USDT$82385.60 (+9.10%)Fear and Greed Index39(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketBABY,PAWS,WCTTotal spot Bitcoin ETF netflow -$326.3M (1D); -$595.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

OneFinity priceONE

Not listed

Quote currency:

USD

Data is sourced from third-party providers. This page and the information provided do not endorse any specific cryptocurrency. Want to trade listed coins? Click here

$0.04117+8.15%1D

Price chart

Last updated as of 2025-04-10 01:44:32(UTC+0)

Market cap:$179,984.73

Fully diluted market cap:$179,984.73

Volume (24h):$310.54

24h volume / market cap:0.17%

24h high:$0.04157

24h low:$0.03787

All-time high:$0.8601

All-time low:$0.03333

Circulating supply:4,371,636 ONE

Total supply:

25,543,088ONE

Circulation rate:17.00%

Max supply:

25,546,534ONE

Price in BTC:0.{6}5002 BTC

Price in ETH:0.{4}2521 ETH

Price at BTC market cap:

$373,697.72

Price at ETH market cap:

$45,089.67

Contracts:

ONE-f9...-f9954f(Elrond)

How do you feel about OneFinity today?

Note: This information is for reference only.

Price of OneFinity today

The live price of OneFinity is $0.04117 per (ONE / USD) today with a current market cap of $179,984.73 USD. The 24-hour trading volume is $310.54 USD. ONE to USD price is updated in real time. OneFinity is 8.15% in the last 24 hours. It has a circulating supply of 4,371,636 .

What is the highest price of ONE?

ONE has an all-time high (ATH) of $0.8601, recorded on 2024-03-14.

What is the lowest price of ONE?

ONE has an all-time low (ATL) of $0.03333, recorded on 2025-04-07.

OneFinity price prediction

When is a good time to buy ONE? Should I buy or sell ONE now?

When deciding whether to buy or sell ONE, you must first consider your own trading strategy. The trading activity of long-term traders and short-term traders will also be different. The Bitget ONE technical analysis can provide you with a reference for trading.

According to the ONE 4h technical analysis, the trading signal is Buy.

According to the ONE 1d technical analysis, the trading signal is Sell.

According to the ONE 1w technical analysis, the trading signal is Strong sell.

What will the price of ONE be in 2026?

Based on ONE's historical price performance prediction model, the price of ONE is projected to reach $0.04812 in 2026.

What will the price of ONE be in 2031?

In 2031, the ONE price is expected to change by +47.00%. By the end of 2031, the ONE price is projected to reach $0.1009, with a cumulative ROI of +158.37%.

OneFinity price history (USD)

The price of OneFinity is -90.00% over the last year. The highest price of in USD in the last year was $0.4571 and the lowest price of in USD in the last year was $0.03333.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+8.15%$0.03787$0.04157

7d-14.06%$0.03333$0.04515

30d-16.07%$0.03333$0.08146

90d-65.76%$0.03333$0.1491

1y-90.00%$0.03333$0.4571

All-time-52.74%$0.03333(2025-04-07, 3 days ago )$0.8601(2024-03-14, 1 years ago )

OneFinity market information

OneFinity's market cap history

OneFinity holdings by concentration

Whales

Investors

Retail

OneFinity addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

OneFinity ratings

Average ratings from the community

4.6

This content is for informational purposes only.

ONE to local currency

1 ONE to MXN$0.841 ONE to GTQQ0.321 ONE to CLP$40.831 ONE to UGXSh151.991 ONE to HNLL1.051 ONE to ZARR0.81 ONE to TNDد.ت0.131 ONE to IQDع.د53.911 ONE to TWDNT$1.341 ONE to RSDдин.4.411 ONE to DOP$2.571 ONE to MYRRM0.181 ONE to GEL₾0.111 ONE to UYU$1.761 ONE to MADد.م.0.391 ONE to AZN₼0.071 ONE to OMRر.ع.0.021 ONE to KESSh5.331 ONE to SEKkr0.411 ONE to UAH₴1.7

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-04-10 01:44:32(UTC+0)

OneFinity news

What You Should Know about Offer.One – Exclusive Crypto Offers for Affiliates

CryptoSlate•2025-04-03 00:00

Hester Peirce Proposes Regulatory Clarity for Crypto Oversight Amid Overlapping Jurisdictions

Coinotag•2025-03-27 16:00

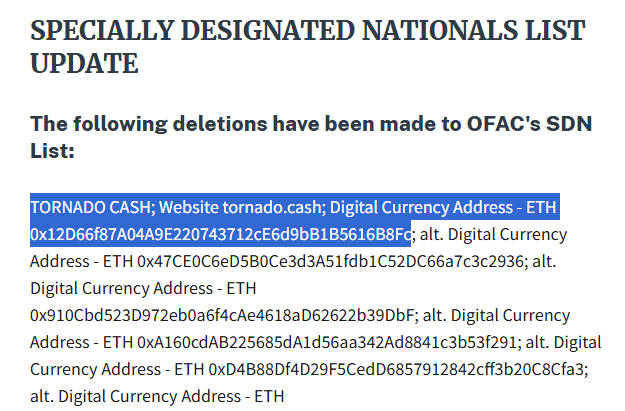

Tornado Cash Removed from U.S. Sanctions List

Cryptotimes•2025-03-22 07:22

How Stephen Tse Built Harmony and Pioneered Blockchain Tech

CryptoNewsFlash•2025-03-04 22:00

BitBoy Blows Whistle: Alleges Extortion, Fraud in Lamborghini & Crypto Empire Feud

CryptoNewsNet•2025-02-11 13:22

New listings on Bitget

New listings

Buy more

FAQ

What is the current price of OneFinity?

The live price of OneFinity is $0.04 per (ONE/USD) with a current market cap of $179,984.73 USD. OneFinity's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. OneFinity's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of OneFinity?

Over the last 24 hours, the trading volume of OneFinity is $310.54.

What is the all-time high of OneFinity?

The all-time high of OneFinity is $0.8601. This all-time high is highest price for OneFinity since it was launched.

Can I buy OneFinity on Bitget?

Yes, OneFinity is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy guide.

Can I get a steady income from investing in OneFinity?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy OneFinity with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying OneFinity online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy OneFinity, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your OneFinity purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

ScalpingX

3h

In financial markets, media is one of the most powerful tools used to steer market behavior.

When you lack a clear stance, your emotions are easily swayed — making you prone to FOMO, panic, and impulsive decisions. That’s when emotional trading kicks in, and one mistake leads to another.

To avoid being "manipulated," the first thing you need to learn is risk management. Every time you're about to hit the Buy or Sell button, define the level of risk you're willing to accept first, then set your expected return. Always respect the unchanging principle: The higher the expectation, the lower the probability of success.

=> This won’t eliminate mistakes, but it will definitely give you a better chance to correct them.

Next, make your investment principles consistent. Don’t let just anyone or any piece of news easily influence you.

Online articles never show me the real numbers behind my profit or loss — but the price chart does. Instead of letting a flood of information wear down my brain, I choose to simplify things by focusing on price movement and developing my own set of reactions accordingly.

Some people say price charts tell no real story — it’s all manipulation. I believe they simply haven’t tried hard enough to truly look. They’re obsessed with grand macro theories but never bother to zoom in and notice the small yet meaningful details.

A small individual should first learn to care about the small stories.

In short, you need to learn how to wrap things up — before someone else wraps you up.

ME-0.43%

ANYONE-0.31%

commatozee

4h

Red Zone: BAN/USDT Slips -18.20%—Breakdown or Fakeout?

Price: 0.0328 USDT

Daily Loss: -18.20%

$BAN continues its bearish streak with nearly one-fifth of its value lost today. This drop brings it to a key historical support area. Volume suggests strong selling pressure, but also the potential for accumulation. A bounce from this area could present a swing opportunity—but only for the brave.

BAN-3.61%

ONE-0.75%

Nilesh Rohilla | Analyst

5h

STOCK ON RECORD ONE DAY JUMP..

SOME TIME YOU NEED ONE DAY TO MAKE 1 YEAR GAIN.

M7 STOCK PUMP LIKE MEMECOIN..😂

#TSLA 22% UP

#NVDA 18% UP

#AAPL 15% UP

#META 14% UP

#AMZN 11% UP

#GOOGL 10% UP

UP+2.63%

ONE-0.75%

IncomeSharks

5h

Amazing how one of the largest weekly green candles we've seen just happens to come after everyone says it's never been worse.

S-2.27%

ONE-0.75%

IncomeSharks

5h

$AMD - Perfect example of why 3 entries is an effective strategy. 3rd one up 17%, and send entry back to even. These are the undervalued stocks you should be bidding in blood.

WHY0.00%

UP+2.63%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to OneFinity in market cap.